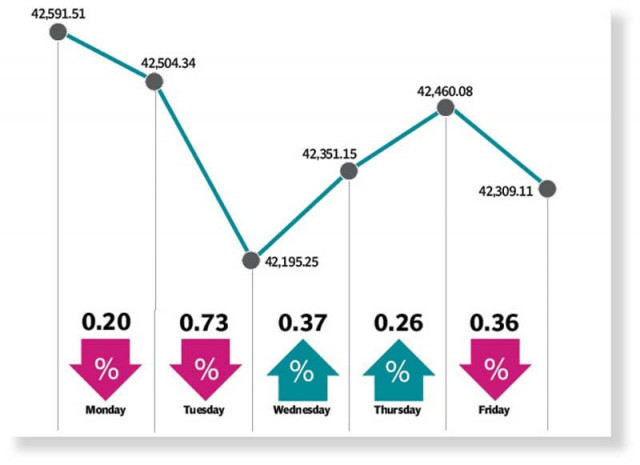

Stocks lose ground in volatile week

Benchmark KSE-100 index drops 282 points to settle at 42,309

The Pakistan Stock Exchange witnessed a volatile trading week as a combination of buying interest and selling pressure made the benchmark KSE-100 index swing on both sides of the fence.

Resultantly, the index fell 282 points, or 0.7%, to close the week at 42,309.

The week began on a negative note and the market declined in the first two sessions. Market participants remained sidelined in the first trading session ahead of the International Monetary Fund’s (IMF) board meeting where the release of $1.2 billion loan tranche was to be considered.

Concerns over floods across the country inflicting $10 billion losses further shattered investor spirits. In addition, political and economic instability in the country fuelled bearish trading.

However, the market reversed direction midweek and lifted the KSE-100 index in a two-day bull run as the government decided to allocate Rs103 billion for the flood-stricken people.

Moreover, market players cherished the arrival of $1.16 billion loan tranche from the IMF, which revived investor confidence, who took fresh positions.

Furthermore, continuous recovery of Pakistani rupee against the US dollar further boosted the positive sentiment.

However, bears staged a comeback as investors remained cautious and anticipated high inflation amid massive flood devastation, which sparked uncertainty at the bourse. Moreover, the absence of positive triggers further dented the investors’ mood. “Pakistan equities closed negative at 42,309, losing 282 points week-on-week,” said JS Global analyst Muhammad Waqas Ghani.

Increased political noise and economic uncertainty over news of damages due to the floods led to profit-taking during the week. The market, however, witnessed a short-lived rally in response to revival of the stalled IMF programme, under which Pakistan received $1.16 billion.

Bond yields on Pakistan’s dollar-denominated instruments eased in response to the IMF loan approval, the report said.

Pakistani rupee extended gains and appreciated 0.8% week-on-week, closing at 218.98 to a dollar in inter-bank on Friday.

On the news front, the government increased petrol prices by Rs2.1 per litre because of increase in petroleum levy to help meet the revenue target set under the IMF programme.

Numerous countries and global organisations pledged assistance to help Pakistan combat challenges due to the flash floods, which affected more than 30 million people.

Moreover, CPI for August 2022 clocked in at 27.2% year-on-year, marking a multi-decade high, while trade deficit for August 2022 came in at $3.5 billion, rising 29% month-on-month due to higher imports.

SBP’s forex reserves for the week ended August 26, 2022 stood at $7.7 billion, the report added.

Arif Habib Limited, in its report, said that the market remained jittery and showed a mixed trend. It commenced on a negative note amid concerns over the flood crisis and its overall impact on the economy.

However, the market soon recovered following the approval and subsequent disbursement of $1.16 billion tranche by the IMF.

As a result, Pakistani rupee strengthened against the greenback, closing the week at Rs218.98, up Rs1.68, or 0.8%, week-on-week.

The bullish trend was short-lived as the announcement of inflation number for August 2022 (a 47-year high) changed the overall sentiment in the market.

In addition, trade numbers too dampened the overall sentiment as they showed a 29% month-on-month jump in deficit in August 2022.

In terms of sectors, positive contribution to the market came from cement (110 points), and leather and tanneries (25 points).

Negative contribution came from banks (118 points), E&P (90 points), automobile assemblers (61 points), miscellaneous (40 points) and textile composite (31 points).

Meanwhile, stock-wise positive contributors were Systems Limited (76 points), Engro Fertilisers (48 points), Kohat Cement (32 points), Faysal Bank (31 points) and Service Industries (25 points).

Negative contribution came from Habib Bank (73 points), TRG Pakistan (47 points), Pakistan Services (41 points), Engro Corporation (39 points) and Pakistan Oilfields (36 points).

Foreign selling continued during the week under review, which came in at $0.74 million compared to net selling of $1.87 million last week. Major selling was witnessed in commercial banks ($1.8 million) and power firms ($0.8 million).

On the domestic front, buying was reported by banks/DFIs ($3 million) followed by individuals ($2.4 million).

Average volumes came in at 211 million shares (down 15% week-on-week) while average value traded settled at $31 million (down 15% week-on-week).

Published in The Express Tribune, September 4th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ