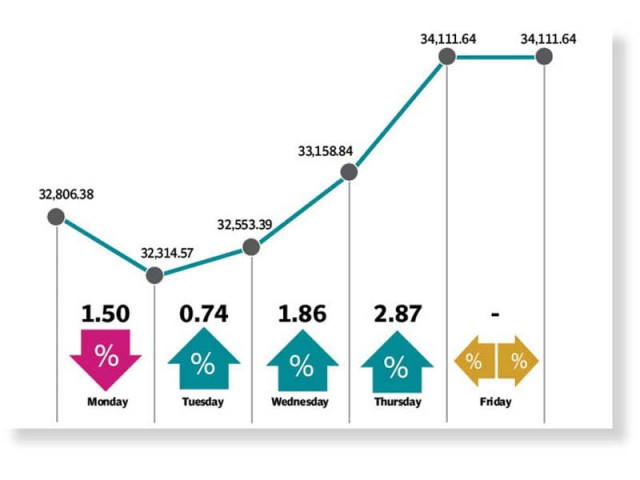

Weekly review: PSX posts smart gains

KSE-100 index jumps 1,305 points despite gloomy economic situation

Sentiment at the local bourse showed signs of improvement in the week as investors remained undeterred by the economic gloom caused by the pandemic, which was reflected in broadly weak corporate earnings.

The bullish trend in global oil prices and expectations of a lower inflation reading for April also fuelled optimism in the domestic equity market.

Global oil prices strengthened more than 49% in four days and crude futures traded between $11.88 and $17.80 per barrel. Traders expected oil prices to stabilise due to a reduction of 9.7 million barrels per day in output announced by OPEC+ members from May this year. The plunge in world oil demand is expected to take a breather in May after France, Spain, Germany and some US states announced an ease in lockdowns from the first week of May. Investors also became hopeful of a further hefty rate cut by the central bank, which drove the index higher.

The week kicked off on a negative note as the benchmark KSE-100 index fell where index-heavy oil stocks bore the brunt of tumbling crude prices. The development stopped investors from accumulating stocks with selling pressure weighing on sentiment.

Moreover, with the beginning of Ramazan, the stock market experienced lacklustre interest, which led to a slump in trading volumes.

However, the bearish spell did not last long and the market rebounded on hopes of a lower inflation reading. The uptrend continued for the remaining sessions with oil stocks gaining traction on the back of rising global prices. The last trading session of the week recorded a handsome rally as the index powered past the 34,000-mark with investors pinning hopes on easing of the lockdown and likely resumption of economic activities in the country.

With business activities suspended for over a month now to curtail the spread of Covid-19, the news acted as a much-needed positive trigger for the market and assisted the KSE-100 index in recording adequate gains.

On the other hand, progress on a vaccine trial against the coronavirus, reported by Gilead and Oxford University, lifted investment climate in global markets, which spilled over into the PSX.

In addition to the International Monetary Fund's (IMF) Rapid Financing Instrument worth $1.4 billion, the Asian Development Bank (ADB) also announced $1.7 billion to help Pakistan deal with the pandemic, which helped jack up confidence in the market.

Meanwhile, the strengthening rupee and relative stability also contributed to the turnaround in investors' confidence.

Participation slowed during the week, with average volumes dipping 32% to settle at 179 million shares while average traded value decreased 32% to $49 million. In terms of sectors, positive contribution came from oil and gas exploration companies (396 points), power generation and distribution firms (201 points), fertiliser producers (158 points), cement companies (126 points) and oil and gas marketing companies (78 points).

Meanwhile, stock-wise the positive contribution was led by Hubco (197 points), OGDC (144 points), Pakistan Petroleum (119 points), Pakistan Oilfields (92 points) and Fauji Fertiliser Company (79 points).

Foreign stock offloading during the week came in at $11.6 million compared to net selling of $2.5 million last week. Selling was witnessed in oil and gas exploration and production firms ($7.7 million), fertiliser producers and banks ($1.5 million each).

On the domestic front, mutual funds accumulated stocks worth $4.2 million while companies bought $3.6 million worth of stocks.

Published in The Express Tribune, May 2nd, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ