Pakistan’s current account deficit surges 43% to $15.96b

Exorbitant imports, sluggish exports and insignificant surge in workers’ remittances contribute to increase

Independent experts said the country requires $5 billion by December 2018 to pay off debt and make interest payments.

PHOTO: EXPRESS

The 11-month deficit stands very close to the full-year’s estimate of $16 billion according to independent economists. The trend suggests the deficit for the full-year would swell to around $17.5 billion by end of June 2018.

The deficit stood at $11.14 million in the corresponding period of the previous fiscal year, SBP reported.

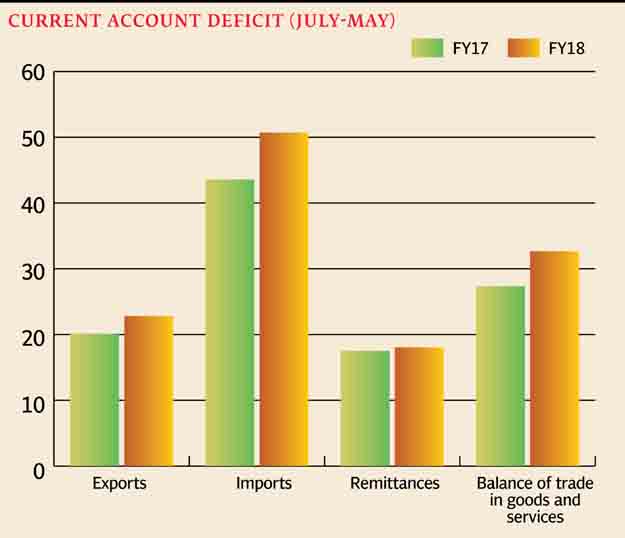

Experts said the exorbitant imports, sluggish exports and insignificant surge in workers’ remittances have continued to fuel the current account deficit.

Current account deficit increases and so do Pakistan’s worries

The import of goods in the 11 months has reached $50.71 billion, which is much higher than the government’s set target of $48.8 billion for the full-year.

The imports remained exorbitant despite the government’s decisions to impose additional regulatory duties on over 300 items to discourse imports during the year. Rupee depreciation by over 15% against the US dollar in the last six months also proved to be unhelpful.

Despite the two measures, the imports hit record high of $5.8 billion in the single month of May 2018.

Similarly, exports stood at $22.78 billion during the 11 months. This was much less than the huge efforts the government put to revive exports to the required level in a bid to narrow down the current account deficit. To achieve higher exports, the government extended the export package of Rs180 billion for another year and depreciated the rupee.

Besides, the workers’ remittances and foreign direct investment remained low and widened the current account deficit.

Although the workers’ remittances have improved 3% to $18.03 billion in the 11 months, the trend suggests that it would remain lower than the set target of $20.7 billion.

Current account deficit widens 28.74% to $1.61b

Cumulatively in the first 11 months, the foreign direct investment in the domestic economy dropped 1.3% to $2.47 billion compared to $2.50 billion in the same period of last fiscal year.

The wide current account deficit has caused fast depletion in foreign currency reserves, which fell to less than two months’ import cover to $10.07 billion on June 8, 2018.

The caretaker government with its limited mandate to fix the faltering is seen actively mobilising bankers and stockbrokers to make the amnesty scheme successful and the introduction of first ever dollar-based saving certificate for overseas Pakistanis. Independent economists and individuals estimate that $1-4 billion will be added to foreign currency reserves through the scheme to declare their hidden assets.

Govt expects current account deficit to slow down to $12.5 billion

Besides, the government has estimated revenue of another $500 million to $1 billion in the next one year through the launch of dollar-based savings certificates for overseas Pakistanis.

Independent experts said the country requires $5 billion by December 2018 to pay off debt and make interest payments in addition to the existing foreign current reserves to successfully avert a default like situation.

Published in The Express Tribune, June 21st, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ