The government has increased the rate of profit on various national savings certificates and schemes by up to 240 basis points to pass on the benefit of surge in its income from Pakistan Investment Bonds (PIBs) and mobilise high investment in saving products.

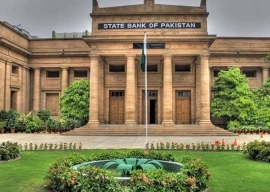

The Central Directorate of National Savings (CDNS), which offers the saving schemes to the general public, reinvests the funds received from retail investors into three to 10-year PIBs.

“The yields (return on investment) on the benchmark 10-year PIBs have increased by around 200 basis points over the past six to eight weeks,” Arif Habib Limited (AHL) Head of Research Tahir Abbas said while talking to The Express Tribune. CDNS, which operates under the ambit of the Ministry of Finance, has announced to increase the rate of profit on Special Savings Certificates (SSC) by 240 basis points to 10.6%.

The Regular Income Certificates (RICs) saw 204 basis point increase in their rates of return to 10.8%.

The rate of return on Behbood Savings Certificate (BSC) surged by 192 basis points to 12.96%.

The directorate also hiked the rate of profit on Defense Saving Certificates (DSC) by 161 basis points to 10.98%.

The net investment in the overall saving certificates and prize bonds remained negative at Rs78.88 billion in the first four months (July-October) of the current fiscal year 2021-22, according to the data updated by the central bank on Monday.

Read Cabinet approves POL dealers’ margin of profit

Net divestment in the saving schemes and prize bonds is being witnessed as institutional investors continue to pull out investment at maturity given that the government has barred them from investing in the schemes.

Moreover, people are continuously encashing prize bonds having the denominations Rs40,000, Rs25,000 and Rs15,000 because the government has discontinued them.

Abbas said that the increase in rate of return on the saving schemes may not massively hurt investment at Pakistan Stock Exchange (PSX) since institutional investors are no longer allowed to invest in saving schemes. The individual investors may however relocate some of their investment from the stock market to fixed-return saving instruments.

CDNS is managing investment portfolio of around 7 million individual and institutional investors. The government utilises the investment attracted through the national saving accounts and certificates to bridge its budgetary deficit.

Published in The Express Tribune, December 10th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (7)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1730752226-0/Untitled-design-(35)1730752226-0-165x106.webp)

1730706072-0/Copy-of-Untitled-(2)1730706072-0-270x192.webp)

It is suggested that individuals whose maturity period in any scheme is still left 2 3 of the total investment period should be allowed to avail the present increase.