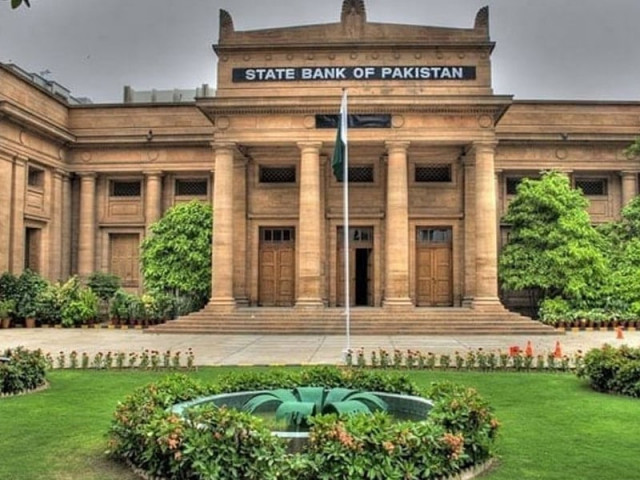

Businesses demand further rate cut

Urge SBP to bring rates to single digits, say current reduction insufficient to counter high costs

Business leaders responded critically to the policy rate announced by the State Bank of Pakistan's (SBP) Monetary Policy Committee (MPC), appealing to the central bank to make more significant rate cuts in line with the declining inflation trend. They argued in favour of single digit interest rate saying that the current reduction is insufficient to meet the business community's need. A single digit interest rate, they said, would lower borrowing costs, boost economic expansion, and reduce the cost of doing business, ultimately benefiting the economy.

They acknowledged that the SBP has consistently eased its monetary policy, this marking the fourth consecutive rate reduction, bringing the interest rate down from 22% to 15%. However, they believe a more substantial reduction is needed to stimulate economic growth and ease the financial strain on businesses and consumers.

The leaders pointed out that the SBP's previously tight monetary policy had led to exceptionally high borrowing costs, causing substantial harm to the economy, particularly in the manufacturing sector. A significant rate cut, they argued, has now become crucial. They pleaded for further reductions in the interest rate saying the move would be welcomed by the entire business community.

Commenting on the 2.5% rate reduction, which brings the policy rate to 15%, Karachi Chambers of Commerce and Industry (KCCI) President Muhammad Jawed Bilwani deemed this insufficient, stating that the business community had hoped for a reduction of at least 5% to better align with the declining inflation trend, which has now reached single digits.

"With this 250 basis-point cut, the key policy rate now stands at 15%, which remains too high. It is essential for the rate to be reduced more aggressively, ideally to between 5% and 7%, in line with many other regional and global economies," he said.

Bilwani praised the four consecutive cuts by the central bank but urged the SBP to lower the policy rate by at least another 500 basis points in the next review.

Site Association of Industry President Ahmed Azeem Alvi criticised the central bank for only scaling down the policy rate by 250 basis points, calling it insufficient. He asserted that the policy rate should fall to single digits to support the growing national economy. Alvi suggested that the MPC should review the rate every 15 days, advocating for an additional 2.5% cut in the next meeting to stimulate business activity and provide better loan options for the Small and Medium-sized Enterprises (SMEs) sector.

"This approach will build business community confidence and encourage a return to long-term investments," he added.

The Landhi Association of Trade and Industry (LATI) also weighed in, calling for a minimum 4% rate cut immediately. The LATI's president and executive committee highlighted the economic importance of the Landhi industrial area, which employs hundreds of thousands of workers and contributes significantly to national exports, valued at $2-$3 billion or approximately 8%-10% of the country's total exports. They urged the SBP to take bold, decisive action on rate reductions to support this vital economic hub.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS (3)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ