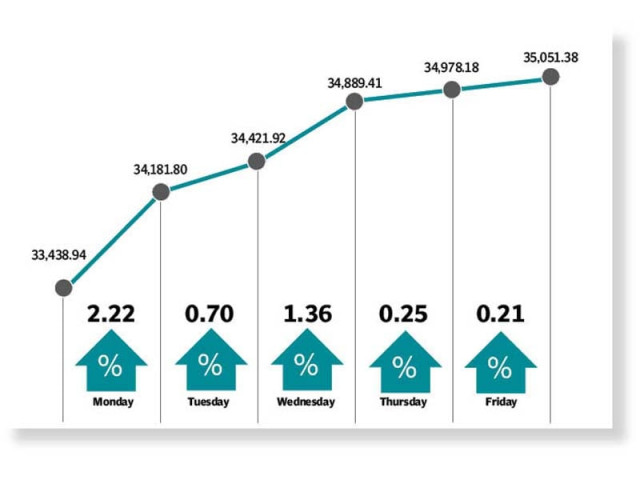

Weekly review PSX finishes all sessions in green

KSE-100 index records gains of 1,112 points or 3.3% to settle over 35,000-mark

Despite an adventurous start to the week, bulls dominated the Pakistan stock market as a spate of positive developments helped the index surge 1,112 points or 3.3% to enter the new fiscal year on a high note. The index managed to power past the 35,000-mark as it settled at 35,051.

On the domestic front, approval of the federal budget from the parliament and inflows from the World Bank and Chinese banks boosted investors sentiments, thus fuelling buying interest at the bourse. Additionally, increase in international oil prices and inflation remaining in line with expectations also went a long way in keeping investors satisfied.

Trading kicked-off Monday on a rather terrifying note as armed men tried to force their way into the Pakistan Stock Exchange (PSX) building during early hours of the day. The attack on the country’s financial institution threatened to push the fragile bourse into a downward spiral. However, quick action by the security personnel saved the country from financial hit.

In fact, trading and settlement continued smoothly as investors did not panic and helped the market recover lost ground. Interestingly, Pakistan emerged as one of the best performing markets on this single day in Asia despite the attack as it finished positive.

Stocks continued to rally in the following session with investors cheering inflows from China. Pakistan received the much-awaited $1.3 billion commercial loan from China on Tuesday, which helped Islamabad achieve the foreign exchange reserve target of around $12 billion by the end of fiscal year 2019-20. The approval of federal budget 2020-21 in the late hours of Monday also proved positive for the bourse and lent further support to the uptrend.

Wednesday marked the first trading day of the new financial year, and the KSE-100 recorded gains of nearly 470 points on back of rising global oil prices, which prompted a rally in oil and marketing scrips, along with reports of an upward revision in cement prices. The inflation rate rose 8.6% in June. Although the numbers were in line with expectations, some investors remained cautious due to which the bourse kept swinging between red and green zones.

However, the low monthly reading fuelled expectations of further cut in interest rates, due to be announced later this month. Despite the somewhat wariness, the index maintained its winning streak for the fifth successive session as it closed in green.

The winning spree continued for the sixth successive session on the last trading day of the week as the benchmark index gradually marched upwards and gained over 70 points following rupee’s significant recovery against the dollar. Furthermore, stability in international crude oil prices and recovery in global markets strengthened investors’ sentiment. Despite growing political and economic uncertainty, strong investors’ interested helped the index post modest gains.

Participation picked up during the week as average volumes jumped 42% to settle at 251 million, while average value traded surged 45% to clock-in at $ 51 million.

In terms of sectors, positive contributions came from commercial banks (176 points), cements (170 points), oil and gas exploration companies (140 points), fertiliser (136 points) and technology and communication (85 points). Meanwhile, automobile parts and accessories (7 points) and textile spinning (4 points) were among the sectors that dragged the index lower. Scrip-wise, positive contributions were led by LUCK (107 points), OGDC (81 points), MCB (72 points), TRG (59 points) and PSO (50 points).

Foreign selling continued this week clocking-in at $20.5 million compared to a net sell of $9.9 million last week. Selling was witnessed in commercial banks ($8.8 million) and E&P ($3.9 million). On the domestic front, major buying was reported by insurance companies ($17.5 million) and companies ($9.6 million). Among major news of the week was; ECC approved hike in K-Electric tariff, Shanghai Electric renewed intention to buy K-Electric and foreign exchange reserves held by the central bank increased $1.3 billion to $11.2 billion.

Published in The Express Tribune, July 5th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ