OPay honoured by CNBC: Makes it to the 'Top 200 Global Financial Technology Companies' list

By leveraging OPay's fintech technology, Pakistan can accelerate digital transformation and achieve 'de-cashisation'

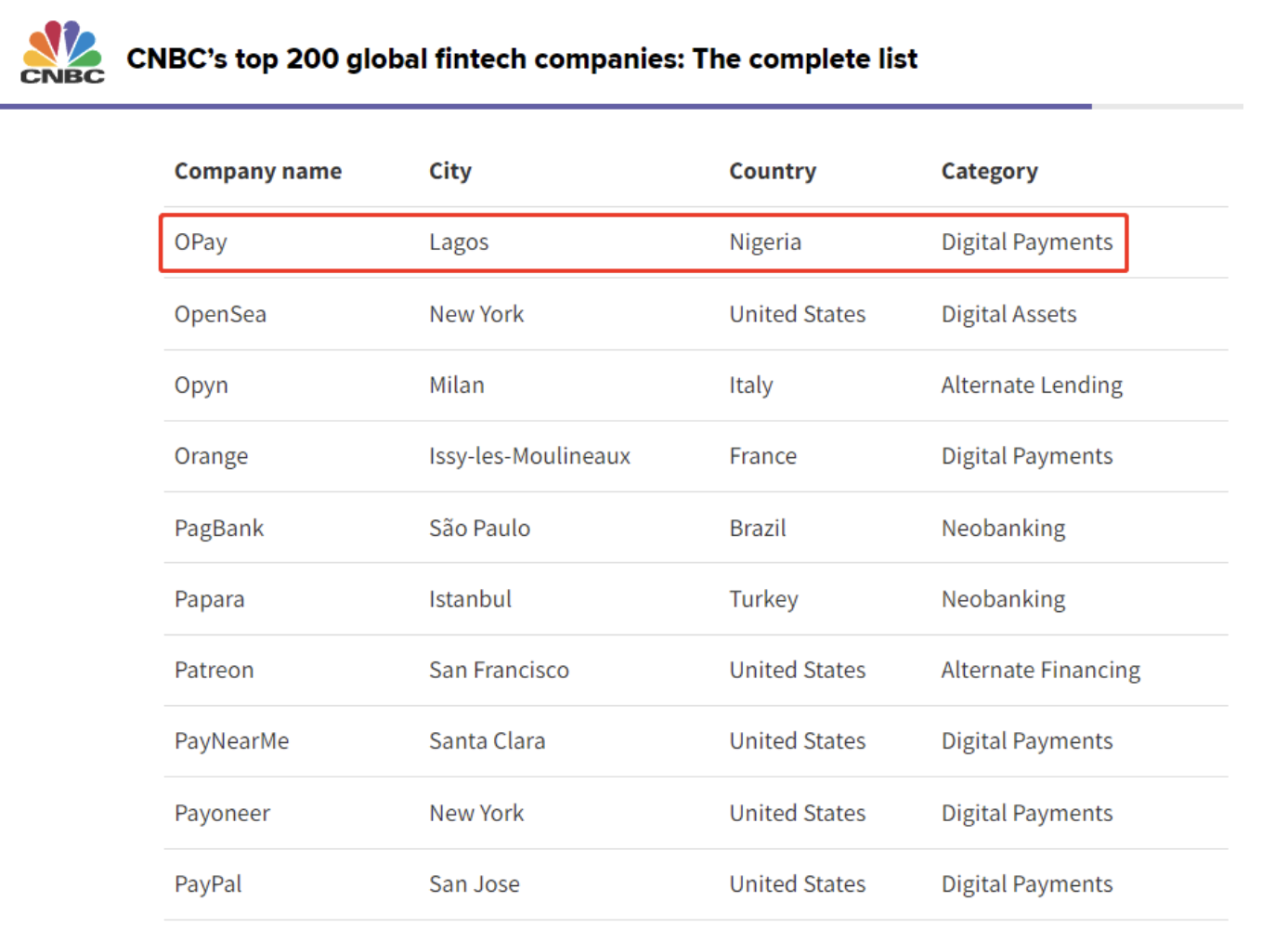

On August 2nd, CNBC unveiled its "Top 200 Global Financial Technology Companies" list, highlighting 200 high-quality companies throughout the world that deal with electronic payments, digital assets, and digital banking.

Among the prominent companies on this list are Ant Group, Tencent, PayPal, Stripe, Klarna, and Revolut, as well as emerging startups with significant growth potential.

A successful entry has also been made by financial technology platform OPay.

Together with Statista, CNBC has launched a ranking of the "Top 200 Global Financial Technology Companies". A plethora of key performance indicators, such as revenue, number of users, business model, and more, were used to identify the top 200 fintech companies, according to Statista's official introduction, which analysed over 1,500 companies across 9 different market segments.

As part of its scoring model, Statista calculated the total score of each company's performance, as well as its respective key performance indicators, and the individual scores for each key performance indicator for each market segment in order to ensure the authority of the list. From each segment, 5-40 companies were selected and only the companies with the highest scores in each market segment ultimately made it onto the list.

With its focus on "making finance more inclusive with technology," OPay has adhered to its mission since its establishment in 2018.

OPay offers payment, digital wallets, and other financial services to emerging market customers in Africa, Asia, and Latin America via innovative technology based on Artificial Intelligence and Big Data

In addition to Nigeria, Egypt, and Pakistan, the market is covered in other countries as well. The company has become one of the most competitive fintech unicorns in emerging markets in less than five years. With the launch of OPay's digital wallet business in 2018, it has provided financial services to people without bank accounts in Africa, contributing to inclusive finance in the continent.

As of 2022, OPay has nearly 40 million registered users and 50 billion dollars in transactions. Monthly Active Users (MAU) of OPay's wallet business exceeded 10 million in May 2023.

Through a strategic partnership with MasterCard, OPay aims to accelerate global progress towards inclusive finance by fostering the further development of an interconnected payment ecosystem.

International media outlets have been reporting on OPay's achievements in Africa and the Middle East.

A Forbes report from February 2022 indicated that OPay offers financial technology solutions to the Middle East and North Africa. OPay was profiled as a leader and pioneer in Africa's business transformation on CNN in June 2022 during an episode of 'Connecting Africa.'

Due to the inadequate payment infrastructure, Pakistan has the lowest bank account coverage in the world, accounting for 80% of the entire society through cash payments. Hence, to encourage the development of cashless payments, the State Bank of Pakistan (SBP) successively released the 'National Payment System Strategy (NPSS)' in 2019 and the "Instant Payment System (Raast)" in 2021, creating a favourable environment for the digital wallet industry.

Earlier this year, at the President House in Islamabad on February 14, 2023, a meeting between Mr Zhou Yahui, CEO of OPay, and President Arif Alvi took place

In the meeting, Mr Zhou Yahui predicted a rapid development of digital banking in Pakistan, which would require strong technological support, such as artificial intelligence. The use of AI technology will soon facilitate fast and accurate assessments and transactions related to digital finance, deposits, withdrawals, credit ratings, and other digital assets. As Pakistan moves toward a digital economy, OPay's Fintech technology can help it achieve "de-cashisation" and accelerate its digital transformation.

A dedicated team of innovative people has made OPay's success possible over the years by providing seamless solutions that continually enhance and significantly improve the African economy.

Through its technical assistance, OPay will also assist Pakistan in developing electronic payment systems, paving the way for digitalisation and cashless payments to come sooner than ever before in the near future.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ