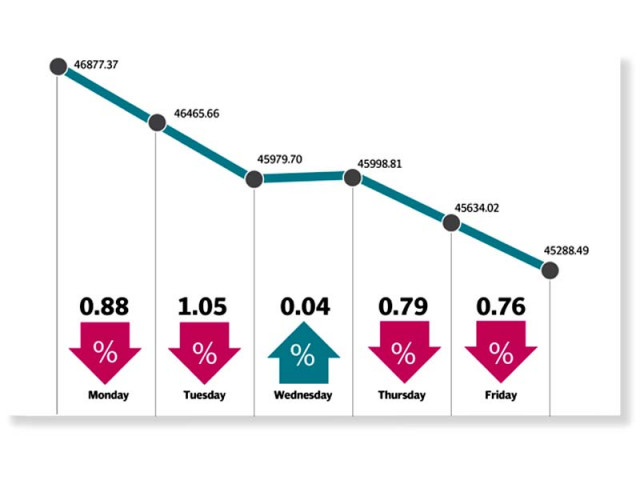

KSE-100 falls 3.4% with marked decline in volumes

Average daily trading value drops 42% week-on-week

KSE-100 falls 3.4% with marked decline in volumes

The unimpressive performance can be attributed to an uncertain political climate following the most-watched Panama Papers case verdict. In a show of strength, the former prime minister was mobilising supporters in a march from Islamabad to Lahore via the GT Road with strategic stops on the way.

In addition to the political noise, heavy foreign selling, unimpressive economic data, dull corporate results and a dip in central bank’s foreign currency reserves dampened investor sentiments and shaved 1,589 points off the benchmark KSE 100-share Index in the week under review.

Market watch: KSE-100 falls over 350 points amid thin activity

Investor participation slowed down markedly as average trading volumes during the week stood low, falling 46% to 190 million shares per day against 349 million traded last week.

Average traded value per day dropped 42% to Rs9.6 billion. Major trading volume was recorded in retail favourites, led by Azgard Nine (62 million shares), TRG Pakistan (58 million shares) and K-Electric (58 million shares).

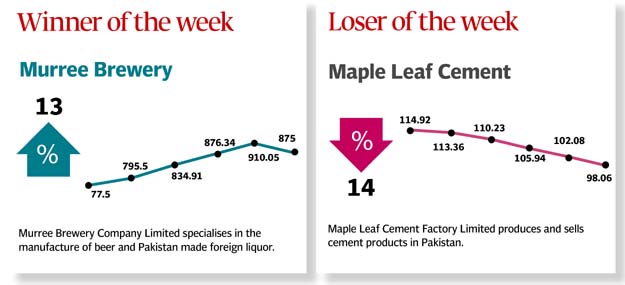

The sectors that led the decline were commercial banks (336 points), fertiliser companies (251 points), cement producers (238 points), oil and gas exploration companies (185 points) and power generation and distribution firms (104 points). Among individual stocks, Habib Bank, Engro Corporation, United Bank, Oil and Gas Development Company and Maple Leaf Cement dragged the index down by 582 points.

On the flip side, PSO emerged as the biggest supporter of the bourse, contributing 51 points amid higher-than-expected dividend and surprise bonus pay-outs. Foreign investors continued to sell equities amidst concern over potential deterioration of the rupee-dollar parity and political uncertainty in the country with another $31 million worth of net selling during the week.

Market watch: KSE-100 Index recovers, finishes few points shy of 46,000

Foreign selling was seen in stocks of oil marketing companies ($8.5 million), commercial banks ($6.7 million) and exploration and production companies ($6.3 million).

On the local front, insurance companies and mutual funds were net buyers of $7.4 million and $6.5 million worth of stocks, respectively.

Published in The Express Tribune, August 13th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ