More reliance on indirect taxes

Province estimates overall revenue collection of Rs1.67 trillion next year

The Sindh government has increased its reliance on indirect taxes to finance its growing expenditures, as it has targeted to collect revenue from everyone – whether rich or poor – for the services received in the next fiscal year.

The burden of indirect taxes on people would grow as Sindh Chief Minister Syed Murad Ali Shah announced the abolition of at least three taxes including the cotton fee, entertainment tax and tax on professions, trades and callings to promote businesses.

He presented the Sindh budget for FY23 with an outlay of Rs1.71 trillion in the provincial assembly on Tuesday. The province has estimated revenue collection of Rs1.67 trillion, indicating that it will incur a budget deficit of Rs33.84 billion in the year.

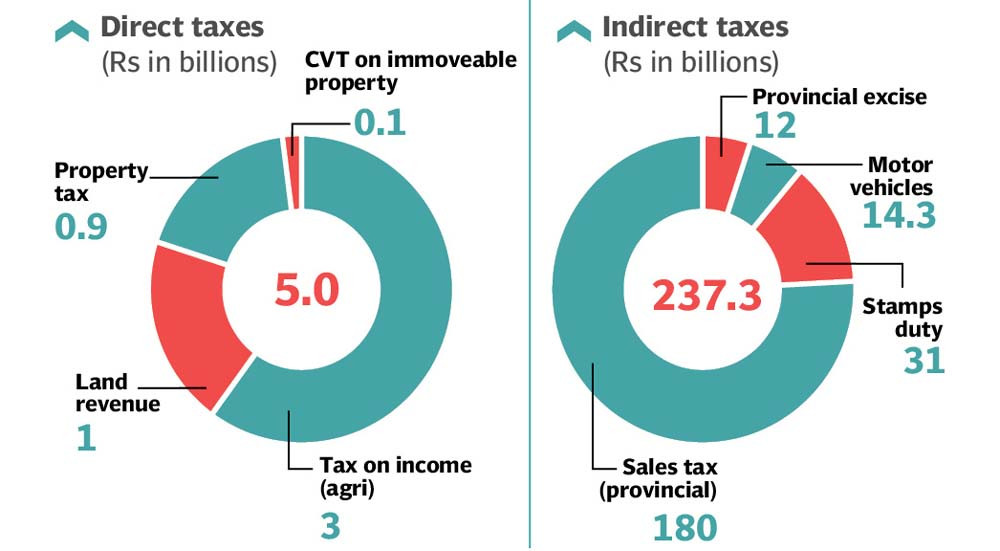

Budget documents suggest that the government has revised down the collection estimate for direct taxes, which are mainly paid by the rich individuals and businesses, by more than half to Rs5 billion for FY23 compared to Rs11.31 billion for the outgoing fiscal year.

The province is, however, estimated to collect Rs4.96 billion in direct taxes in FY23 against the target of Rs11.31 billion for FY22.

The agriculture sector, which earns billions of rupees through the sale of crops and livestock ever year, has paid a mere Rs810 million in taxes against the target of Rs2 billion for FY22.

The provincial government has so far remained unsuccessful in increasing the agriculture taxes, though a number of landlords are members of the provincial assembly.

Ignoring the historical trend of sluggish tax payments by the agriculture sector, the provincial government has targeted the collection of Rs3 billion from the sector in FY23 against the collection of Rs810 million in FY22.

Similarly, it revised down the target for collection of direct taxes on property to a mere Rs900 million in FY23 against the collection of Rs3.04 billion in FY22.

It also revised down the target for collection of capital value tax (CVT) on immoveable property to only Rs100 million in FY23 after receiving just Rs50 million against the target of Rs2 billion in FY22.

It has targeted the collection of zero tax on professions, trades and callings against the collection of Rs750 million in FY22.

It has, however, revised up the target to Rs1 billion for land revenue in the next fiscal year against poor collection of Rs310 million compared to the target of Rs840 million for FY22.

Indirect taxes

The Sindh government has targeted to increase the collection of indirect taxes by 20% to Rs237.30 billion in FY23 compared to Rs198.29 billion in FY22.

The government is, however, expected to collect Rs176.80 billion in indirect taxes in FY22.

The government has targeted to collect a larger chunk of indirect taxes from sales tax (general sales tax provincial) at Rs180 billion in FY23 against the target of Rs150 billion in FY22.

It, however, has estimated to collect Rs145 billion under the head in FY22.

Similarly, it has targeted to collect Rs12 billion in provincial excise in FY23 compared to the target of Rs11 billion for FY22. It, however, has estimated to collect only Rs5.50 billion under the head in FY22.

The excise duty will mostly be collected on liquor and beer to be manufactured in Pakistan and the imported ones, according to the budget documents.

The provincial government has targeted to collect stamps duty of Rs31 billion in FY23 compared to the target of Rs25 billion for FY22.

It has targeted to collect Rs14.30 billion on motor vehicles compared to the target of Rs12.29 billion for FY22.

While presenting the budget, Sindh CM Murad Ali Shah said the PPP government had not proposed any new tax for the second consecutive year (FY23).

“As a relief measure, a special moratorium has been proposed on the collection of cotton fee, professional tax and entertainment duty.”

Exemption has been proposed on the levy of Sindh Infrastructure Development Cess on the export-oriented units in order to minimise the cost of doing business in the province.

Services provided by the cable TV operators are levied at a reduced rate of 10%, and the existing relief is proposed to be extended for a further period of two years ending on June 30, 2024. The cable TV operators in rural areas under Pemra licence of “R” category will be exempt from SST till June 30, 2023.

The rate of Sindh sales tax (SST) on commission charges received by food delivery channels (ie foodpanda, Cheetay Logistics, etc) from home chefs is proposed to be reduced from 13% to 8% for a period of two years ending on June 30, 2024.

The existing exemption on health insurance services is proposed to continue for a period of one year till June 30, 2023.

Exemption from SST is being proposed on toll manufacturing services. A 5% reduced SST rate for “Recruiting Agents” will continue for next two years, ie up to June 30, 2024. “This relief is proposed for Pakistanis aspiring to work overseas,” Shah said.

Published in The Express Tribune, June 15th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ