PTI govt envisages record Rs1tr in additional taxes

Federal cabinet approves 3% GDP growth target, inflation target set at 8.4% for FY21

PHOTO: REUTERS

The federal cabinet on Tuesday approved a heavily tax-loaded and low economic growth budget strategy paper for the third year of the Pakistan Tehreek-e-Insaf (PTI) government, envisaging imposition of a record Rs1 trillion in additional taxes and continuation of the stabilisation policies.

In addition, the cabinet approved the 3% gross domestic product (GDP) growth target while inflation target is set at 8.4% for fiscal year 2020-21. The total size of the federal budget is projected at Rs7.6 trillion -- up by 8.5% over this year’s budget.

Out of Rs7.6 trillion, an amount of Rs4.64 trillion has been proposed for debt servicing (Rs3.23 trillion) and defence (Rs1.4 trillion), which is equal to 61% of the projected budget, according to the strategy paper.

The net federal receipts of Rs4.2 trillion, after paying provinces’ share in taxes are Rs464 billion less than the total requirements of debt servicing and defence.

The lion’s share of Rs3.23 trillion or 42.5% of the projected budget size will go for debt servicing.

Low growth budget

The economic and fiscal plans laid out in the Budget Strategy Paper 2020-21 are contrary to Prime Minister Imran Khan’s promise of the year 2020 as the year of economic growth and job creation.

The targeted 3% growth rate is insufficient to absorb the youth bulge and suggests that the government remained unable to remove structural imbalances for achieving a higher economic growth rate.

The strategy paper has been prepared and approved while keeping in mind the upcoming board meeting of the International Monetary Fund (IMF).

The strategy paper will be the guiding document for the budget 2020-21 that the government will unveil either in May or June.

The paper showed that Pakistan will miss the IMF’s primary budget deficit target of Rs264 billion for this fiscal year and the deficit is projected at Rs346 billion. For next fiscal year, Pakistan will have to show a primary surplus of Rs339 billion.

The federal cabinet has approved the budget strategy paper, confirmed Omar Hamid Khan, spokesperson of the Ministry of Finance.

“The government endeavours to stay on course of stabilisation measures in addition to implementing policies that are geared towards acceleration of economic growth and in its wake, creating jobs and reducing unemployment,” read the strategy paper.

A study carried by the Asian Development Bank stated that given the prevailing structural impediments, economic growth rate of more than 3.8% will lead to economic crisis.

The strategy paper briefly talks about implication of coronavirus contagion and says that Pakistan will benefit from reduced global crude oil prices. But the reduced global economic growth can negatively impact Pakistan and hence cautious fiscal and monetary policies need to be pursued keeping both the short-term and medium term perspective.

“The government will maintain a tight fiscal policy over the medium term,” said the strategy paper. For fiscal year 2022-23, the last year of the PTI rule, the budget strategy paper projects 5% economic growth rate and public debt-to-GDP ratio at 77% -still far above the statutory limit of 60% of the GDP.

The budget strategy paper also sets the guidelines for the central bank. Going forward, the State Bank of Pakistan is trying to manage two fundamental risks of balance of payments -stable foreign exchange reserves position and decrease in inflation.

Taxation

The government intends to remove tax exemptions, preferential treatments and concessions that are likely to result in added tax collection of around 2% of the GDP, according to the strategy paper. The projected size of next year’s GDP is around Rs49.5 trillion and 2% will translate into Rs1 trillion worth of additional taxation in next fiscal.

The strategy paper reveals that “income tax slabs will be rationalised and thresholds will be lowered to broaden the tax base”. Amnesty schemes will no longer be offered and exemptions will be curtailed. The government will enforce real-income based taxation by gradually phasing out final tax regime.

In this fiscal year, the government had also imposed Rs735 billion worth additional taxes.

For the medium term the government plans to continue reduction in budget deficit path “through increase in government revenues,” maintaining policy of zero borrowing from SBP, a flexible exchange rate and structural reforms in public entities.

Fiscal framework

The defence and territorial integrity will remain the top priority of the PTI government next year and the government has projected to allocate Rs1.402 trillion for stated defence budget -up by Rs250 billion or 22% over this year’s original budget of Rs1.15 trillion. The revised defence spending for this fiscal year is projected at Rs1.25 trillion, although the military had announced that it will take a hit on its budge due to precarious economic conditions.

The debt serving cost has been projected at Rs3.235 trillion for next fiscal year -Rs343 billion or 11.9% higher than this fiscal year’s original budget. The revised debt cost for this fiscal is estimated at Rs2.8 trillion. The cost of pensions would further surge to Rs475 billion for next fiscal -up from Rs435 billion.

The cost of running the civilian government would increase to Rs495 billion in next fiscal year -an addition of only Rs25 billion. The subsidies will go down from Rs273 billion in this fiscal to Rs260 billion in next fiscal year. The government has also set aside Rs130 billion for meeting contingencies in next fiscal year.

The federal budget deficit is estimated at Rs3.4 trillion or 6.9% of the GDP for next fiscal year. But once again, the federal government has projected a huge provincial cash surplus of Rs531 billion to show the overall budget deficit at Rs2.9 trillion or 5.8% of the GDP.

For this fiscal year, the government had projected Rs421 billion provincial cash surplus in the budget but in the revised estimates it has been shown at Rs90 billion only.

As against primary deficit of Rs264 billion in this fiscal year, the government will have to show primary surplus of Rs339 billion in next fiscal year.

The total federal receipts have been estimated at Rs7.8 trillion for next fiscal year and provincial share will be Rs3.6 trillion, leaving the federal government with net projected receipts of Rs4.2 trillion.

Macroeconomic targets

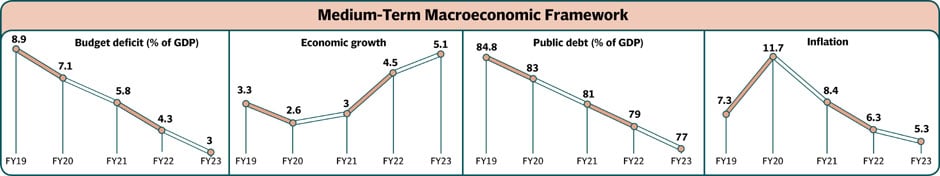

For this fiscal year the government has projected only 2.6% GDP growth -down from 4% official target. For next fiscal year target is 3% that it sees growing to 5.1% in the last year of the PTI government. It has a target to keep inflation at 8.4% in next fiscal year at 5.3% for last year of the PTI.

The budget deficit has been projected at 7.1% of the GDP for this fiscal year and at 5.8% of the GDP for next fiscal year. The public debt which is projected at 83% of the GDP for this fiscal year has been shown at 81% of the GDP or Rs40 trillion for next fiscal year.

The current account deficit is projected at 4.6% of the GDP for next fiscal year and gross official foreign currency reserves equal to 3.3 months of imports cover of fiscal year 2020-21.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ