Market watch: KSE-100 extends losses with little institutional interest

Benchmark index drops 398.04 points to settle at 39,634.13

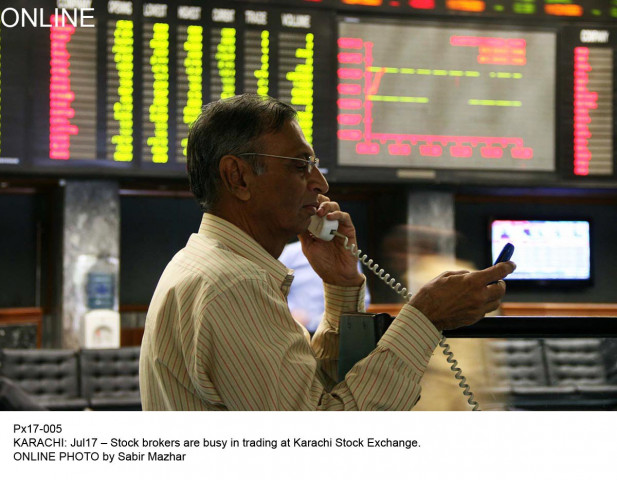

PHOTO: ONLINE

A decline in global crude oil prices dampened investor sentiments as oil and gas exploration companies suffered losses due to heavy selling.

At close, the benchmark KSE 100-share Index registered a decrease of 398.04 points or 0.99% to settle at 39,634.13.

Elixir Securities, in its report, stated that Pakistan equities extended the decline and the benchmark index broke below the 40,000-point support to settle a little above 39,600.

The market briefly traded in the positive zone and then entered the negative territory, led by losses in exploration and production companies, as investors tracked the fall in global crude prices. Later, index names across key sectors skidded lower on limited institutional interest.

The highlight of the day was Engro Corp (+1.62%) that emerged on the buyers' radar after news that the company had signed an agreement for a $500-million LNG terminal. The stock recovered from its 20-month low and contributed near one-fourth to the total market turnover.

Market watch: KSE-100 falls, but not as much as sit-in ends

Meanwhile, K-Electric (-2.1%) continued to dominate the volumes board, but closed lower on profit-taking after gaining over 10% in the last two sessions on excitement over the Shanghai Electric Power deal.

"We predict that the market will remain choppy and volatile in the near term while investors will continue to closely monitor institutional activity to get a sense of market direction," the report added.

JS Global analyst Danish Ladhani said the KSE-100 Index followed previous day's trend and remained bearish predominantly. Trading activity remained dull as well.

The index lost 398 points to close at 39,634 likely due to the current political scenario. Major laggards were heavyweight Mari Petroleum (-1.24%), Pak Suzuki Motor Company (-3.45%) and Lucky Cement (-2.40%) which contributed 49 points to the index's fall.

Traded volumes, however, improved 1.8% to 113 million shares while the traded value jumped to $51 million. K-Electric (-2.08%) continued to lead the volume charts with more than 27 million shares changing hands.

The fertiliser sector settled in the red zone though off-take numbers depicted higher sales for October 2017 at 375,000 tons (up 4% and 110% year-on-year and month-on-month respectively).

Market watch: KSE-100 ends marginally negative

Moreover, sentiments in the banking sector remained bearish where heavyweights MCB Bank (-0.06%), Habib Bank (-0.61%) and Bank Alfalah (-2.25%) closed lower.

"Moving forward, we recommend investors to stay cautious at current levels where any upside can be considered as an opportunity to reduce short-term positions or book profits," Ladhani added.

Overall, trading volumes rose to 113 million shares compared with Monday's tally of 110 million.

Shares of 361 companies were traded. At the end of the day, 97 stocks closed higher, 244 declined while 20 remained unchanged. The value of shares traded during the day was Rs5.36 billion.

K-Electric was the volume leader with 27.8 million shares, losing Rs0.13 to close at Rs6.13. It was followed by TRG Pakistan with 9.2 million shares, losing Rs1.27 to close at Rs36.12 and Dewan Motors with 6.5 million shares, losing Rs0.55 to close at Rs25.48.

Foreign institutional investors were net sellers of Rs408 million during the trading session, according to data compiled by the National Clearing Company of Pakistan.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ