Budget 2018-19: Ismail unveils new relief measures in windup speech

Finance minister appeases middle and upper-income groups, rejects concessions for non-filers of tax returns

Finance Minister Dr Miftah Ismail

PHOTO: EXPRESS

While ending the debate in the lower house of parliament, the finance minister announced additional measures which would appease sitting parliamentarians, importers, small firms, commercial entities of the military and low-paid government employees.

He rejected the opposition’s proposal to enhance income tax for individuals and also did not agree with lower taxes on petroleum products.

To service maturing debt, Pakistan to borrow Rs22 trillion in 2018-19

Ismail finally managed to deliver his budget windup speech after his first attempt was frustrated by Pakistan Tehreek-e-Insaf (PTI) MNA Dr Shireen Mazari on Friday when she pointed out lack of quorum in the house.

The opposition, however, again forced the house speaker to adjourn the session due to lack of quorum, delaying approval of all the demands for recurrent and development expenditures.

Budget 2018-19: Historic high of Rs1.03tr allocated for PSDP

However, before the adjournment, the National Assembly approved Rs23.7 trillion in compulsory expenditure for the next fiscal year, mainly Rs22 trillion to service the maturing public debt. These expenditures were approved without debate by the National Assembly.

The finance minister announced that the government had accepted 42 out of 49 recommendations given by the Senate. He thanked the Senate Standing Committee on Finance for its productive contribution to scrutiny of the budget.

Defence, debt to eat up half of proposed Rs5.237 trillion budget for 2018-19

The federal government had unveiled a Rs5.247-trillion budget on April 27, which is likely to be approved by the assembly on Wednesday or Thursday.

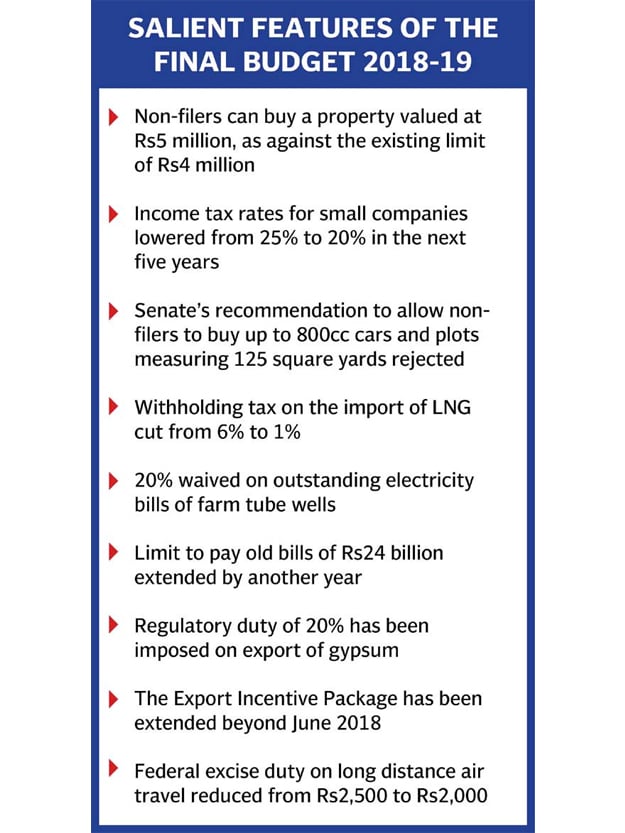

For the agriculture sector, the finance minister waived 20% of the outstanding electricity bills of tube wells. He also extended the deadline for payment of old bills of Rs24 billion by another one year.

In case, farmers pay the old bills between July and September 2018, they will be given a relief of Rs6 billion.

The minister announced the imposition of 20% regulatory duty on the export of gypsum in order to encourage its use in the domestic agriculture sector.

He extended the Export Incentive Package beyond June 2018, but did not share concrete details. A 50% increase was made in the conveyance allowance for people serving in non-officer pay scales of 1 to 16.

Ismail announced a reduction in income tax on small companies from the existing 25% to 20% over the next five years. Every year the tax rate will go down by 1%.

Builders, who will construct low-cost housing units of up to Rs2.5 million, will receive 50% income tax exemption.

The government has proposed that it could bar non-filers of income tax returns from purchasing cars and buying houses and plots valuing more than Rs4 million. It did not accept the Senate’s recommendation to allow non-filers to buy up to 800cc cars and plots measuring 125 square yards.

Ismail, however, said the Federal Board of Revenue would prescribe one-page e-return for Pakistanis living abroad aimed at helping them to buy properties. He also said non-filers could buy property valuing up to Rs5 million against the existing limit of Rs4 million.

The minister also partially accommodated commercial importers by lowering the minimum withholding tax to 5% from the existing 6%. Commercial importers will have to pay 6% tax, but they can claim 1% refund, if they have low profit margins.

The government resisted the pressure to reverse the declaration of withholding tax at the import stage as “minimum”. This step will discourage under-invoicing by the importers.

The minister also announced more incentives for liquefied natural gas (LNG) importers with a significant cut in withholding tax on imports from 6% to 1% and reduction in sales tax to 12% from 17% for all kinds of imports.

In the budget, the government had reduced the tax rates only for Pakistan State Oil and Pakistan LNG Limited.

In order to accommodate some senators, the finance minister reduced sales tax on the import of fish babies to 5%. Similarly, in order to accommodate a PTI senator, the tax structure was changed for matchbox manufacturing factories.

The minister reduced federal excise duty on long-distance air travel from Rs2,500 to Rs2,000 per ticket. He accommodated Fauji Fertilizer with a reduction in sales tax on its major input - rock phosphate - from 17% to 10%.

During the speech, the minister responded to criticism from the opposition on the mounting debt pile, declining exports and imposition of heavy taxes on petroleum products. He said increase in the petroleum levy to Rs30 per litre would not adversely affect prices of diesel and petrol.

His statement suggests the government wants to enhance federal government revenues through the enhanced petroleum levy and will lower sales tax proportionately that will hit revenues of provinces.

The minister admitted that public debt had increased significantly in the past five years, but he claimed that the hike was lower when compared with Pakistan Peoples Party (PPP) government of 2008-13. Ismail explained that new loans had been taken for productive sectors of the economy.

Published in The Express Tribune, May 16th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ