Stocks edge up in range-bound trading

Benchmark KSE-100 index gains just 73 points to settle at 40,150

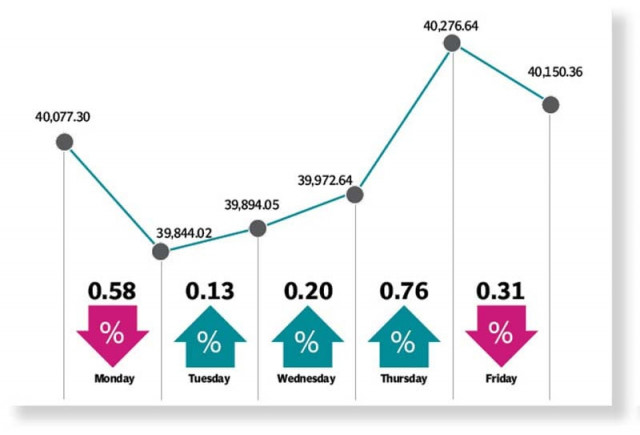

The Pakistan Stock Exchange experienced a range-bound trading week as the benchmark KSE-100 index swayed between positive and negative territories, driven by a mix of encouraging and discouraging developments.

Subsequently, the KSE-100 index closed the week with a marginal gain of 73 points at 40,150. Market participants mostly remained sidelined as jittery investors weighed the impact of growing political chaos, economic uncertainty and the persistent rupee depreciation.

Earlier, the week kicked off with a decline as the KSE-100 index dipped over 200 points in the first trading session in the backdrop of anticipated Supreme Court verdict in the Punjab chief minister election case. Moreover, the market came under pressure due to rupee depreciation, which shattered investors’ confidence.

However, the KSE-100 index in the next two sessions inched up marginally to close in the green but remained under pressure and stood below the 40,000-point mark.

The index staged a comeback with over 300 points as the talk of settlement amongst the country’s political leadership boosted investors’ confidence. A healthy buying activity was observed and value buying lifted the index above the 40,000 mark. Furthermore, a lower-than-expected current account deficit was also cheered by the market players.

The final session of the week ended on a negative note as KSE-100 recorded profit-taking, which took the index on the downward trajectory despite the rupee’s recovery. The index closed the week slightly positive and settled at 40,150, up 73 points week-on-week.

“Political uncertainty and deteriorating macroeconomic indicators kept the market range bound as the benchmark KSE-100 index closed the week on a slightly positive note at 40,150, up 73 points week-on-week,” said JS Global analyst Faisal Irfan. Volumes declined 8.1% with an average of 150 million shares traded per day during the week. Key underperformers were auto (-5.4%), fertiliser (-4%) and refinery (-1.9%) sectors while technology (+4.7%), textile (+3.8%) and banks (+1.6%) outperformed.

The week started with political noise over the election of Hamza Shehbaz as the Punjab chief minister. However, later in light of the Supreme Court’s ruling, Parvez Elahi was declared the CM of Punjab.

On the economic front, macros deteriorated further as Pakistani rupee depreciated 14% against the US dollar, marking July as the worst month in the past five decades. Moreover, the current account balance recorded a deficit of $2.3 billion in June, up 39% year-on-year and 59% month-on-month.

State Bank’s foreign currency reserves also registered a sharp decline of $754 million to $8.6 billion.

Based on the deteriorating macros, the S&P ratings agency revised the outlook on Pakistan’s long-term rating to ‘negative’ from ‘stable’. On the news front, the electricity base tariff was revised upwards by Rs7.91 per unit. Moreover, an automaker halted production due to delay in import of CKDs, said the analyst.

Arif Habib Limited, in its report, said that the market commenced on a negative note during the week as political and economic uncertainty kept investors on edge.

Moreover, Pakistani rupee continued its free fall against the US dollar (reaching an all-time low at Rs239.94) amid scepticism over the release of IMF loan tranche.

Volatility became more evident as the current account deficit climbed up by 39% year-on-year during June 2022, to stand at $2.3 billion. The sentiment turned positive, however, after the finance minister reiterated that all prior actions had been undertaken for the revival of IMF programme. Furthermore, the SBP echoed the finance minister’s statement and rejected claims of default on global payments in the near future. In addition to this, Fitch and Moody’s showed optimism over the disbursement of $1.2 billion by the IMF soon. However, the S&P Global downgraded Pakistan’s credit outlook from neutral to negative, hence keeping the bourse in check. The market closed at 40,150 points, gaining 73 points (up 0.18%) week-on-week.

In terms of sectors, positive contribution came from technology (176 points), banks (138 points), E&P (58 points), chemical (37 points) and OMCs (16 points).

On the flip side, the sectors which contributed negatively included fertiliser (231 points), automobile assembler (73 points) and cement (35 points).

Meanwhile, stock-wise positive contributors were TRG Pakistan (132 points), Lotte Chemical (51 points), Pakistan Oilfields (47 points), Bank Alfalah (46 points) and Habib Bank (30 points).

However, negative contribution came from Engro Fertilisers (88 points), Engro Corporation (84 points), Indus Motor (45 points) and Fauji Fertiliser Company (44 points). Foreign buying was witnessed during the week under review, clocking in at $0.57 million compared to net buying of $1.64 million last week. Major buying was witnessed in technology ($3m) and textile ($0.64 million). On the local front, selling was reported by individuals ($2.04m) followed by insurance companies ($1.78m).

Average volumes clocked in at 150m shares (down 8% week-on-week) while average traded value settled at $22m (up 3% week-on-week).

Published in The Express Tribune, July 31st, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ