Car sales fall 18% to 17,891 units in May

Car manufactures sold 21,813 units in May last year

PHOTO: REUTERS

Sales of cars and LCVs declined 18% to 17,891 units in May compared to 21,813 units in the same month of previous year. On a month-on-month basis, the sales fell 8%.

In 11 months of the current fiscal year, sales of cars and LCVs dropped 7% to 222,774 units from 240,114 in the same period of previous fiscal year.

Similarly, sales of trucks and buses plunged 50% on a yearly basis, tractor sales dropped 47% and bike and three-wheeler sales fell 10%.

“Keeping 11 months of FY19 in view, this month (May) was the fifth case of a year-on-year double-digit decline in volumes,” said JS Research analyst Ahmed Lakhani. “This indicates the plight of auto assemblers in the country.”

Auto parts makers criticise electric vehicle policy

There are many reasons for negative growth of the auto sector including economic slowdown in the country, 44% depreciation of the rupee against the US dollar since December 2017 and high inflation at 9.11% in May 2019.

Apart from these, a continued hike in the key interest rate, which was raised to 12.25% by the end of May 2019, played a major role in the decline in car sales.

Despite these hurdles which sharply hiked car prices and slashed the purchasing power of consumers, the government has proposed imposition of federal excise duty (FED) on cars of all engine capacities in the new budget.

In the last mini-budget, the government imposed 10% FED on cars of 1,700cc and above engine capacity. Now, it has imposed FED at 2.5% on cars of 1,000cc and below, 5% on 1,001-2,000cc cars and 7.5% on vehicles of 2,000cc and above.

“The proposed duty will undoubtedly lead to further price increase,” said the analyst.

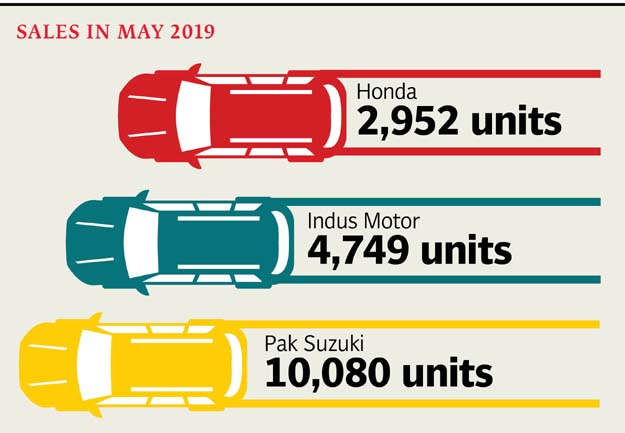

Company-wise sales

Sales of Pak Suzuki Motor Company (PSMC) fell 13% to 10,080 units in May 2019 compared to 11,651 units in the same month of previous year.

On the other hand, sales of Honda Atlas Cars (HCAR) plunged 31% to 2,952 units in May as opposed to 4,252 units last year. Similarly, Indus Motor Company sold 20% less units in May compared to the same month of previous year. Its sales fell from 5,910 to 4,749 units.

“Although Indus Motor had previously survived the impact of macroeconomic challenges and recorded a rise in vehicle sales in 11 months of FY19, it seems that the company has run out of luck as this is the third consecutive month showing a drop in its sales,” said Lakhani.

He added that in 11 months of the current fiscal year, monthly auto sales had either declined or remained stagnant barring one or two exceptions. A meaningful growth in auto sales, above 5% on a year-on-year basis, was last seen back in July 2018, said the analyst.

“In addition to these obstacles, new entrants KIA, Hyundai and others are expected to compound miseries of the Japanese assemblers in coming months, which will make it increasingly difficult to increase prices in response to the cost hike,” said the analyst.

Published in The Express Tribune, June 14th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ