Bears dominate, drag PSX below 40,000

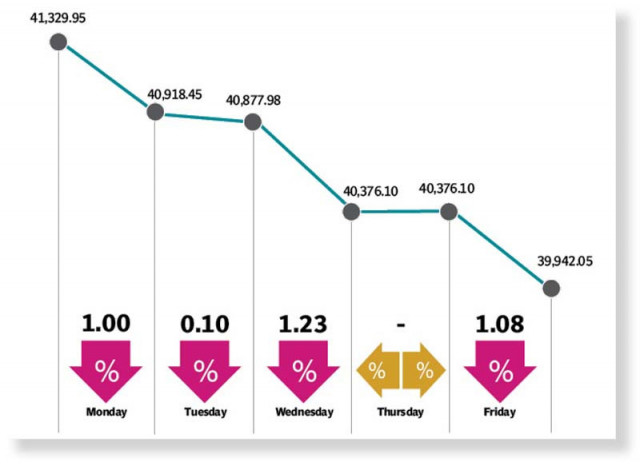

KSE-100 index plunges 1,388 points, or 3.36%, at 39,942

Bears held their firm grip over Pakistan Stock Exchange (PSX) throughout the four-day trading week as investor interest remained weak amid mounting concerns over the economic and political situation in the country.

The week kicked off on a negative note over persistent delay in resumption of the International Monetary Fund (IMF) loan programme coupled with the political noise, which dented investor confidence and resultantly the KSE-100 index fell below the 41,000-point mark. The negative momentum continued on Tuesday in a mixed session where no development about reaching a staff-level agreement (SLA) with the IMF hurt investor sentiment.

The market maintained the bearish momentum for two more days and the index dived by over 500 points on Thursday ahead of the monetary policy announcement with investors adopting a wait-and-see approach and expecting a hike of approximately 2% in policy rate.

The index also remained in the red on Friday, the first session of Ramazan, when it dropped nearly 450 points as political chaos and delay in the revival of IMF programme triggered selling pressure in the absence of positive triggers. Resultantly, the bourse dipped below the 40,000 mark.

The KSE-100 index dropped by 1,388 points, or 3.36% week-on-week, and settled at 39,942. JS Global analyst Muhammad Waqas Ghani, in his report, noted that the KSE-100 closed the week in the red as the IMF’s ninth assessment continued to be delayed, which depended on assurances of assistance from friendly countries.

The index closed at 39,942 points, down 3.4% week-on-week, where cement, fertiliser and banking sectors were the major laggards. On the economic front, Pakistan’s balance of payments for February 2023 stood positive at $0.92 billion, as it received $700 million from China.

The positive balance of payments was further bolstered by the minuscule current account deficit (CAD), which contracted to a 24-month low at $74 million, bringing 8MFY23 CAD to $3.86 billion (-68% year-on-year), he said. As a major relief, the government announced a petroleum relief package of up to Rs100 per litre for the low-income citizens. Following that, the IMF sought details of the scheme.

During the week, the government in its T-bills auction saw the rate on short-term papers rise to 22%, signaling expectations of a rate hike in the upcoming monetary policy meeting. Meanwhile, China rolled over $2 billion of SAFE deposits for a year to help Pakistan meet its external financing needs, the JS analyst added.

Arif Habib Limited, in its report, said that in the outgoing week the stock market hovered in the red, mainly because of uncertainty about the resumption of IMF programme. “The government announced a subsidy scheme without consulting the IMF, which can potentially cause further delay in unlocking the next loan tranche,” it said.

As a result, Pakistani rupee depreciated against the US dollar by Rs1.41, 0.53% week-on-week, closing the week at 283.2/$.

Additionally, the Sensitive Price Indicator (SPI) saw a record increase of 45.64% due to a consistent increase in prices of essential commodities. On the political front, the Election Commission postponed the Punjab elections, originally scheduled for April 30, till October 8.

In terms of sectors, positive contribution to the market came from leather and tanneries (5 points) and modarabas (2 points).

Negative contribution came from miscellaneous (210 points), cement (191 points), E&P (186 points), fertiliser (180 points) and banks (173 points). In terms of individual stocks, positive contributors were Service Industries (5 points), Rafhan Maize Products (4 points) and Millat Tractors (3 points).

Negative contributors were Pakistan Services (211 points), Oil and Gas Development Company (87 points), Pakistan Petroleum (79 points), Engro Fertilisers (68 points) and Engro Corporation (61 points).

Foreigners’ buying continued during the week as they bought stocks worth $0.5 million as compared to net buying of $5 million last week, the AHL report added.

Published in The Express Tribune, March 26th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ