Pakistan’s debt-bearing capacity has deteriorated, admits govt

Govt says low remittances, volatile situation in Middle East contributed to worsening situation

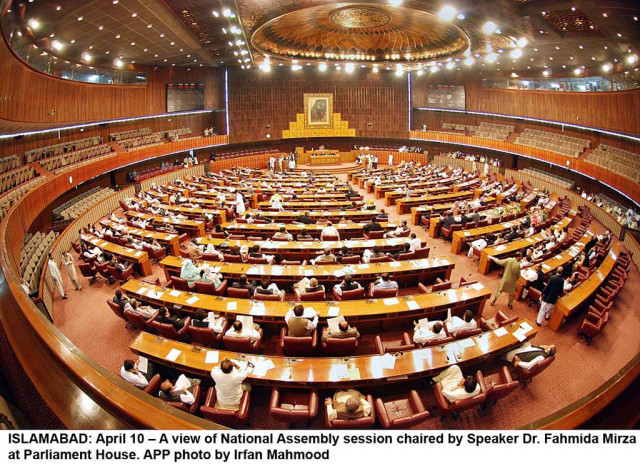

National Assembly.

PHOTO: APP/FILE

In its Debt Policy Statement 2017-18, which the finance ministry submitted to the lower house of parliament, the government has admitted that during the last fiscal year the country’s external debt has increased at a rapid pace than its foreign exchange earnings.

It was the highest ratio after the one recorded during the last year of the PPP government.

Not only that, Pakistan’s external debt in percentage of foreign exchange reserves also increased to the three years highest level. Similarly, the cost of external debt servicing in percentage of foreign exchange earnings significantly increased –also the highest than the last year of the PPP.

The Debt Policy Statement 2017-18 has been submitted to the National Assembly as per the requirements of the Fiscal Responsibility and Debt Limitation (FRDL) Act of 2005 aimed at allowing legislators to assess the government’s failures and successes in managing the public debt.

However, some parts of the FRDL Act of 2005 have been rendered ineffective after the government’s decision to introduce sweeping changes to the law aimed at hiding its failures by changing the goalposts.

PPP not to resign from Parliament

Despite changing goalposts by amending the law, there were certain areas where the government could not show improvement. However, it was able to claim progress in certain other areas.

Headed by its Director General Ehtesham Rashid, the Debt Policy Coordination Office prepared the statement in the light of the FRDL Act.

The external debt increased to 120% of the foreign exchange earnings by the end of FY 2016-17, showing that Pakistan’s debt-bearing capacity has weakened. It is consecutive second year when the ratio has slipped. In fiscal year 2015-16 year the ratio was 110%.

Similarly, external debt as percentage of foreign exchange reserves increased to 290%, reflecting the adverse impact in decline in the reserves due to growing current account deficit. This ratio was 250% in FY 2015-16, which within one year jumped to three years high level.

The external debt servicing-to-foreign exchange earnings ratio also worsened to 12.4% due to the growing debt servicing cost.

This ratio was only 8.5% just a year ago. The 12.4% external debt servicing in percentage of foreign exchange earnings was even worse than last year of the PPP government when it was 11.1%.

Official Justification

The Ministry of Finance has tried to shift the blame of tho failures on others, mainly the Ministry of Commerce and the situation in the Middle East.

National Assembly passes bill to bring FATA under SC, PHC jurisdiction

“The lower foreign exchange earnings during 2016-17 led to increase in these ratios,” according to the statement.

It added stagnation in the exports largely due to global economic conditions, low commodity prices and bottlenecks in the energy and infrastructure sectors of the economy were some of the other factors for the situation.

The finance ministry did not mention the adverse impacts of withholding over Rs300 billion genuine tax refunds and increasing the cost of doing business by levying indirect taxes and enforcing electricity surcharges on the exports.

The debt statement also noted that remittances remained marginally lower than the preceding fiscal year due to adverse economic conditions in the Middle East and stringent regulations by the United States.

The only external indicator that showed slight improvement was the external debt-to-gross domestic product ratio that improved from 20.7% to just 20.6%.

The finance ministry noted that slight improvement was because of higher repayments of external debt and translational gain on account of appreciation of the US dollar against other international currencies.

Total external debt and liabilities rose 12.3% to $83 billion by the end of last fiscal year, according to the statement.

Total public debt stood at Rs21.4 trillion at the end of June 2017, which was equal to 67.2% of GDP, and way above the original limit set under the original FRDL Act of 2005.

Before the amendments in the FRDL law, the government was bound to keep public debt below 60% of the total size of the economy.

For a developing country like Pakistan, a debt-to-GDP ratio below 50% is considered sustainable. Anything above this threshold is counted as dangerous in the long term, according to economists.

The public debt-to-government revenue ratio stood at 433.6%, which was slightly better than preceding year’s ratio of 442.5%. However, this was way above the generally acceptable threshold of 350% for developing countries. This means fewer resources are available for spending on human resources and development.

The government also could not increase revenues and its receipts were not sufficient to finance current expenditures. Revenue deficit – total revenues minus current expenses – was recorded at 0.7% of GDP in 2016-17. However, this was marginally better than the previous year and the trend was positive.

The primary deficit – which is calculated by excluding interest payments -- also increased to 1.5% from only 0.2% a year ago.

The ratio of debt servicing as percentage of total revenues also deteriorated from 35.9% to 38.3% -showing reversal of previous year’s trend.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ