KSE-100 gains 255 points amid dull trading, but rally expected

Analysts expect positive run in light of pro-market budget announcements

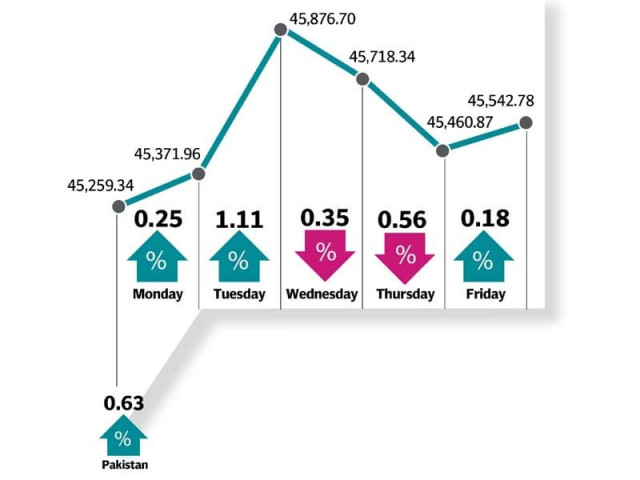

However, news on the political front and developments related to the economy continued to guide market direction, as the KSE-100 finished with a gain of 255 points or 0.6% in the outgoing week to settle at 45,543.

With the budget 2018-19 now unveiled, it is expected that the market will witness an upward rally.

The week began on a positive note as banking and cement stocks garnered interest. Although the positive trend continued in the next session, activity remained dull as most investors chose to remain on the sidelines. Resultantly, the market turned bearish on Wednesday, with selling pressure in cement and banking stocks dragging the index lower.

Weekly review: Rupee devaluation propels KSE-100 past 45,000

The pattern of lacklustre trading came to an end on Thursday, with market reacting to news of disqualification of Foreign Minister Khawaja Muhammad Asif by the court for concealing his foreign work permit.

In contrast to the directionless trading, buying momentum was witnessed, which helped the index recover marginally - though it still finished negative.

On the last trading day of the week, investors eagerly awaited for positive development ahead of the federal budget. GIDC removal/reduction beneficiaries again gained attention of investors.

In terms of participation, average volumes increased by 9%, while value rose 8% in the outgoing week.

Oil marketing sector stocks cumulatively contributed 123 points to the index, where HASCOL gained 20% in the outgoing week amid better financial results, while PSO and SHEL gained 6% and 3%, respectively. Moreover, commercial banks and fertilisers contributed 86 and 70 points, respectively.

Fauji Fertilizer Company (FFC) gained 4% on last day of the week, followed by Fauji Fertilizer Bin Qasim (FFBL) 4%, and Lotte Chemicals (LOTCHEM) increasing 2%.

Foreigners were net sellers during the week with shares amounting to $2.8 million offloaded versus net selling of $41.8 million last week.

On the other hand, local mutual funds were net sellers of $4 million whereas companies were net buyers of $4.7 million.

Published in The Express Tribune, April 29th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ