With demand growth, big industries pick up momentum

Fiscal, monetary measures provided incentives to businesses to perform better

Pakistan’s large industries like food, fertiliser, textile and automobile maintained a robust growth for the second consecutive fiscal year in FY2021-22, as the supportive measures taken by the ousted PTI government created renewed demand for goods in the country.

Economic Survey 2021-22 said that accommodative fiscal and monetary measures continued in FY22 which provided incentives to the businesses to perform better.

“Thus, large-scale manufacturing (LSM) sector picked up momentum and posted overall growth of 10.4% during July-March FY22 compared to growth of 4.2% in the same period of last year,” it said.

“The performance was broad-based on the back of strong growth of high weighted sectors such as textile, food, wearing apparel, chemicals, automobile, tobacco, and iron and steel products.”

The operationalisation of Special Economic Zones (SEZs) under the China-Pakistan Economic Corridor (CPEC) in Nowshera, Pishin and Faisalabad further paved the way for fast-track industrial development, which is pivotal to achieve inclusive and sustainable economic growth, the report said.

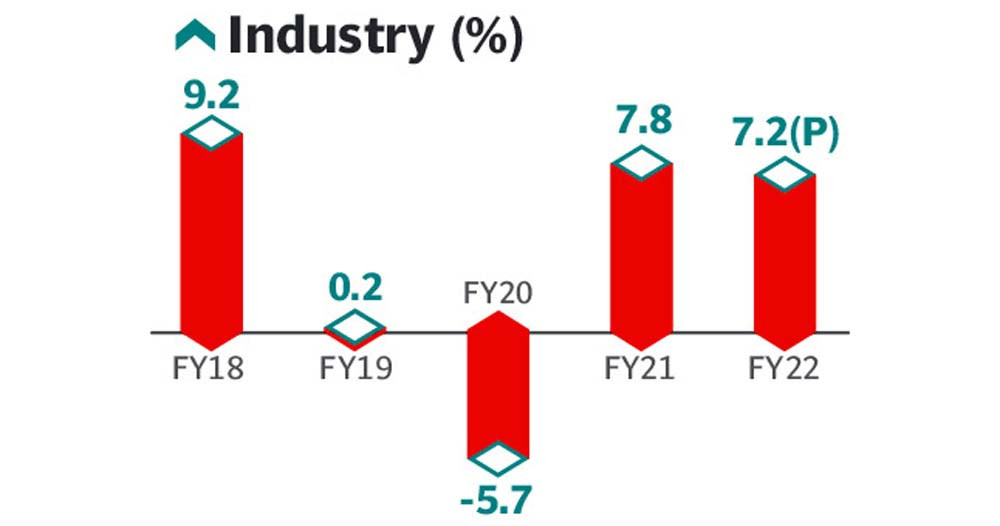

The overall industrial sector achieved a growth of 7.2% in July-March FY22. The industrial sector comprises sub-sectors like mining, manufacturing, construction and electricity generation and distribution.

“During FY22, LSM with 9.2% of gross domestic product (GDP) dominates the overall manufacturing sector,” the survey said.

“Pakistan’s Industrial sector posted a robust growth of 7.2% in FY22 on the back of various support measures by the then government (including) low policy rate, cheap housing finance, construction package (ended in Dec-21), industrial support package, and reduction in automobile taxes provided much needed impetus to Pakistan’s industrial sector,” Ismail Iqbal Securities said in a comment after the launch of Economic Survey 2021-22.

The survey, however, raised a red flag over future prospects of growth in the overall industrial sector and particularly in large-scale manufacturing sector.

The survey said that supply-side disruptions, which were originated from pandemic still in place due to emergence of new variants. Ukraine-Russia conflict has further escalated this disruption. Thus, internationally commodity prices are increasing significantly along with intense uncertainty in the market confidence.

“All these may result in severe challenges in LSM performance, as industrial production is mainly dependent on import of capital goods. Thus, the future prospects of industrial sector are uncertain, as risks still prevails owing to geopolitical environment, surge in energy prices, and new variants.”

Of 22 subsectors in LSM, 17 posted growth during July-March FY2022. The performance was broad-based on the back of strong growth of high weighted sectors such as textile, food, wearing apparel, chemicals, automobile, tobacco, iron & steel products along with furniture, wood products, and footballs.

Food group witnessed the growth of 11.7% during the period under review against 27.1% same period last year. Sugar, bakery and chocolate and sugar confectionary, tea blended, and starch posted strong growth in range of 10.6-38.1%. Production of cooking oil increased by 10.8%, while vegetable ghee down by 2.5%.

Textile sector grew by 3.2% during July-March FY2022, as compared to 8% in the same period last year. “Surge in imports of textile machinery, rising demand for concessionary financing from textile firms and high exports of this sector show a sizeable improvement in the textile sector.”

Coke and petroleum products marginally grew by 2% in July-March FY2022 against 12.3% of same period last year. “High global energy prices depressed the overall growth momentum. However, pickup in economic activities, especially automobile and resultant increase in transportation activities and oil sales partially offset the impact of high fuel prices.”

Automobile sector marked a vigorous growth of 54.1% in nine-month against 21.6% growth last year. New Auto Policy, to promote new technologies including Electric Vehicles (EVs) and Hybrid, and accommodative monetary policy to promote auto financing paved the way to grew automobiles production. Besides, tax incentives to promote locally manufactured cars also pent-up the demand.

Similarly, iron and steel production jumped by 16.5% during the period under review against the contraction of 8.6% in the same period last year. Pharmaceuticals growth witnessed a dip of 0.4% against the growth 10.5% last year, the survey said.

Published in The Express Tribune, June 10th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ