After six weeks of decline, KSE-100 gains 225 points

News of inflows from China, MoUs with Malaysia and improved current account deficit drive sentiments

After six weeks of decline, KSE-100 gains 225 points

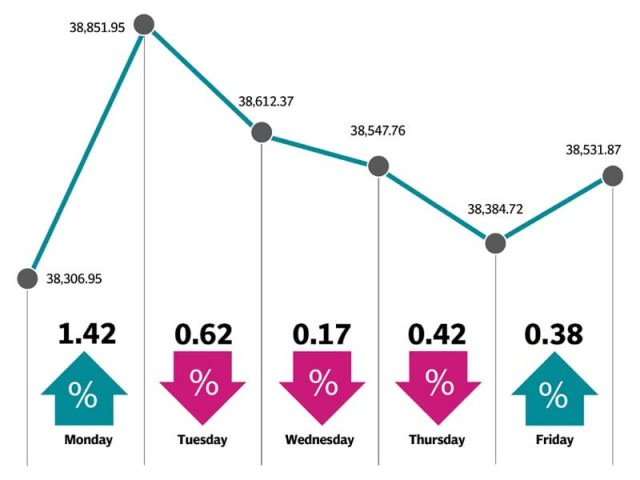

Although volumes remained dreary, investor confidence was revived amid clarity on talks between Pakistan and the International Monetary Fund (IMF). Finance Minister Asad Umar revealed that negotiations had entered the final stages regarding a bailout programme. Furthermore, a significant decline in the current account deficit also helped consolidate confidence of the participants.

Following these two developments, the market witnessed a rally of over 500 points on the first trading day of the week. However, the momentum could not be sustained as a lack of positive triggers prompted investors to sell and remain on the sidelines. The ongoing tensions at the political front and NAB-related headlines also dented the index, which lost ground for the following three sessions.

The trend changed on Friday, as bulls returned to dominate as the finance ministry announced Pakistan would receive a $2.1-billion commercial loan from China next week. Sentiments were further buoyed by the expectations of agreements worth millions of dollars to be signed with Malaysia. Additionally, improving ties with the US all contributed towards stimulating positivity in the market.

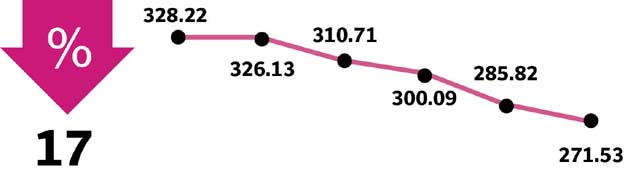

Participation remained dull as average volumes during the week were down 10% to 84 million shares, whereas average value traded increased 6.6% to $28 million.

In terms of sectors, positive contributions came from commercial banks (up 278 points), oil and gas exploration companies (194 points), and fertiliser (75 points). On the other hand, power generation and distribution (down 126 points), oil and gas marketing companies (39 points) and pharmaceuticals (30 points) dragged the index lower.

Scrip-wise, PPL (up 115 points), MCB (91 points), HBL (77 points), POL (57 points), and OGDC (51 points) added to the index, while major laggards included HUBC (down 122 points), SEARL (30 points) and MARI (29 points).

Foreign buying worth $3.1 million was witnessed in the week compared to a net sell of $15.6 million last week. Buying was witnessed in commercial banks ($2.9 million) and exploration and production ($1.7 million). On the domestic front, major selling was reported by insurance companies ($4.8 million) and other organisations ($2.7 million).

Among major news of the week were; Pakistan to receive loan worth $2.1 billion from China by Monday, govt reshuffled SNGPL’s top management on overbilling inquiry, Imran Khan-led govt to reimburse inflated gas bills amounting Rs2.5 billion, economy to slow further in ‘calibrated moderation’, says SBP governor, finance minister said Pakistan is closer to reaching accord with IMF, 300MW of Thar power beginning trial runs and agreements to the tune of $900 million were signed between Malaysia and Pakistan.

Winners of the week

Orix Leasing Pakistan

Orix Leasing Pakistan Limited is a leasing and diversified financial services company. The company offers full payout finance leases for machinery, office automation, computers, vessels, aircraft and automobiles. Orix financial service products include loans, rentals, security brokerage, options trading and life insurance products.

Pakistan Petroleum

Pakistan Petroleum Ltd specialises in the exploration and production of crude oil and natural gas. The company also sells liquefied petroleum gas and condensates.

Losers of the week

Pak Suzuki Motor Company

Pak Suzuki Motor Company Limited manufactures, assembles and markets Suzuki cars, pickups, vans and 4X4 vehicles.

International Industries

International Industries Limited manufactures cold-rolled steel strips, steel tubes and galvanised piping products.

Published in The Express Tribune, March 24th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ