Weekly review: Investors remain sidelined as KSE climbs marginally

Budget-related news keeps investors at bay as index rises 0.7%.

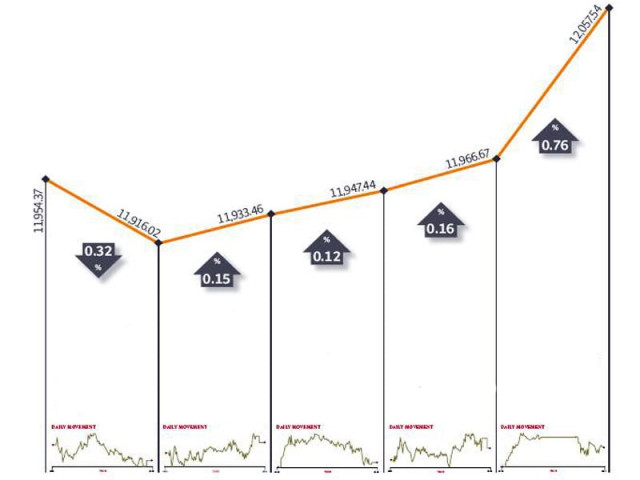

Activity at the stock market remained subdued as investors chose to wait and watch ahead of the upcoming budget for fiscal year 2011-12. The benchmark KSE-100 index climbed 0.7 per cent (88 points) amidst low volumes.

Macro data, sector-specific activity and foreign activities were also factored into the market’s movements during the week, although with mild effect, as volumes remained low at an average of 68 million shares per day.

Investors remain wary of the upcoming budget, in which the government is expected to levy higher taxes and enforce the International Monetary Fund’s (IMF) policies, which may cause a dent in corporate earnings.

Talks with IMF started this week with the intention of resuming the loan programme, which has been on hold since May last year. IMF is expected to demand that the government implement the Reformed General Sales Tax (RGST) and Gross Asset Tax (GAT) in the upcoming budget.

Aside from the budget, there was positive news from the macro-economic data. The country’s exports hit $20 billion, while remittances stood at a record high $9.05 billion, as per data collected at the end of April.

The high exports have aided in the two per cent year-on-year decline in trade deficit. The current account position was also expected to improve with the expected release of $300 million by the United States as part of the Coalition Support Fund.

Sector-specific news also played their part as the fertiliser sector was again in the limelight after news circulated about a possible increase in urea prices by Rs105 per bag, to offset the production declines due to gas shortages.

Foreign inflows declined 70 per cent over the previous week, but still remained positive at $5.6 million during the week.

Average daily value declined 12.4 per cent and stood at Rs2.32 billion per day. The index’s market capitalisation climbed by 0.6 per cent and stood at Rs3.17 trillion.

Investment in the Margin Trading System stood at Rs174 million between Monday and Thursday, down 38 per cent over the previous week.

What to expect?

News from the ongoing talks with IMF will be crucial for the direction of the market in the coming weeks, as the decision taken will likely be enforced in the upcoming budget and hence investors should keep an eye on the updates from Dubai.

Investors should also remain wary of the fluctuating commodity prices in global markets. The all important crude oil price has been fluctuating wildly in the previous few weeks and the impact of these changes could dominate news at the bourses in the coming weeks.

Monday, May 9

The stock market remained positive on the first trading session of the week as concerns related to Osama’s death had started to fade away which revived investor confidence.

Tuesday, May 10

The stock market continued its bullish trend with healthy gains, primarily due to active participation of foreign institutions. Foreign portfolio investment registered a net inflow of Rs102 million during the trade session.

Wednesday, May 11

The stock market crawled up led by the oil sector amid a jump in volumes. Share prices inched up slightly with expectation that negotiations with the International Monetary Fund will make a positive progress.

Thursday, May 12

The stock market fell in line with global peers amid tumbling international commodity prices. Crude oil prices tumbled more than five per cent to below $100 per barrel while silver prices sagged seven per cent in a major sell-off on Thursday.

Friday, May 13

Thin activity was witnessed at the Karachi bourse with all eyes focused on the twin bomb blasts in Charsadda. Concerns that terrorist attacks may continue after the Charsadda blast kept investors on the sidelines.

Published in The Express Tribune, May 15th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ