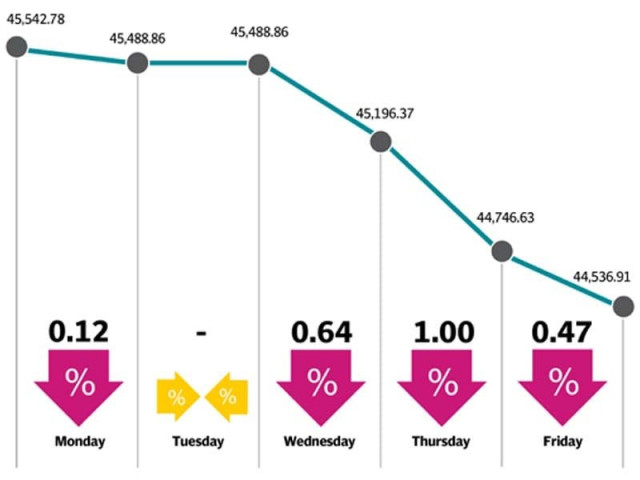

KSE-100 loses 1,006 points as bearish trend persists

Political uncertainty, balance of payment concerns and upcoming elections dent market sentiment

Contrary to expectations of a positive rally, measures announced in the budget failed to excite investors, leading to a drop on the first trading day of the week despite the positive start.

Concerns at the political front, pertaining to upcoming elections, and concerns over balance of payments dented investors’ sentiment. Additionally, the market only traded for four days during the week on account of Labour Day.

On Wednesday, selling pressure was witnessed in index-heavy stocks in the automobile, cement and banking sectors.

The trend continued for the following session, as uncertainty dragged the index 640 points lower in intra-day trading with investors continuing to book profits, amid panic-induced selling.

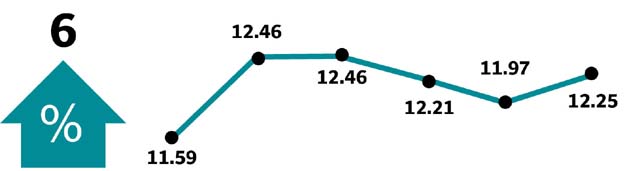

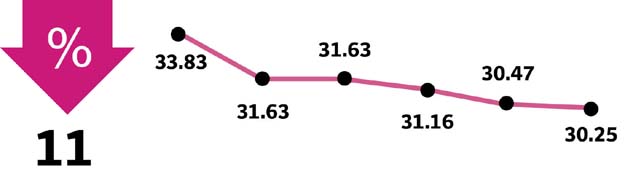

Friday marked the fourth successive trading session that saw the KSE-100 close negative as interest remained low. Investors chose to wait on the sidelines until clarity emerged on the political front. Participation slowed down during the week, with volumes declining 1.6% to 166 million shares while the value traded dropped 23% to $54.9 million.

Weekly review: KSE-100 plummets 813 points as sentiment remains negative

Sectors that contributed negatively included; commercial banks (458 points), fertilisers (106 points), oil & gas exploration companies (86 points), oil & gas marketing companies (65 points) and textile (-42 points).

Foreign selling worth $8.2 million was witnessed in the banking sector; imposition of super tax translating into additional seven percentage points tax rate for 2018 and no reduction in corporate tax contributed to the sector’s decline.

Among banks, Habib Bank (HBL) and United Bank (UBL) lost 7.5% and 6.9% week-on-week respectively, as they stand to lose the most from the announced change in tax calculation for provisioning on foreign Non Performing Loans (NPL). Credit ratings agency Moody’s also highlighted continuation of Super Tax as a credit negative for the banking sector during the week, putting further pressure on the banking sector. This also led to foreign investors offloading their positions, further dampening investor sentiments.

Fertiliser sector also declined, as a pre-budget rally already priced in positive announcements. Additionally, the sector was expecting a reduction the Gas Infrastructure Development Cess (GIDC), which failed to materialise.

In terms of scrips, ENGRO (down 57 points), OGDC (57 points) and PPL (48 points), suffered a setback. On the flip side, major positive contribution came from MARI (up 15 points), BOP (15pts), EFERT (9 points), DGKC (9 points) and FCCL (8 points).

Foreign buying this week clocked-in at $0.57 million compared to a net sell of $2.8 million last week, concentrated majorly in all other sectors ($3.2 million) and fertiliser ($1.3 million). On the domestic front, major selling was reported by insurance companies ($4.3 million), broker proprietary trading ($3.9 million) and banks/DFIs ($3.8 million). Domestic buying was largely executed by other organisations ($9.1 million) and companies ($6.4 million).

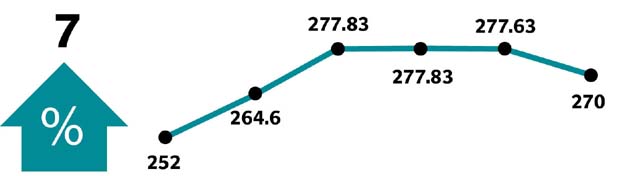

On the economic front, Pakistan received a loan of $1 billion from a Chinese bank(s) - increasing SBP’s foreign exchange reserves by $593 million. Among other highlights of the week were; prime minister backed sale of K-Electric, ADB ruled out need for IMF’s bailout package, price of petrol increased by Rs1.7 per litre for May and ECC approved incentive package for oil refineries.

Winners of the week

Punjab Oil Mills

Punjab Oil Mills Limited manufactures and sells vegetable ghee, cooking oil, and laundry soap

Bank of Punjab

The Bank of Punjab (Pakistan) operates under the status of a scheduled bank in Pakistan. The bank provides commercial bank services

Losers of the week

Fatima Fertilizer

Fatima Fertilizer Company Limited produces fertilisers. The Company is developing a fully integrated fertiliser complex, capable of producing Ammonia, Nitric Acid, Nitro Phosphate (NP), Nitrogen Phosphorous Potassium (NPK), and Calcium Ammonium Nitrate (CAN)

Pakistan Int Container Terminal

Pakistan International Container Terminal operates a container shipping facility in Karachi, Pakistan

Published in The Express Tribune, May 6th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ