Inflation remains above 13%

Food and transport prices main contributors to double-digit inflation.

In spite of a slowdown in economic growth inflation has remained above 13 per cent, requiring immediate corrective measures on the part of the government to ensure financial discipline for reversing the trend in the upcoming financial year.

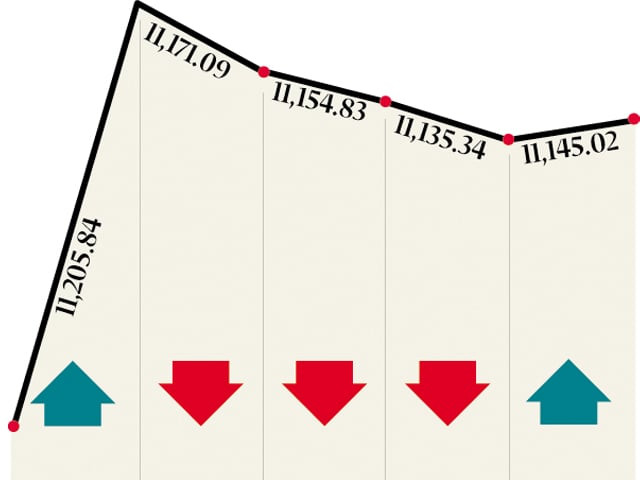

Inflation measured by the Consumer Price Index (CPI), which determines changes in prices of 375 essential items, rose 13.3 per cent in May over the corresponding period of last year, reported the Federal Bureau of Statistics (FBS) on Wednesday.

At a time when the economy is showing nominal growth of 2.4 per cent, almost half the targeted level, constant double-digit inflation suggests that the tight monetary policy has not had much impact on bringing down inflation, as admitted by the State Bank of Pakistan in its recent quarterly report. Economists term the slow growth and rampant inflation dangerous indicators that ultimately lead to high unemployment and increase in poverty level.

In the last monetary policy review meeting, the central bank kept the discount rate – the interest rate at which it lends to banks – unchanged at 14 per cent in a bid to control inflation. Despite that, inflation has remained above 13 per cent.

According to the Annual Plan 2011-12, which the government will unveil on budget day, “factors contributing to rising inflation (in this fiscal year) are spurt in prices of commodities, high government borrowing from the banking sector for budgetary support and increase in prices of petroleum products and electricity charges.”

The plan suggests that in the next financial year “efforts must be made to bring down inflation by following fiscal stringency, tight monetary policy and ensuring adequate supply of essential items.”

Target under threat

For the outgoing fiscal year, the government had originally targeted to restrict inflation to 9.5 per cent which was later on revised to 15 per cent. The Annual Plan document shows that inflation may slip even beyond 15 per cent by June 30 – a worrisome aspect that is hurting the purchasing power of consumers.

For the next financial year, the government has decided to restrict inflation to 12 per cent that seems to be quite challenging after it failed to bring inflation down to single digits, argue economists working in the economic advisory wing of the finance ministry.

On yearly basis, food and beverage prices went up by 15.9 per cent in May over the corresponding month last year. Apparel, textile and footwear group prices increased 13.8 per cent, house rent 7.5 per cent, fuel and lighting 12 per cent, household, furniture and equipment 11.9 per cent and transport and communications around 16 per cent.

Average inflation during the first 11 months (July-May) of the outgoing fiscal year remained at 14 per cent.

In the wholesale market, the inflationary pressure is higher than in the retail market. According to the FBS, in May the inflation measured by the Wholesale Price Index rose 23.3 per cent.

Compared to April, the CPI-based inflation rose 0.3 per cent due to a major increase in prices of potatoes, milk powder, milk products, beverages, fresh milk, cotton cloth, hosiery, readymade garments, kerosene oil, petroleum products, drugs and medicines.

Published in The Express Tribune, June 2nd, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ