PM lauds SBP financing policy for low-cost houses

Premier Imran urges LHC to resolve pending case on foreclosure laws for building 5 million houses in five years

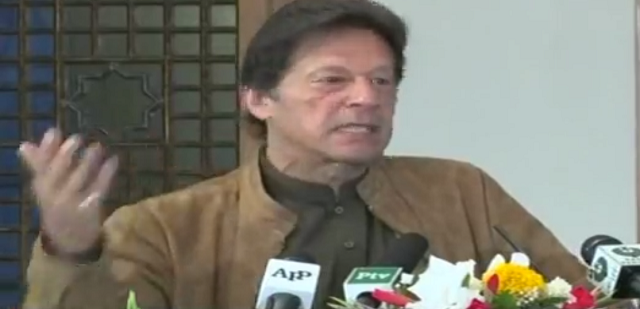

Premier Imran urges LHC to resolve pending case on foreclosure laws for building 5 million houses in five years. SCREENGRAB:

Prime Minister Imran Khan on Monday launched a low-cost finance scheme for the Pakistan Tehreek-e-Insaf (PTI) government’s flagship project of constructing five million housing units in the country.

Addressing a ceremony in connection with the launch of State Bank of Pakistan’s (SBP) financing policy for low-cost housing, the prime minister said that besides addressing housing issues at affordable cost, the project would be a force multiplier giving momentum to economic activities by creating jobs and boosting 40 allied industries.

He said a huge part of the population of the country was cash starved and could not afford to build houses, which was why the government was going to finance them for the purpose.

PM Imran ‘nominated for Nobel Peace Prize’ by US publication

PM Imran said the incumbent government had a different mindset from the past regimes as it was focusing on poverty alleviation like China, which had lifted some 700 million people in rural areas out of poverty with planning.

The low-cost housing project was a component of the PTI government’s plan for poverty alleviation, he added.

The premier appreciated SBP Governor Tariq Bajwa for launching the financing facility for the low-cost housing project at a low interest rate, in addition to providing cash loan facility to small growers and the small and medium enterprises (SME) sector.

The SMEs were the backbone of economy and with the cash loans they would not only get a boost but also provide jobs to people, he added.

He also said the extent of housing finance facility in Pakistan was just 0.2 per cent, while it was 10 per cent in India, 30 per cent in Malaysia and 80 per cent in the United Kingdom and United States.

The prime minister also appreciated the steps to include the people of erstwhile Federally Administered Tribal Areas — who had suffered a lot because of the war on terrorism — transgender persons and under-privileged segments of the society in the scheme.

The PM said a social welfare state was the great dream of the forefathers, but unfortunately the present day Pakistan had become a country of the powerful and elite.

The PTI-led government was developing Pakistan on the pattern which had been dreamt by the forefathers, he added.

The prime minister also pledged to bring an ambitious programme for the slum areas, for which private sector developers would be encouraged to build flats with all facilities. They would be allotted on ownership basis, he added.

He said efforts were being made to check sprawling cities, which were engulfing cultivated land and creating climate issues. The construction of high-rise buildings would be encouraged to protect green areas and Islamabad would be made a model city with vertical buildings, he added.

On the occasion, Finance Minister Asad Umar said it was in the PTI’s manifesto to provide all possible facilities to the downtrodden segments of the society.

He said currently Pakistan had a backlog of 10 million housing units and bank financing was a must to achieve the target of constructing five million low-cost houses.

Naya Pakistan Housing Project: Egyptian tycoon offers to build 100,000 houses

“It is our constitutional responsibility to provide shelter to the people,” he added.

Umar said housing schemes for the federal government employees would also be launched in 12 cities. Highlighting salient features of the scheme, the SBP governor said the central bank had prioritised three sectors, including agriculture, SMEs and low-cost housing project, for bank lending.

He said a housing unit costing less than Rs3 million would be funded under the scheme. The banks would provide loan of up to Rs2.7 million under the scheme.

The banks and other financial institutions were being given incentives to extend loans for the scheme, he added.

Bajwa said special segments, including widows, orphans, transgender person, families of martyrs and people living in areas affected by the war against terrorism, would be given priority under the scheme.

The new housing units could neither be rented out nor sold, he added. He said the low-cost financing would be made available for 100,000 housing units at the mark-up rate of five per cent for 12.5 years.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ