Pakistan’s budget deficit widens to Rs796.3b

Amount is 2.2% of GDP; gap higher despite development spending being reduced by Rs152b

Amount is 2.2% of GDP; gap higher despite development spending being reduced by Rs152b

PHOTO: FILE

Overall gap between expenditure and income during July-December period of this fiscal year was equal to 2.2% of gross domestic product (GDP), said a summary of Consolidated Federal and Provincial Budgetary Operations. The finance ministry released the provisional summary on Tuesday.

SBP proposes changes in rules for foreign currency account holders

The deficit ballooned to over Rs796 billion despite authorities restricting development spending by about Rs152 billion against the limits approved by the National Economic Council (NEC). It was, however, equal to last year’s level in absolute terms.

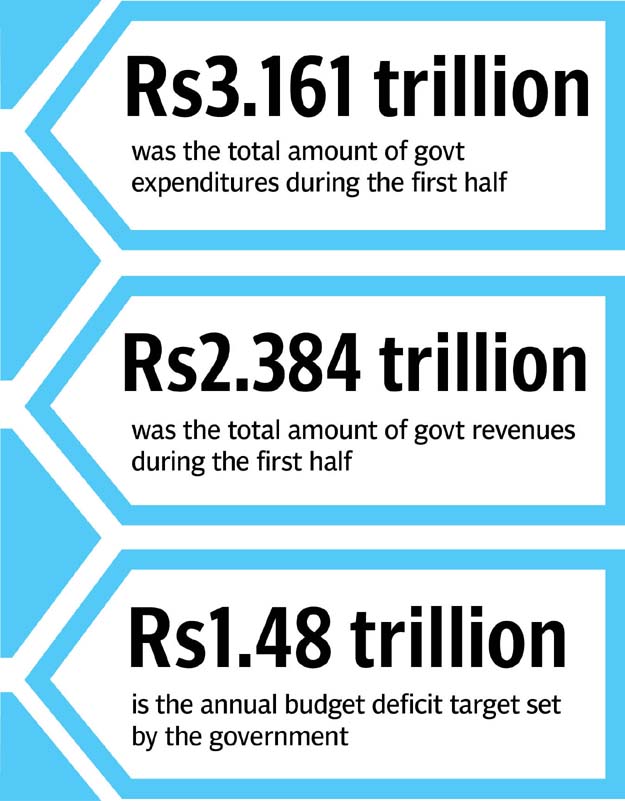

Overall, total expenditures increased to Rs3.161 trillion during the first half, equal to 62% of the annual budget, giving a clear indication of slippages in election year. The current expenditures increased to Rs2.54 trillion, two-thirds of the annual target.

In comparison, total revenues including those of the provinces stood at Rs2.384 trillion in the first half, which were equal to 50.5% of the annual target. The tax revenues in the first half amounted to Rs2.02 trillion, only 46.7% of the annual target.

The government got a boost in its ‘other taxes’ collection, which stood at Rs287 billion, and were equal to 90% of the annual target. This was because of Rs93.2 billion as sales tax on services collection by the provinces and a gain of Rs93.8 billion from the petroleum levy in the first half, according to the finance ministry summary.

Non-tax revenues stood at only Rs357.7 billion or 36.4% of the annual target due to the United States’ decision to withhold Coalition Support Fund (CSF) disbursements. The State Bank of Pakistan (SBP) transferred Rs125 billion in profits to the federal government, almost 48% of the annual target.

The overall budget deficit widened to Rs796.3 billion despite the fact that the four federating units showed Rs150 billion as cash surplus during the first six months. Excluding provincial savings, the federal budget deficit jumped over Rs927 billion or 2.6% of GDP in the first half.

The trend suggests that the annual budget deficit target of 4.1% of GDP or Rs1.480 trillion, which the parliament had approved in June last year, has already become unrealistic in the first half. The Rs796-billion budget deficit was equal to 54% of the annual target. It should have been close to Rs600 billion, as the pace of expenditures in the second half significantly increases.

During the last round of talks, the International Monetary Fund (IMF) had informed the finance ministry that the budget deficit would swell to 5.4% of GDP or over Rs1.9 trillion.

One of the key reasons for the increasing budget deficit from July through December was roughly Rs751.5 billion cost of domestic and foreign debt servicing, according to a Ministry of Finance summary. The debt servicing is 55% of the annual budget earmarked for this purpose. For the current fiscal year 2017-18 (FY18), the federal government has earmarked Rs1.363 trillion for domestic and foreign debt servicing.

The defence sector consumed Rs393.4 billion in the first half, which was largely in line with its annual budget of Rs920 billion.

PAC accuses PM of sabotaging parliament’s business

The budget deficit and the current account deficit remain the two biggest challenges for Pakistan’s economy that overshadow the government’s economic performance in other areas. Because of these twin deficits, there are apprehensions that Pakistan may go back to the IMF for yet another bailout package. But the outgoing government is reluctant to take this decision due to upcoming general elections. Federal development spending in the first six months amounted to Rs248 billion or about one-fourth of the annual budget. This is significantly lower than the limit set by the NEC.

The federal development spending should have been close to Rs400 billion. The federal government borrowed net Rs384 billion from foreign lenders and Rs412 billion from domestic sources to finance the budget deficit. The gross foreign borrowings in the first half stood at Rs612 billion but the federal government returned Rs228.2 billion in external debt.

Published in The Express Tribune, February 21st, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ