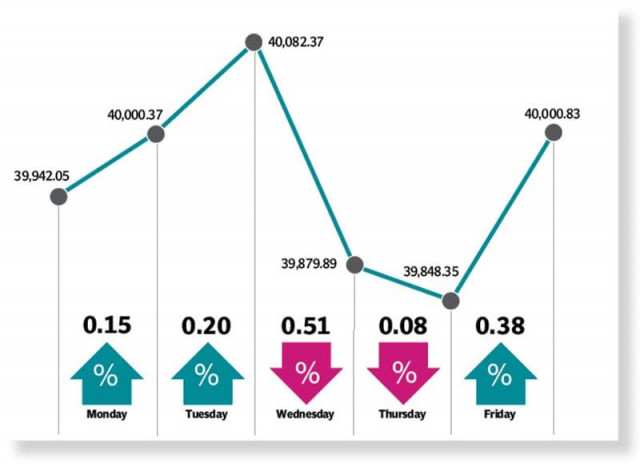

Stocks end flat in roller-coaster week

KSE-100 index inches up by 58 points, or 0.15%, and settles at 40,001

Pakistan Stock Exchange (PSX) endured a roller-coaster ride with several ups and downs in the outgoing week as trading remained volatile due to the prevailing economic and political tensions, which kept the benchmark KSE-100 index on a leash. The index closed flat at 40,001 points at the end of the week.

The week started on a positive note when the index managed to recover slightly following Finance Minister Ishaq Dar’s announcement that matters with the IMF would be settled soon.

Another flat session was witnessed on Tuesday during which investors remained cautious due to delay in revival of the International Monetary Fund (IMF) loan programme and political chaos, which impacted the buying momentum.

Bears took complete control of the market on Wednesday owing to the rising political temperature after a local court in Islamabad issued non-bailable arrest warrants against Pakistan Tehreek-e-Insaf (PTI) chief Imran Khan in the case of threatening a female judge.

Negative momentum prevailed on Thursday as well when the index inched down in the absence of positive triggers coupled with uncertainty on the political front with calls of early elections and delay in resumption of the IMF programme.

The market staged a rebound in the final session of the week and the index crept up after finance minister’s revelation that “all technical discussions have been completed and an agreement is nearing with the IMF.” The index closed above the 40,000 mark on the back of buying in selective stocks ahead of the quarter’s end.

At close of the week, the KSE-100 index recorded gains of 58 points, or 0.15% week-on-week, and settled at 40,001.

JS Global analyst Muhammad Waqas Ghani, in his report, noted that the KSE-100 index ended the week flat as the IMF’s ninth review remained on hold due to the pending assurances from friendly countries. Political noise rose during the week in the backdrop of a Supreme Court hearing on the Election Commission of Pakistan’s (ECP) decision to postpone the provincial assembly elections, he said.

The index closed at 40,000 points, up 0.1% week-on-week, where cement and fertiliser sectors were the prominent performers. On the economic front, the IMF programme remained stalled as the lender awaited guarantees of $3 billion assistance from the UAE and Saudi Arabia.

As per the latest State Bank of Pakistan’s (SBP) numbers, the foreign currency reserves held by the central bank decreased by $354 million to $4.2 billion owing to the external debt repayment.

“The decline came after six consecutive weeks of increases, which were mainly on the back of commercial loans given by China,” the JS analyst said.

Pakistan again requested China to roll over a $2 billion loan to help prop up the dwindling reserves and according to the finance ministry, documentation process for the loan had been completed, he added.

Arif Habib Limited, in its report, said that the market witnessed a lacklustre activity during the week, mainly because of uncertainty about the resumption of IMF programme.

In order to unlock the next loan tranche, the IMF sought confirmation of financing from friendly countries including Saudi Arabia and the UAE.

As a result, it said, Pakistani rupee depreciated against the US dollar by Rs0.59, or 0.21% week-on-week, closing at 283.79/$. Moreover, the SBP’s reserves shrank $345 million week-on-week and reached $4.2 billion. In terms of sectors, positive contribution to the market came from automobile assemblers (61 points), fertiliser (34 points), cement (10 points), insurance (4 points), and glass and ceramics (3 points).

Negative contribution came from miscellaneous (112 points), commercial banks (20 points), and power generation and distribution (17 points). Foreigners’ buying continued during the week as they bought stocks worth $0.3 million as compared to net buying of $0.5 million last week, the AHL report added.

Published in The Express Tribune, April 2nd, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ