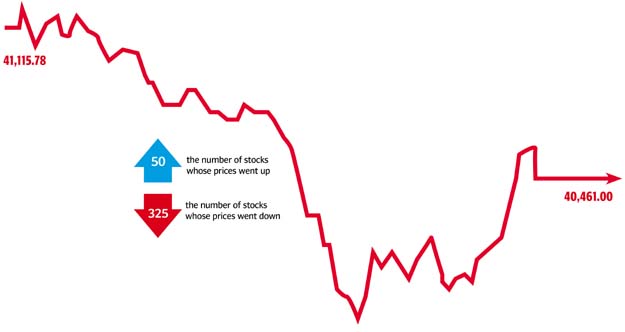

Market watch: Stocks battered as index touches new 11-month low

Benchmark KSE-100 index falls 654.78 points or 1.59% to settle at 40,461

PHOTO: AFP

The KSE-100 index opened negative and recorded small ups and downs till midday. By noon, it began a steady descent and plunged 1,234 points in intra-day trading, hitting 39,869.88 points.

Later, investors emerged to buy stocks at attractive valuations, which helped the index recover significantly. Despite the change in direction, the index still stood negative.

At close, the KSE-100 index registered a fall of 654.78 points or 1.59% to finish at 40,461, the lowest level for 2017. Elixir Securities, in its report, stated Pakistan equities touched a new 11-month low, settling below 40,500 on institutional selling.

Market watch: KSE-100 gets a hammering as political turbulence intensifies

“The market, after a lacklustre opening and trading sideways for a brief period, started to skid lower as index names across major sectors came under selling pressure with reports of selling by a few local institutions,” stated Elixir.

The slide later turned into a full-blown hammering by midday where many notable names hit lower price limits and the KSE-100 index dropped 3% below 40,000 points.

Afterwards, selective value-buying in late trading helped the benchmark index to pare losses and gain 1.8% from its intra-day low.

Pakistan Oilfields (+0.8%) in a notification announced flows in its recent discovery at the Ikhlas block which, according to an analyst at Elixir, would have an annualised positive impact of Rs10.3 on the company’s earnings per share and would raise its bottom-line by 20%.

“(We) expect the market to remain choppy with flows primarily guiding direction in coming days,” the report added.

JS Global analyst Maaz Mulla said the market continued its steep decline during initial hours of Wednesday’s trading session, hitting an intra-day low of -1,246 points.

He was of the view that selling pressure was likely on the back of investor scepticism about political scenario in the country. However, buying in heavyweight stocks in latter hours resulted in a recovery in the KSE-100 index as it closed at 40,461.

Market watch: Dullest day for stock market since mid-2015

The cement sector led the decline where Lucky Cement (-1.28%), DG Khan Cement (-3.01%), Maple Leaf Cement (-5%) and Fauji Cement (-4.29%) contributed -75 points to the index. Steel companies also fell where International Steels (-4.93%), International Industries (-3.48%) and Amreli Steels (-4.77%) dipped the most. Moreover, Oil and Gas Development Company (-2.04%) and Pakistan Petroleum (-0.74%) closed in the red as oil prices edged lower in the global market.

“We believe negativity in the market will continue on the back of political uncertainties and concern over economic indicators. Also, potential redemptions in mutual funds are likely to cause further selling pressure. We recommend investors to trade with caution in the near term,” he added.

Overall, trading volumes rose to 192 million shares compared with Tuesday’s tally of 121 million.

Shares of 391 companies were traded. At the end of the day, 50 stocks closed higher, 325 declined while 16 remained unchanged. The value of shares traded during the day was Rs9.6 billion.

How the currency markets are viewing Dar’s indictment

Aisha Steel Mills was the volume leader with 10.9 million shares, losing Rs0.76 to close at Rs17.26. It was followed by Pakgen Power with 10.1 million shares, gaining Rs0.58 to close at Rs21.63 and K-Electric with 9.7 million shares, losing Rs0.19 to close at Rs6.67.

Foreign institutional investors were net sellers of Rs316 million during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ