Soliciting expats patriotism to help revive Pakistan's economy

Pakistan Banao Certificate: an attractive investment avenue for the Pakistani diaspora

Soliciting expats patriotism to help revive Pakistan's economy

Pakistan is facing serious pressure on the external account due to lower inflows and massive external debt obligations. The government of Pakistan seems to be determined to try all the options to bridge the gap in the external sector accounts before finalising a bailout package with the IMF. Despite the fact that the balance-of-payments crisis has been taken care of, to a good extent, through assistance packages from friendly states, the country’s dwindling foreign exchange reserves – currently standing at $15.25 billion, including $8.86 held by the SBP – is still worrisome.

The government has decided to tap into the international savings of overseas Pakistanis for building foreign exchange reserves via an attractive investment opportunity. For this purpose, the government has launched a Pakistan Banao Certificate (PBC) in order to provide the much needed Sovereign investment avenue to overseas Pakistanis so that they can earn handsome returns on investment. The certificates are issued globally by the government in conjunction with the State Bank of Pakistan (SBP).

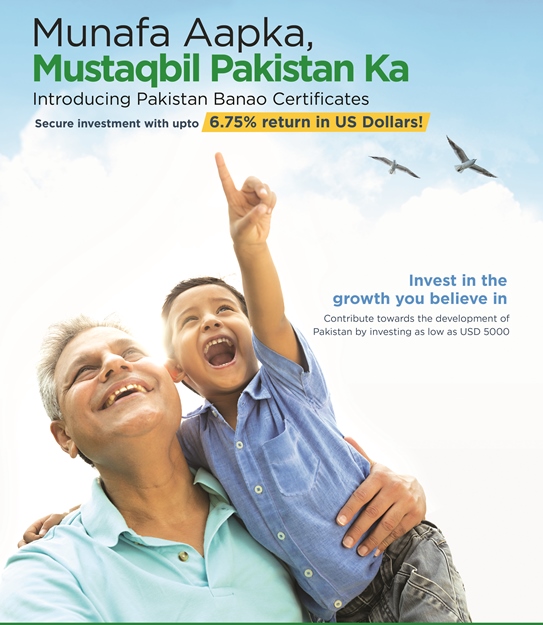

After getting approval from the federal cabinet, the government promulgated Pakistan Banao Certificate (PBC) Rules, 2018, under which it will issue dollar-denominated scrip-less certificates to expats who hold Computerized National Identity Card (CNIC), National Identity Card for Overseas Pakistani (NICOP) or Pakistan Origin Card (POC) and are eligible to invest, either individually or jointly. These certificates issued in US dollars are providing an attractive investment avenue to Pakistani diaspora by empowering them to contribute to the development of the country at this important juncture. The investment will not only be favourable for the country’s Balance of Payment but it will also raise financing for critical infrastructure projects including dams, road networks, power generation and transmission projects etc.

The certificates comprise of two types, one is of three years that offers 6.25% return semi-annually and the other one is of five-year maturity with 6.75% return semi-annually. For example: if certificates are issued on 6th February the profit payments would be made on 6th August and on subsequent six-monthly dates accordingly. The minimum investment amount should be USD 5,000 or higher in the integral multiple of US$1,000 with no maximum limit. National Bank of Pakistan (“NBP”) will open the Investor Portfolio Securities (IPS) Account of the investor after verification and screening of investor’s credentials. The certificates will be issued through Subsidiary General Ledger Account (SGLA) and will be placed in a separate account of National Bank of Pakistan, namely, NBP PBC holding account.

The premature encashment of the certificates can be done anytime in Pakistani Rupees without levy or penalty, but in the case of encashment in USD within the first year of issuance, a penalty of 1% will be levied. The investment will provide maturity of money in USD as well as PKR with a semi-annual profit. However, if you opt for PKR maturity, there is an added incentive of 1% on the final premium. The PBC’s can be purchased individually or jointly by the resident and non-resident Pakistanis having bank accounts abroad, but it’s mandatory that funds for the purchase of certificates originate from their foreign accounts and remitted through official banking channels.

It is commendable that the entire process is not only safe and secure, but also efficient and rapid. PBC is offered for subscription through a specially designed Web-Portal which is fairly simple. The investors first register themselves on the portal by giving their investment and bank account details for successful registration. The certificates are then issued to the investors electronically on receipt of funds in State Bank of Pakistan Account that exists on the portal. The investor successfully will receive confirmation of the issuance of the certificates both through email and by an update on their account on the portal. Once the confirmation has been sent, the investors are free to check the status of their application by accessing the web-portal through their respective user ID and password.

The certificate is set to be advertised on multiple platforms including digital, electronic and print media to ensure maximum outreach to potential investors. Further, road-shows and awareness sessions will be held in the upcoming days for the overseas Pakistanis in the targeted countries.

With this initiative, there is a chance to keep expat interest alive in the country’s economy through continuous subscriptions of PBCs. The key, however, is to generate goodwill on governance matters so that it can retain expats’ trust for investing back home in government-sanctioned saving schemes. Be a part of this mission because all it takes is seven minutes to bring a change in Naya Pakistan.

The certificates offered through a web-based portal are accessible at the following link: https://www.pakistanbanaocertificates.gov.pk/Default

For more information in regards to Pakistan Banao Certificates, visit here.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ