Stocks retreat as investors stand on sidelines

KSE-100 index drops by 623 points, or 1.49%, at 41,119

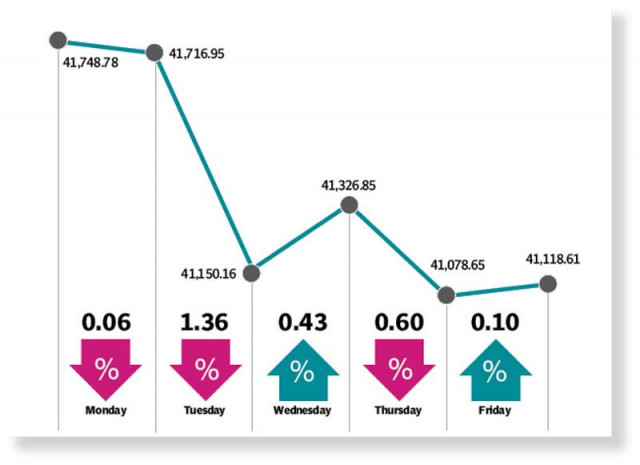

Pakistan Stock Exchange (PSX) ended the week on a negative note as the benchmark KSE-100 index fell by over 600 points with many investors standing on sidelines for most of the week.

Trading commenced with a dip in the wake of uncertainty about the fate of International Monetary Fund’s (IMF) loan programme, which dented investor confidence. They opted for a wait-and-see approach and refrained from taking fresh positions on the first trading day that closed on a flat note.

Volatility prevailed on Tuesday following news that the IMF had demanded a further increase in interest rate to 20%. It discouraged investors and as a result the KSE-100 index dropped by over 550 points.

However, some positivity was witnessed on Wednesday as the government appeared willing to meet conditions of the IMF. The market could not sustain the positivity on Thursday owing to rumours of an emergency meeting of the State Bank of Pakistan (SBP). Consequently, the index closed in the red.

The bourse lost ground next day as well in the absence of positive triggers regarding the IMF programme, though Pakistani rupee continued to recover against the US dollar coupled with some increase in foreign currency reserves.

The KSE-100 index dropped by 623 points, or 1.49% week-on-week, and settled at 41,119.

JS Global analyst Muhammad Waqas Ghani, in his report, noted that “in a turnabout from previous trend, the market closed negative this week, losing a total of 623 points”.

It came despite the government taking steps towards pending reforms like higher taxation measures and rationalisation of energy tariffs for the completion of IMF review, he said.

During the week, the Economic Coordination Committee (ECC) approved an increase in gas prices in the range of 10% to 69% for various segments other than residential consumers.

According to the analyst, a number of manufacturing sectors would bear a negative impact on earnings, assuming that the ability of passing on the impact to end-consumers would be limited.

Finance Minister unveiled the Supplementary Budget FY23 in parliament, whereby Rs170 billion worth of taxes were imposed. An increase of 1% in GST was proposed whereas FED on cement, cigarettes, fruits and juices was also proposed to be increased.

The SBP’s forex reserves increased slightly, standing a little above $3 billion. The week also witnessed appreciation of the rupee against the US dollar, which closed 2.5% (+Rs6.5) higher at Rs262.8/$, the JS analyst added.

Arif Habib Limited, in its report, said that at the start of the week, the market experienced a downturn in response to the anticipated mini-budget post-discussion between the government and the IMF.

During a session in parliament on Wednesday, the finance minister presented tax measures that would generate additional revenue of Rs170 billion in the remaining period of current fiscal year.

Additionally, inflationary pressures were exacerbated by the recent increase in gas and electricity prices, contributing to the overall negative sentiment in the stock market, it said.

Petrol and diesel prices were also increased by Rs22.2 per litre and Rs17.2 per litre, respectively.

“Despite these challenges, there were some positive developments, as the SBP’s reserves jumped by $276 million and settled at $3.2 billion,” the report said.

In terms of sectors, positive contribution to the market came from power generation and distribution (66 points) and fertiliser (56 points). Negative contribution came from oil and gas exploration companies (238 points), technology and communications (103 points), miscellaneous (72 points), commercial banks (56 points) and cement (53 points).

Foreigners’ buying continued as they bought stocks worth $1.6 million as compared to net buying of $3.2 million last week, the AHL report added.

Published in The Express Tribune, February 19th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ