KSE-100 slips 281 points as election euphoria dies down

US official’s remarks on Pakistan, selling pressure in bank stocks cause the decline

With the incoming government keeping all options on the table, the investors have now set their eyes on future economic policies.

PHOTO:EXPRESS

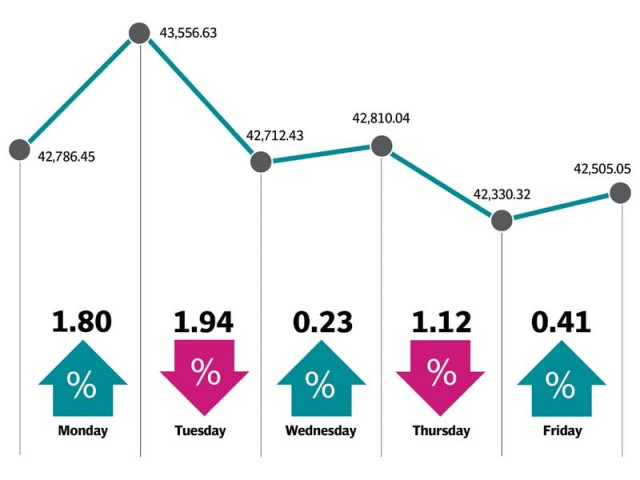

Monday kicked off on a positive note as favourable election results and the rupee’s surprising recovery against the US dollar over the weekend kept investors’ interest alive. The market rallied 770 points and managed to surpass 43,500.

However, the bullish momentum petered out and the index succumbed to profit-taking in the following trading sessions. There were three positive and two negative sessions during the week. Despite the selling spree, a gradual recovery helped limit the losses.

Negative comments from US Secretary of State Mike Pompeo on Pakistan’s expected approach to the IMF for a bailout contributed widely to bearish sentiments, which led to selling pressure in bank and cement sectors.

Additionally, poor earnings announcements by two of Pakistan’s top five banks also dented sentiments.In his talk with the media, Asad Umar, who is likely to be the next finance minister, has also not ruled out going to the IMF for the bailout package.

Market watch: KSE-100 plunges over 1,200 points before minor recovery

With the incoming government keeping all options on the table, the investors have now set their eyes on future economic policies.

Market participation picked up during the week as average daily volumes increased 21% to 284 million shares, while average traded value rose 37% week-on-week to $96 million.Sector-wise, commercial banks (down 604 points), led by index-heavy Habib Bank and United Bank, oil and gas exploration companies (59 points) and insurance firms (21 points) pulled the index down. On the other hand, positive contribution was led by fertiliser stocks (up 132 points) on account of higher urea prices amidst shortage, tobacco stocks (87 points) and power generation and distribution stocks (81 points).

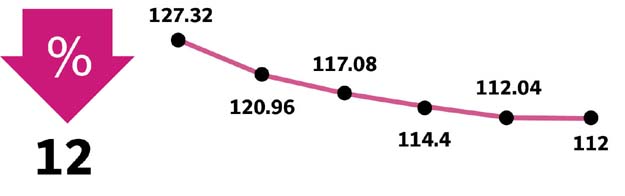

Meanwhile, major stocks that traded in the red were Habib Bank (down 271 points), United Bank (214 points), MCB Bank (83 points) and Pakistan Petroleum Limited (51 points). United Bank lost 11.2% of its stock price during the week after posting a 40% year-on-year decline in its 2Q2018 earnings, caused by an unexpected pension liability provisioning of Rs2 billion.

Habib Bank fell 9.8% week-on-week after it reported a 48% year-on-year drop in its 2Q2018 results due to lower-than-expected net interest income and a significant surge in administrative expenses.

However, Pakistan State Oil (PSO) stock went up 4.3% as the market expected resolution of the circular debt problem, in which PSO would be the prime beneficiary. Agritech Limited, up 15% week-on-week, outperformed the benchmark index on news of gas supply to its closed plant.

Market watch: KSE-100 starts FY19 on negative note

In addition to this, Fauji Foods, up 17% and its parent Fauji Fertilizer Bin Qasim, up 5%, rallied on news of Inner Mongolia Yili Industrial Group Co of China expressing interest in acquiring a 51% stake in Fauji Foods. Foreigners took advantage of increased trading activity and offloaded shares worth $14.6 million during the week.

Domestic mutual funds and banks also continued with their selling spree as they sold shares worth $7.1 million and $6 million respectively. On the other hand, individuals continued to stand out as net investors as they bought shares worth $26.4 million, up from $19 million last week.

Among major highlights of the week include Chinese loan of $1 billion pushing foreign exchange reserves up to $10.3 billion, CPI inflation hitting a four-year high of 5.8% in July, National Transmission and Despatch Company connecting Engro’s power plant with the national grid, Pak Suzuki Motor Company raising car prices in the range of Rs20,000 to Rs45,000 and the Islamic Development Bank activating a $4.5-billion credit facility for Pakistan’s oil imports.

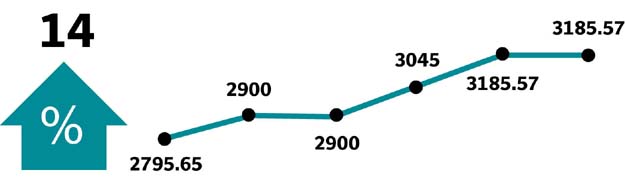

Winners of the week

Philip Morris (Pakistan)

Philip Morris Pakistan Limited manufactures and sells tobacco and cigarettes.

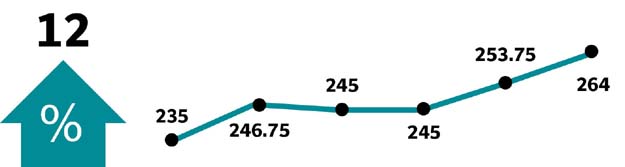

Shifa International Hospitals

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicines, paediatrics, surgical, obstetrics and gynaecology, dentistry, rehabilitation services and ophthalmology.

Losers of the week

Systems Limited

Systems Limited is Pakistan’s leading IT company that specialises in providing next-generation BPO solutions, ERP solutions and BI services worldwide

United Bank

United Bank Ltd provides commercial banking and related services. The bank offers a wide range of banking and financial services, including brokerage services.

Published in The Express Tribune, August 5th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ