Keeping track of monthly cash flow can be a tedious task, however, with the help of budgeting apps you can easily monitor your spending, expenses, and bills. Here are five budgeting apps that can help you oversee your expenditures and savings and in keeping your financial plan in check.

Personal Capital

Personal Capital is an online financial advisor and personal wealth management company that lets you sync and track your financial accounts. Whether you want to create budgets, track your cash flow, or simply save for the future, this app lets you do it all.

The app has a team of licensed fiduciary advisors that provide you guidance and also alert you to new investment opportunities.

Google suspends Parler social networking app from Play Store

Personal Capital is also equipped with tools such as Fee Analyzer, which checks whether you are losing money through hidden fees in your mutual funds, Investment plan, or Retirement Planner.

At present, the app has over 2.7 million registered users of its free tools and manages over $15 billion in assets.

Mint

Mint allows users to create a budget, track their expenses, and also gives them an insight into their cash flow and credit score. However, the unique feature about Mint is that it lets users link their bank and credit card accounts to the app and then suggest a budget.

The app gives you a guides you about how much money should be spent on food, shopping, etc, and also how much you can save by cutting out unnecessary expenses. Users get reminders about upcoming bills and alerts if they’re running out of funds.

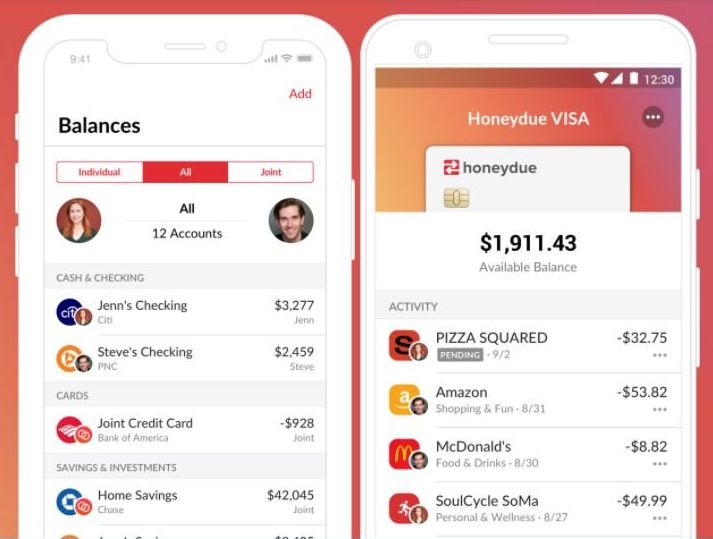

Honeydue

Honeydue is a free budget app that is perfect for couples that wish to see their finance such as bank accounts, credit card details, loans, investment, and savings on a single platform. The best part is that you can decide how much information you want to share with your partner.

The app helps couples track their monthly expense, savings and also sends an alert if you are going over budget or when bills are due.

Users can also send emojis or chat with each other.

Too many apps can spoil online learning

PocketGuard

PocketGuard is another great budgeting app that can help you monitor your spending patterns. You can keep a tab on your monthly expenditure while also get bill payment notifications.

The app is free but if you want to switch to an ad-free version of the app then you will have to sign up for a premium subscription for $4.99 a month or $34.99 a year.

YNAB

You Need A Budget (YNAB) uses four rules to budget expenses. First, if users have a partner then the best thing is to budget together so that there is no overspending.

Secondly, the app suggests users to set a budgeting goal such as vacation or education expenses. Following this, users can link their personal accounts such as savings, credit cards to fund this goal.

Further, users can allocate their income to categories such as grocery shopping, transportation, medical bills, gym expense, tuition bills, etc.

YNAB offers a free trial for 34 days after which the app charges $6.99 a month.

1724760612-0/Untitled-design-(12)1724760612-0-405x300.webp)

1731838555-0/BeFunk_§_]__-(5)1731838555-0.jpg)

1731652244-0/apple-(6)1731652244-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ