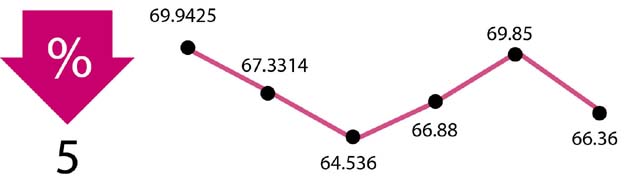

Stock market recovers after five weeks of constant battering

Political calm and increased activity spur growth

File photo

PHOTO: EXPRESS TRIBUNE

A relative calm in the country’s political landscape helped improve investor sentiment as announcement of Shehbaz Sharif as the PML-N’s prime ministerial candidate and President Mamnoon Hussain’s announcement of elections being held on schedule helped allay fears of political instability.

The bourse kicked off the week on a negative note with the first two sessions closing in the red. The prime minister’s announcement that furnace oil-based power plants would be phased out brought down the index as the energy sector took a major hit due to the news.

The passage of the delimitation bill on Wednesday reinvigorated the market, led by the banking sector, as worries over timely elections were put to rest.

SECP proposes foreign investors’ participation in PSX shares

The positive momentum continued for the next two days as increased institutional investor interest in heavyweight sectors, including cement, steel and banking, allowed the bourse to extend gains.

Market participation increased somewhat with average daily traded volumes rising 2.3% week-on-week to 138 million shares while average daily traded value fell 17.3% to $52 million.

The week started with meagre volumes of 50 million shares, but they jumped fourfold to 222 million by Friday, Elixir Securities said in its report, adding that the traded value recorded a similar increase with $24 million traded on Monday and $83 million on Friday.

The highest week-on-week value buying was witnessed in heavyweight sectors including banks (+5%), fertiliser (+3%), cement (+3%) and oil and gas marketing (+2%). Food and personal care (-3%) and refinery (-1%) sectors suffered losses during the week.

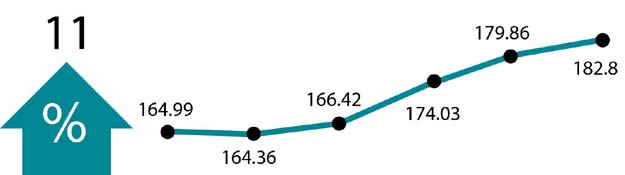

The banking sector alone contributed 543 points to the index on the back of an expected rise in interest rates. UBL (+187 points) and HBL (+172 points) were the largest contributors followed by Oil and Gas Development Company (+67 points), Lucky Cement (+4%) and Engro (+3%).

Negative contribution came from Pakistan Oilfields (-4%), Hubco (-3%), Pakistan Petroleum (-2%), Nestle (-5%) and Mari Petroleum (-3%) cumulatively erasing 170 points from the index.

With an improved political outlook, foreign selling fell to $5.4 million during the week from $8.9 million last week. Individuals, organisations and insurance companies were net buyers of $2 million, $5.2 million and $1.6 million worth of shares respectively while banks saw selling of $4.5 million worth of stocks.

Sector-specific major highlights of the week were 57% increase in foreign direct investment, revision in the budget deficit target to 5% of GDP, Hyundai’s announcement about inauguration of its automobile plant on December 20, surge in power sector receivables to Rs800 billion, spending of over $2 billion on external debt servicing in the first quarter of FY18, central bank governor’s remarks that the rupee was at its fair value and the near doubling of current account deficit in July-November FY18.

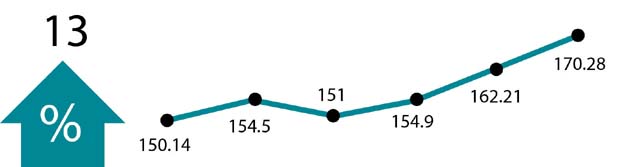

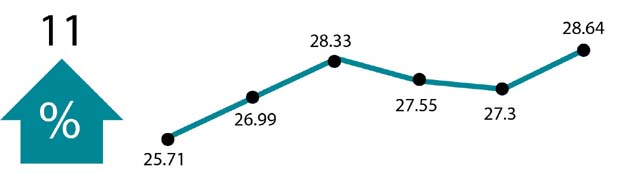

Winners of the week

Attock Cement

Attock Cement Pakistan Limited manufactures and sells cement and related products. The company is also part of the Pharaon group which, in addition to investments in the cement industry, also owns interests in the oil and gas sector.

PICIC Growth Fund

PICIC Growth Fund is a closed-end fund registered in Pakistan. The fund’s objective is to generate capital growth. The fund invests in stocks listed at the stock exchange.

United Bank

United Bank Ltd provides commercial banking and related services. The bank offers a wide range of banking and financial services, including brokerage services.

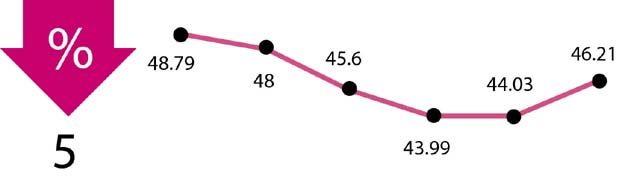

Losers of the week

Adamjee Insurance Company

Adamjee Insurance Company Ltd underwrites insurance. The company offers fire, marine, automobile, engineering and miscellaneous coverage. The engineering coverage includes contractor’s all risks, plant and machinery, electronic equipment and machinery, and excise and customs, maintenance, and performance bonds. Miscellaneous includes health, accident and liability.

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres Ltd also owns an in-house power generation plant.

Pakistan’s fake news problem is hurting gullible investors

Thal Limited

Thal Limited manufactures jute goods. The company also undertakes engineering projects.

Published in The Express Tribune, December 24th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ