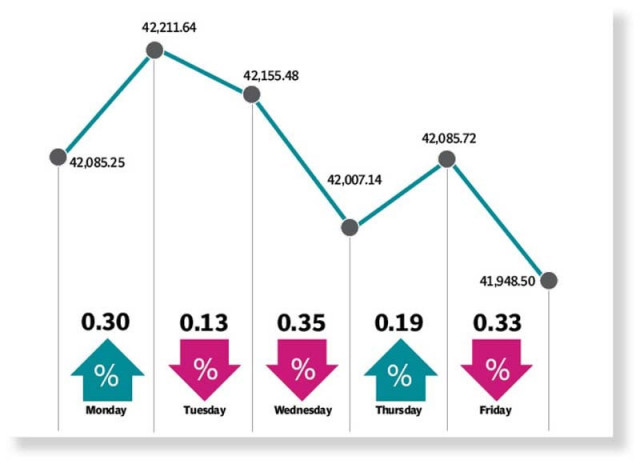

Bears pull stocks below 42,000 mark

Benchmark KSE-100 index sheds 137 points to settle at 41,949

The Pakistan Stock Exchange (PSX) recorded a slight decline in the outgoing week on the back of profit-taking and thin investor participation, which dragged the KSE-100 index below the 42,000-point mark.

The index shed 137 points to settle at 41,949 at the end of the week.

Earlier, trading commenced on a positive note on Monday as the State Bank of Pakistan (SBP) maintained the status quo in its monetary policy for the next seven weeks in line with expectations of investors.

However, the unchanged policy rate, which stood at 15%, failed to help the market sustain the positive sentiment on Tuesday where profit-taking pulled the index down. The market maintained its bearish trend on Wednesday as participants grew worried about Moody’s downgrading of five major commercial banks of Pakistan with a negative outlook.

Despite remaining under pressure and swaying between negative and positive territories, the KSE-100 index managed to notch up marginal gains of nearly 80 points on Thursday to close the day in the green.

Market participation remained thin as a lack of positive triggers kept bulls at bay. The KSE-100 index endured lifeless trading where investors avoided taking fresh positions. The index tried to rise past the 42,000 mark but succumbed to weak buying interest, closing the week at 41,949, down 137 points, or 0.3%, from the previous week.

“After a two-week-long bull-run, KSE-100 remained largely stable throughout the week, closing at 41,949, down 0.3%,” said JS Global analyst Wasil Zaman.

Key performers during the week were refineries (+2%), food companies (+1.4%) and sugar and allied industries (+1.4%) while tobacco firms (-8.8%), power companies (-7.7%) and cement producers (-0.9%) were the key underperformers.

Average volumes registered a notable decline of 39% week-on-week to 267 million shares whereas foreigners were net buyers with most of the buying in tech sector ($12.4 million). On the news front, the SBP on Monday decided to keep its policy rate unchanged along with a downward revision in its GDP forecast to 2% for FY23 compared to 3-4% earlier.

On the other hand, the IMF projected Pakistan’s GDP growth at 3.5% (excluding the impact of floods) along with inflation estimate of 20% for FY23. Moody’s further downgraded Pakistan’s credit rating to Caa1 from B3. SBP’s foreign currency reserves dipped by $303 million to $7.6 billion mainly due to external debt payments whereas PIB yields decreased in line with investors’ expectation of stability in interest rates.

Lastly, data released by PAMA showed a downward trend in auto sales where volumes declined by 6% month-on-month in September 2022, which was marred by subdued demand and production halts, the JS analyst said.

Arif Habib Limited, in its report, said that the market commenced trading on a positive note this week as investors anticipated that the policy rate would be left unchanged at 15%. However, the momentum turned negative after Moody’s downgraded the rating of five commercial banks and maintained a negative outlook.

Moreover, remittances dropped 12% year-on-year in September 2022. In addition to that, Pakistani rupee after appreciating against the US dollar for the past two weeks, broke the winning streak and closed the week at Rs218.43 (up just Rs1.49, or 0.7%, week-on-week).

SBP’s reserves depleted by $303 million and hit a three-year low of $7.6 billion. Furthermore, automobile sales plummeted by 51% year-on-year, reaching a 27-month low, the AHL report said.

In terms of sectors, positive contribution came from E&P firms (46 points) and refineries (22 points). Negative contribution came from technology and communications (-117 points), commercial banks (-48 points), tobacco (-32 points), cement (-15 points) and engineering (-12 points).

Meanwhile, stock-wise positive contributors were Systems Limited (83 points), Pakistan Oilfields (20 points), Lotte Chemical (17 points), Oil and Gas Development Company (16 points) and Nestle Pakistan (15 points).

Negative contribution came from TRG Pakistan (-207 points), Pakistan Tobacco Company (-32 points), Meezan Bank (-24 points), Engro Fertilisers (-19 points) and Engro Corporation (-18 points).

Foreigners continued to buy stocks during the week under review, making purchases of $12.3 million compared to net buying of $4.7 million last week.

Major buying was witnessed in technology sector ($12.4 million), power sector ($0.8 million) and cement sector ($0.3 million). Average daily volumes came in at 267 million shares (down by 39% week-on-week).

Published in The Express Tribune, October 16th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1710175205-0/image-(9)1710175205-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ