Current account deficit contracts 2.5% to $3.66b

Central bank revises up previous fiscal year’s current account gap by $1b

PHOTO: FILE

The State Bank of Pakistan (SBP) has enhanced the deficit for the previous fiscal year by around $1 billion to a record high of $18.99 billion compared with $17.99 billion reported in July 2018.

Following the change, the deficit shrank 2.5% to $3.66 billion in first quarter (Jul-Sept) of the current fiscal year compared with $3.76 billion in the same quarter last year.

Rehman Malik pens secrets to resurrect crippling economy in a letter to PM

Had the deficit for the first quarter of FY18 not been revised upwards to $3.761 billion from previously reported $3.438 billion, the deficit for the Jul-Sept quarter of FY19 would have been 6.6% higher year-on-year.

Giving the reason for the sharp rise of $1 billion in the deficit for FY18, the SBP reported that based on the regular foreign investment survey of entities having foreign direct investment (FDI), a significant part of profit - $623 million - was reported to have been reinvested by the foreign investors, mainly in financial, power and cement sectors.

“The reinvested earnings resulted in an increase in the FDI and the current account deficit,” the central bank elaborated.

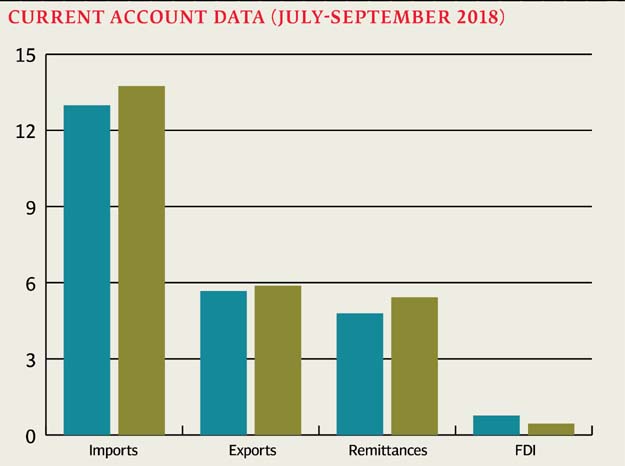

Latest numbers suggested that the drop in the current account deficit in the first quarter of FY19 mainly came on the back of a notable increase in worker remittances and uptick in exports.

Otherwise, imports maintained a steady growth and the FDI dropped sharply.

Changes in remittances, exports and imports came after the central bank let the rupee depreciate by a massive 27% to Rs133.89 to the US dollar in the inter-bank market in the past 10 months and hiked the benchmark interest rate by 275 basis points to a 44-month high at 8.5% in the same period.

Besides, the government imposed regulatory duty on 570 import items and announced massive incentives for exports, especially for the five zero-rated sectors.

The central bank reported that the remittances increased 13% to $5.42 billion in the Jul-Sept quarter compared with $4.79 billion in the same quarter last year.

Moreover, exports of goods rose 3.60% to $5.88 billion compared with $5.67 billion last year whereas imports of goods improved 5.87% to $13.75 billion compared with $12.99 billion last year.

The FDI dropped 43% to $438 million in the Jul-Sept quarter compared with $763 million in the same quarter last year.

Last week, Finance Minister Asad Umar emphasised that the current account deficit was expected to drop to $12 billion in FY19 from $19 billion in FY18 in the wake of monetary and financial measures.

Information minister defends going to IMF for a bailout

In the previous fiscal year 2018, the SBP said, the 13-year high GDP growth of 5.8% was achieved at “the cost of widening macroeconomic imbalances as manifested in a five-year high fiscal deficit and a record high current account deficit in FY18”.

The central bank has projected economic growth of 4.7-5.2% for the current fiscal year against the ambitious target of 6.2%.

The International Monetary Fund (IMF) and the World Bank have projected economic growth in the range of 3-4% for FY19.

The unsuitable current account deficit drained foreign currency reserves to a critically low level at $8.08 billion as of October 12, 2018.

Pakistan has knocked on the IMF’s door for a bailout to avoid default on import payments and debt repayments and fix the beleaguered economy through structural changes.

Besides, it is also in contact with friendly countries like Saudi Arabia, China, Malaysia and Azerbaijan to seek large foreign investment and/or soft loans to finance the current account deficit till FY20.

Published in The Express Tribune, October 23rd, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ