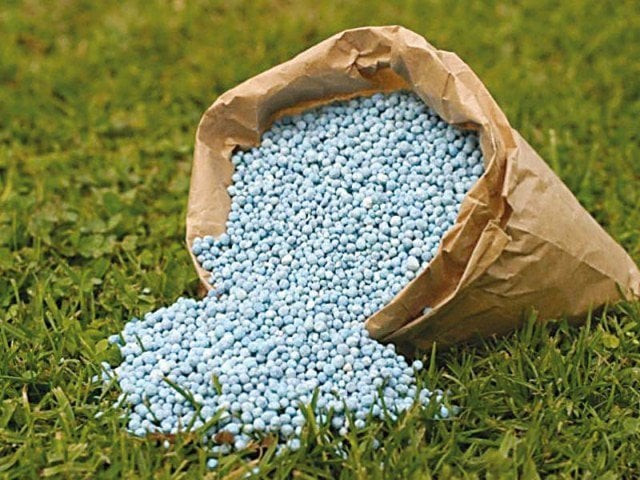

Urea sales jump 24% in July

Surge comes as customers purchase urea in huge quantities due to unfolding developments

Urea sales jumped 24% to 575,000 tons in July 2020, from 465,000 tons in the same period last year, according to the latest data released by the National Fertiliser Development Centre (NFDC).

However, on a sequential basis urea, volumetric sales declined by 51% primarily due to a high base effect, stated a research report published by Aba Ali Habib Securities.

During June 2020, farmers and dealers materialised accumulated demand amid clarity regarding subsidy coupled with pre-buying owing to uncertainty regarding sales of urea to unregistered dealers. Prior to that, the farmers and dealers were waiting for the subsidy, which later the government decided not to grant.

The decision, however, had an inverse effect and customers purchased urea in huge quantities due to said reasons.

Meanwhile, DAP volumetric sales increased by 41% on a month-on-month basis and 22% year-on-year to 248,000 tons anticipating that the subsidy will most likely be granted in the rabi season, said the report.

On a cumulative basis, during the first seven months of calendar year 2020, urea sales declined by 3% to 3,247,000 tons as compared to 3,353,000 tons in the corresponding period of last year. While DAP sales remained largely flat at 846,000 tons.

Company-wise analysis indicates, Fatima Fertiliser posted the highest growth of 124% year-on-year in July to post urea sales of 95,000 tons, followed by Engro Fertiliser up 91% yearon-year at 334,000 tons. While Fauji Fertiliser Company (FFC) recorded a decline of 37% year-on-year to record sales at around 111,000 tons. Urea sales of Fauji Fertiliser Bin Qasim Limited (FFBL) remained flat at 32,000 tons.

In the DAP segment, Fatima Fertlizer’s volumetric sales increased 9.76 times to 31.4,000 tons followed by Engro Fertilizer up 74% year-onyear to 72,000 tons, FFBL 5% year-onyear to 105,000 tons. While FFC’s DAP sales declined by 56% year-on-year to 174,000 tons.

The fertiliser sector has Rs110 billion of outstanding Gas Infrastructure Development Cess (GIDC) on their books which is 26.37% of the total amount of GIDC to be paid. The GIDC verdict will impact the cash flow and recurring earnings per share of the companies, however, this amount is to be paid in 24 equal instalments.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ