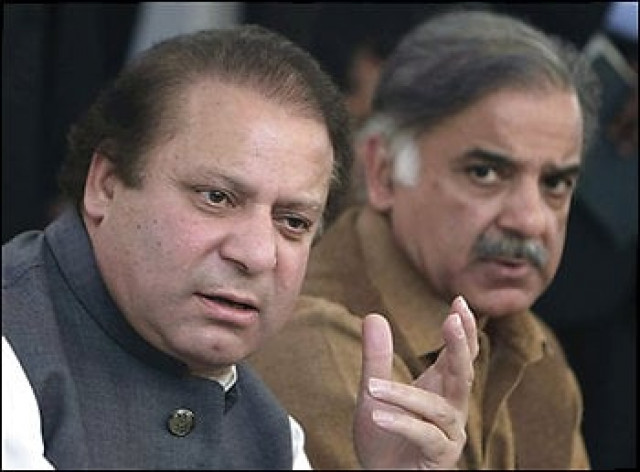

Special excise duty: Action against Sharif family mills stopped

Respondent’s lawyer argues that govt wrongly applied special excise duty.

A division bench of the Lahore High Court (LHC) on Wednesday restrained the Federal Board of Revenue (FBR) from taking coercive measures against three sugar mills owned by the Sharif family for recovery of special excise duty and directed it to file a reply by June 14.

The bench headed by Justice Umar Ata Bandial issued the order on an intra court appeal filed by Ittefaq Brothers and Ramazan Sugar Mills challenging an order of a single bench wherein their writ petition against the special excise duty was dismissed.

Representing the sugar mills, Advocate Ijaz Awan submitted that on June 29, 2007 the Ministry of Finance had issued a notification relating to Federal Excise SRO 655(I)/2007 whereby special excise duty (one per cent of the value) was levied without having lawful jurisdiction.

He said the government wrongly exercised the powers conferred by Section 3A of the Federal Excise Act, 2005. He argued that the section was not part of the Federal Excise Act, 2005 at the time and date when the impugned SRO was issued as it was inserted subsequently vide act of Parliament.

Awan argued that the rate of the special excise duty had recently been enhanced from 1 to 2.5 per cent through an amending SRO on March 19, 2011 in pursuant to Federal Excise (amendment) Ordinance, 2011. He said the FBR enhanced the rate of the duty ignoring the fact that the basic notification of levying the excise duty was itself issued without lawful authority.

The counsel said the appellants were earlier also forced by the respondent and its officials with respect to the payment of allegedly due special excise duty on goods produced and manufactured prior to the cutoff date of July 1, 2007 regardless of the fact that the special excise duty was not liable to be paid with retrospective effect.

Subsequently, after filing of the writ petition, the respondent authorities realised the fact and accepted the plea of the appellants and issued a conceding clarification, he said.

However, a single bench of the LHC had on May 13 dismissed the writ petition.

The counsel prayed that the May 13 order of the single bench be set aside and the appeal be accepted in the interest of equity and justice.

The counsel further prayed that the impugned notification with regard to levy of special excise duty be declared illegal and it also be declared that Section 3A of the Federal Excise Act, 2005 amounts to double taxation.

Published in The Express Tribune, June 2nd, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ