Macro and exchange rate

To promote exports, country should have necessary exportable surplus

The advent of October has increased political instability a great deal. On this front, temperature is on the rise with a series of events, which have been reported by the print, electronic and social media.

On the economic front, inclusive talks with the International Monetary Fund (IMF) have been reported, though the government has taken prior actions to satisfy the multilateral lender.

The flexible exchange rate regime has been in place since June 2019, however, the prior actions are normally required before and during the dialogue with the IMF.

The fund usually requires higher taxes and lower expenditure to meet the quantitative criteria set for a particular fiscal year. When the programme stalled, the government slightly increased petrol and utility prices, though fiscal austerity remained in place.

The hope of resumption of dialogue brought an upward adjustment in utility rates and petroleum prices.

Under the emerging situation, the government took a stance that petrol prices were lower in Pakistan as compared to neighbouring countries and electricity prices got an upward adjustment because of higher international crude oil prices as the energy mix was heavily tilted in favour of imported fuels.

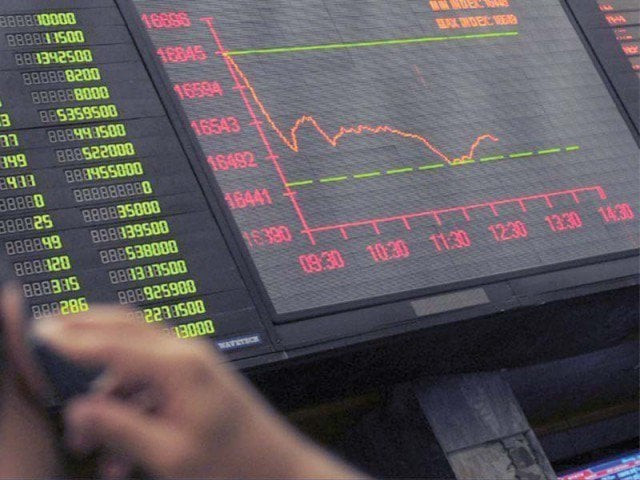

Under the new regime, the rupee has become volatile. The currency remained stable during the Covid period when trade remained a bit lower.

Capital flows swing the rupee up and down as has been witnessed at the beginning of 2021. The rupee vis-a-vis dollar appreciated to Rs152 owing to capital inflows. Then the surge in demand for dollars associated with the current account requirements and Afghanistan brought a slide in the currency.

When a currency is going down, the speculators become active to take it down further.

Some analysts are of the opinion that the flexible exchange rate is significant from the point of export promotion in Pakistan.

They state that Pakistan followed a fixed exchange rate regime to promote import substitution-based industrialisation at the early stage of development. Then it followed a managed float regime to promote exports.

However, the anti-export bias remained in place as the policy was tilted towards import substitution.

In order to bump up exports, the country has to adopt the flexible exchange rate regime and the intervention of authorities should be minimal in this regard.

There is a need of an independent State Bank of Pakistan (SBP), which remains out of the influence of the Ministry of Finance. The flexible exchange rate will take time to yield positive results as the industrial capitalists are tuned to the managed exchange rate along with an overvalued rupee.

The overvalued rupee makes imports cheaper and exports expensive, which even increases the trade deficit a great deal.

In order to make imports dearer, the country needs to let the rupee depreciate that will make exports cheaper and reduce the trade deficit.

The media is replete with this kind of oversimplified statement. However, the data shows that imports outpaced exports by a wide margin despite the depreciation of the rupee over the last many years.

The wild swings up and down in the rupee have increased problems of industrial capitalists and they are facing high uncertainty.

In short, the heightened political instability increases economic uncertainty. In order to promote exports, the country should have necessary exportable surplus.

The lesson of history is that exports sprang up in countries due to exportable surplus and the role of exchange rate was supportive, which implies that focus on exchange rate to jump-start exports is an oversimplification of facts.

The rupee has depreciated a lot since 2017. The question is how much time the depreciated rupee will take to bump up exports. Let’s see how things unfold in the coming months.

The writer is the Assistant Professor of Economics at SDSB, Lahore University of Management Sciences (LUMS)

Published in The Express Tribune, November 1st, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ