Commercial banks reluctant to lend a hand

The meeting also discussed various financial models that could be followed to ensure maximum participation

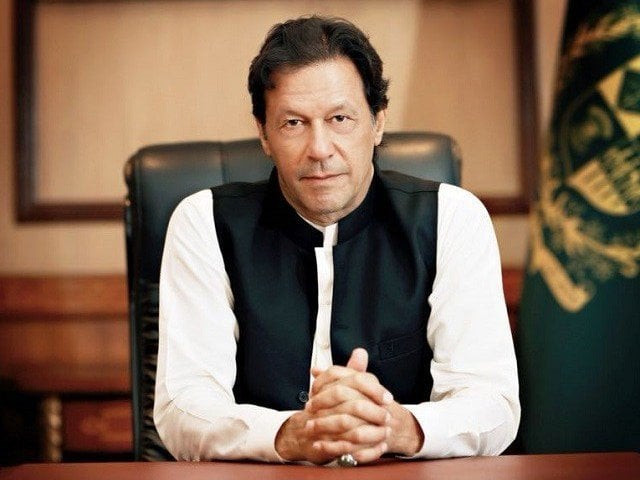

PM Imran Khan. PHOTO: GOVERNMENT OF PAKISTAN

Bankers have termed the government’s proposed zero-interest financing model “a highly risky venture”.

The government, it is learnt, was discussing various financial models for the project, including the zero interest model.

A senior government minister confirmed that commercial banks were reluctant to provide loans under the interest-free model, citing other such ventures, including the PM’s Youth Loan scheme that flopped because it followed the same principles.

A meeting to review progress on the project was held here on Friday at the Prime Minister Office under PM Imran Khan.

The prime minister is likely to launch this project on October 10.

The government is also learnt to have engaged the National Database and Registration Authority (NADRA) for developing a database of applicants to assess the actual demand in different areas of the country.

NADRA has already prepared an application form for applicants which will be available for Rs250.

PTI lawmaker for death sentence of corrupt

Applicants will be able to submit these forms at as many as 25 locations across the country. Submission of applications is likely to start from October 22.

Provinces are expected to pass a resolution in respective assemblies about establishing the proposed “Apna Ghar Authority” while the federal government would provide adequate legal cover to this authority.

A participant of the meeting said that houses would be offered under at least three categories. “Initial discussions suggest that the cost of a 3.5-marla house will be around Rs1.2 million,” he said, adding that prices of houses would vary between Rs1.2 million and Rs2 million depending on the size of house.

He said that Railways and other government departments would provide land for this project.

“Enough state land is available to initiate this project,” he said adding that the government would encourage greater participation of private developers in the project.

Pakistan is a role model in corruption fight: NAB chief

Initially, he said, the project would be launched in two or three cities in Punjab two each cities in Sindh, KP, and Balochistan.

The meeting was attended, among others, by Minister for Finance Asad Umar, Minister for Housing Tariq Bashir Cheema, Planning Minister Khusro Bakhtiar, Minister for Railways Sheikh Rasheed Ahmed, Advisor to Prime Minister Abdul Razak Dawood, Punjab Housing Minister Mehmood-ur-Rasheed.

According to a statement issued by the PM’s Office, the meeting deliberated upon modalities of the launch of the initiative, the legislative framework for implementing the project and the establishment of an apex body to serve as one-window facility for ensuring an enabling environment.

The meeting also discussed various financial models that could be followed to ensure maximum participation of the private sector besides ensuring affordability of the housing units.

The Prime Minister expressed satisfaction over the progress made by the task force created for this project.

Providing cheap housing to the poor and regularizing Katchi Abadis all over the country was one of the government’s priorties.

The housing project, he said, would act as a force multiplier in generating economic activities through job creation and boosting allied segments of construction and housing sectors.

The Prime Minister directed the committee to finalize modalities for launching this project.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ