The road to financial literacy: Strategies to adopt for a better future

Join Binomo today and begin living the life of your dreams

In the recent years, the world has become increasingly fast-paced as a consequence of frantic lifestyles and the desire to live appropriately. The key to achieving all this and realising one's dream is to focus on efficient money management. Thus, financial literacy along with financial management is essential because a lack of understanding of either can have adverse effects on an individual.

The objective of financial literacy is to equip individuals with the tools to make financially responsible decisions every day. To ensure a quality life and provide adequate support for retirement, it is crucial to plan and save enough.

According to statistics by Standard Chartered Bank, 44% of Pakistanis are financially not prepared for their life after retirement. Therefore, those with little financial understanding may suffer adversely over time. Besides, in the past, employees' retirement savings were managed by their employers, but now individual employees are taking on more responsibility for their retirement savings. Apart from that, financial products have also expanded, giving consumers more choices.

Having a grasp of financial literacy is imperative in today's world. As a result, we have researched and compiled information to assist you in reaching your goals. Follow these steps to become more proficient at managing your finances:

Start Budgeting

A good example of financial literacy can be found in the way we manage our day-to-day spending. Consider a person with a monthly income of $8,000. If they managed their expenses properly, they would keep their expenses at no higher than $8,000. Hence, it is crucial for every individual to have a budget in accordance with their income. The expenses can be monitored on any budgeting app in order to be aware of the financial progress.

Another way to budget framework is by implementing the 70/20/10 rule. One must allocate 70% of its income to expenses (including both needs and wants), 20% to savings and 10% to investing. Third-quarter of the 70% of income must be allocated to essential needs like grocery, fuel, insurance, housing while the remaining must be allocated to wants.

If your essentials exceed the average criteria, then you may have to compromise on your wants. Automate budgeting as much as possible so the amount that you have kept for a specific purpose is fulfilled with minimum effort. This will keep you accountable for the choices that you have made. Expenses and income may change over time depending on your priorities. Managing your budget actively is therefore essential.

Trading in Financial Market

Trading is a way to plan ahead while you are busy with other things and have capital work for you. Trading in the financial market enables you to achieve both short- and long-term goals. Thus, investing is considered an act of committing capital to an endeavour.

As soon as you have determined your trading goals, you can choose to trade on Binomo, one of the most popular international trading platforms. Binomo is operational in 133 countries, including Pakistan. The reliable platform offers different trading strategies to assist in becoming a successful financial trader. These strategies are for both beginners and experienced traders to trade efficiently. Also, you can find 70+ high-yielding assets and allocate your capital accordingly.

When trading on Binomo, traders must be aware of the essential fund management guidelines. A solitary trade should not contribute more than 2-5 percent of your total account value. This means that if you make trades with 2% of your deposit , you can make up to five trades at once , or two, if one is worth 5% of your account.

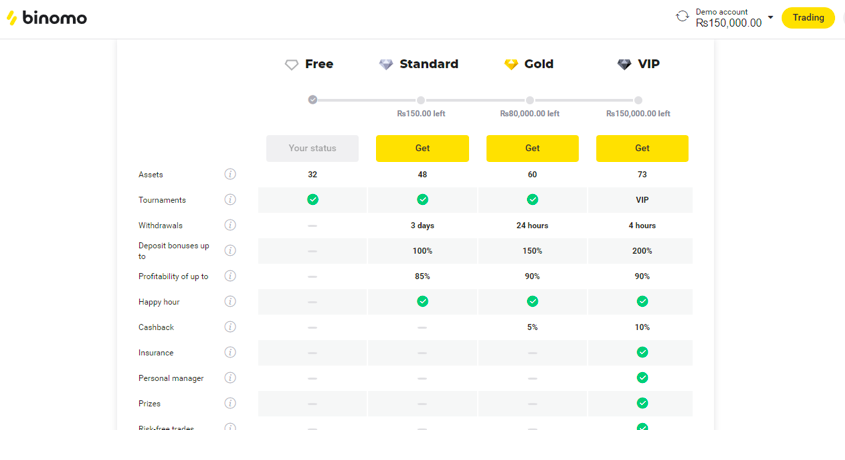

Demo, Standard, Gold, and VIP accounts are available, each providing different benefits and requiring different deposit fees. As a beginner, you can learn to trade with $1,000 on a demo account. Once you have learned the techniques to trade, you can upgrade your account by depositing the required fees. It is important to remember, however, that gains are not always obtained while trading, so a person should be cautious when investing their money as trading involves a high level of risk.

Invest in Saving Accounts

When it comes to saving money, there is a plethora of options available. Depending on the length of time a bank has to hold your funds, each savings option has a different interest rate. To put it another way, banks borrow funds from you to invest in other securities and pay the interest on that. A standard savings account, for example, allows you to withdraw all of your funds at any moment without incurring any fees. Regular savings accounts have lower interest rates than other types of savings accounts since you choose to have funds available to you anytime.

Establish Emergency Fund

Being prepared for emergencies by keeping three to six months of spending in cash is an invaluable aspect of overall financial health. The sum however, can be startling to many people, discouraging even the most well-intentioned saver. But don't give up before you've even begun! Saving is primarily a psychological game that you can win. Even if you're starting from scratch, putting money aside on a regular basis, albeit in modest amounts, will help you reach your objective.

Still, it is essential to balance emergency funds with everyday expenses. Excessive spending could contribute to the depletion of emergency funds. Hence, 10% of your savings must go into emergency savings. Making several small contributions will assist you in meeting your savings goal.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ