In a flawed policy, 45% of taxes collected at import stage

This leads to increase in prices of goods as importers pass the impact on to consumers

Except for customs duty, the FBR missed the target for three other taxes, which raised questions over the ability of the Inland Revenue Service.

PHOTO:FILE

The change in tax structure over the past five years led to a situation where 58% of sales tax and 14% of income tax was collected at the import stage in fiscal year 2017-18, said sources in the FBR.

Federal cabinet extends tax amnesty scheme for a month

Although the FBR has not yet revealed provisional revenue collection figures for FY18, according to sources the receipts have marginally increased to Rs3.841 trillion. They are still lower than the original target of Rs4.013 trillion and revised target of Rs3.935 trillion.

Except for customs duty, the FBR missed the target for three other taxes, which raised questions over the ability of the Inland Revenue Service.

The collection of Rs3.841 trillion may go up slightly once the State Bank of Pakistan releases final figures of tax collection till June-end from the offshore amnesty scheme. The FBR voices hope that tax receipts will touch Rs3.9 trillion after reconciled figures are available.

The Rs3.841-trillion collection includes tax receipts of roughly Rs90 billion from domestic and offshore tax amnesty schemes. Excluding these, the revenue collection stands at Rs3.751 trillion.

The overall collection was 14.2% higher than the previous fiscal year. Pakistan’s tax-to-gross domestic product ratio picked up slightly to 11.1%, better than the previous year but lower than the target.

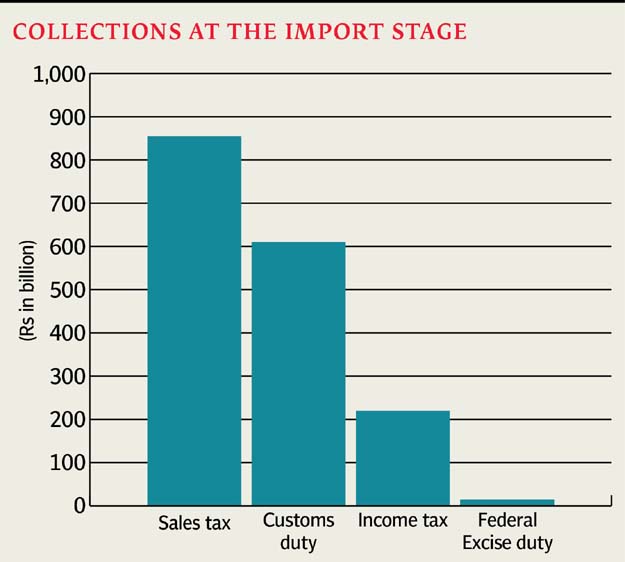

Of the total receipts, Rs1.7 trillion was collected at the import stage on account of sales tax, customs duty, federal excise duty and withholding tax. Sales tax collection at the import stage stood at Rs855 billion, income tax Rs220 billion, federal excise duty Rs15 billion and customs duty Rs610 billion.

Higher reliance at the import stage indicates a flawed tax policy that will eventually suffocate economic growth due to increasing cost of goods. This will then hurt output of factories because of reduction in their sales.

Importers and manufacturers recover these taxes from consumers by including them in the cost.

July-March FY18: Govt’s tax collection falls Rs129b short of target

Over-reliance on the collection of taxes at the import stage is also promoting inefficiency as tax officers achieve their collection targets without making any meaningful effort. About 70% of the FBR’s total workforce comprises officers of the Inland Revenue Service, but they collect only 55% of taxes.

Sales tax

According to sources, out of the total collection of Rs3.84 trillion, about Rs1.488 trillion came from sales tax, but it was lower than the Rs1.6-trillion target approved by parliament.

Collections at the import stage stood at Rs855 billion or roughly 58% of total sales tax. It is collected by the Customs group, but is reflected in performance of the Inland Revenue Service.

Five years ago, sales tax collection at the import stage was 51%, which, according to sources, suggested that there were huge leakages at the domestic stage.

They pointed out that the effective sales tax was about 4.5% against the standard 17% due to revenue leakages and tax exemptions. The main source of sales tax collection was petroleum products as the FBR charged higher taxes than the 17% rate. Sales tax on high-speed diesel is 31%.

Govt considering taxing ‘gifts’ among non-family members

Income tax

Sources said the income tax collection stood at only Rs1.53 trillion, which was Rs67 billion less than the target. About 14% of the collection or Rs220 billion was generated at the import stage in the shape of withholding tax.

Importers recover the withholding tax from the consumers, but show it as their contribution.

The share of income tax in total collection was only 39%, about two-percentage-point lower than five years ago. This also included one-off payments made under the amnesty scheme.

Excise and customs duty

The FBR collected roughly Rs218 billion in federal excise duty. About 95% of the duty was collected at the domestic stage, sources said. The excise duty collection was short of the target by Rs15 billion.

Customs duty collection stood at Rs610 billion, exceeding the target by Rs29 billion.

Published in The Express Tribune, July 4th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ