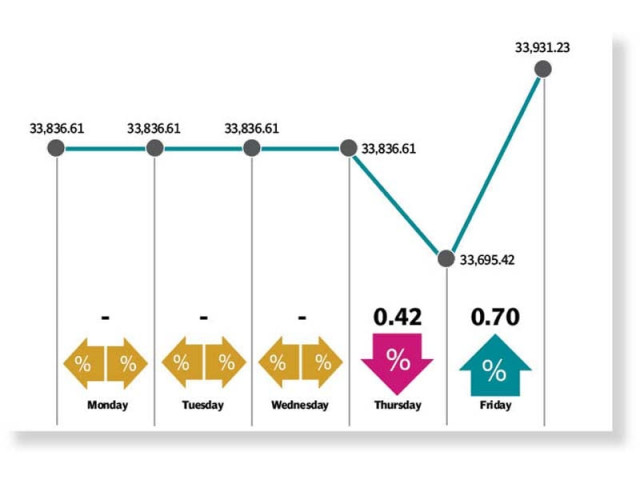

Weekly review: Index finishes two-day sessions with gains

Investors await budget announcement, expect measures to uplift economy

Weekly review: Index finishes two-day sessions with gains

Investors remained subdued and opted to hold positions as they anticipated the upcoming budget to focus on measures to uplift the economy. “Stringent revenue targets are likely to be a major deterrent. That said, news coming in this week has been suggestive of no new additional taxation measures,” stated and AHL report.

Trading on Thursday commenced on a bearish note as budget uncertainty weighed on investor sentiments. Market participants speculated about the upcoming budget announcement for fiscal year 2020-21, which seemed quite a challenge for the government. Termed the “Corona Budget”, it may provide relief for the ordinary people, however, the tax collection target has been set at a massive Rs5.1 trillion, according to Adviser to Prime Minister on Finance Abdul Hafeez Shaikh.

Investor sentiment had remained weak throughout the day due to absence of positive triggers. In contrast to the sombre mood of the preceding day, the index rebounded on the last trading day of the week. The uptrend was seen on back of a rally in shares of oil companies, driven by a slight improvement in global crude prices.

Although the index had managed to cross the 34,000-point mark, selling pressure, stemming from concern over a surging fiscal deficit, wiped off most of the gains. An expected Rs216-billion subsidy for the power sector in the federal budget for FY21 pushed stocks up. However, rupee instability against the dollar coupled with pre-budget uncertainty dented investor interest. The ongoing developments also prompted profit-taking, which tempered gains during the day.

Participation remained slow as average volumes ticked up 4% week-on-week to settle at 214 million shares while average value traded jumped 13% to clock-in at $54 million.

In terms of sectors, positive contributions came from technology & communication (up 46 points), cement (43 points), and pharmaceuticals (39 points). On the other hand, negative contributions from fertilisers (down 43 points), and commercial banks (39 points) dragged the index lower.

Scrip-wise, positive contributions were led by TRG (28 points), OGDC (26 points), and LUCK (23 points) while ENGRO (49 points) and UBL (30 points) remained laggards.

Foreign offloading during the week arrived at $2.42 million compared to a net sell of $8.77 million last week. Selling was witnessed in fertiliser ($2.54 million), textile composite ($1.81 million) and banks ($1.01 million). On the domestic front, individual accumulated stocks worth $3.93 million, while buying by Broker Proprietary Trading arrived at $0.62 million.

Among major news of the week was; private sector sputters, fiscal balance improves in latest data, Ogra asked to keep room for higher levy in oil prices, new tariff policy to reduce duties, says Razak, and companies resume plant operations.

Published in The Express Tribune, May 31st, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ