For the record, Imran Khan dodged taxes too using offshore firm: German journalist

Frederik Obermaier is one of the reporters who unearthed the Panama Papers scandal

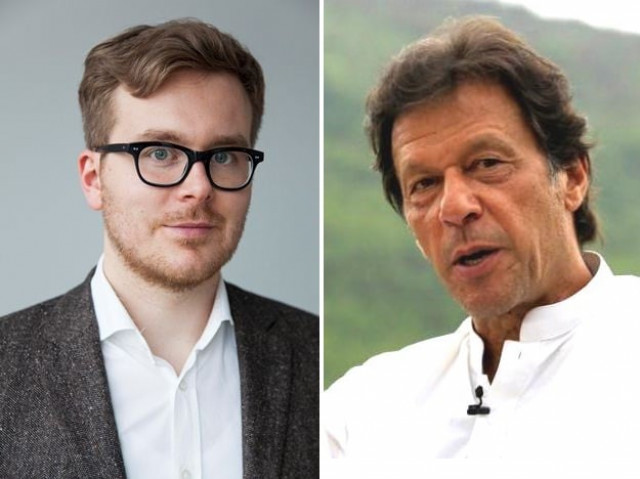

German investigative journalist Frederik Obermaier and PTI chief Imran Khan. PHOTO: ICIJ/File

Just for the record: Mr Khan avoided UK-taxes via an offshore-company #NiaziServicesLimited https://t.co/XgGUCFmR2Q

— Frederik Obermaier (@f_obermaier) July 31, 2017

The tweet comes in the wake of the Supreme Court deposing prime minister Nawaz Sharif following a probe into his family's offshore assets that surfaces in the Panama Papers.

SC cannot disqualify Imran Khan for submitting false declaration: CJP

The court disqualified Sharif from holding a public office for hiding assets in his nomination papers for the 2013 general elections.

The court is also hearing a petition against Imran Khan seeking his disqualification alleging non-disclosure of assets, ownership of offshore companies and receipt of foreign funds for the party.

The PTI chief informed the apex court that he had started earning money abroad when he started playing cricket during his days as an undergraduate student at Oxford University, England.

He was later selected to play for Pakistan along with Worcestershire from 1971. He had played for Sussex County from 1977 to 1988. All the payments Imran received had income tax deducted from them at source, the statement reads.

He further informed the court that he had to spend his days outside Pakistan to fulfil his commitment to Sussex Country Cricket and to participate in other international cricketing events between 1977 and 1988. As he was a “non-resident, the Pakistani income tax law did not apply to him”.

SC seeks money trail of Imran’s London flat

He also played for the Kerry Packer series, a cricket competition, between 1977 and 1979, for $25,000 per year. Besides his earning, there were also the airfare, boarding, lodging costs and prize money.

Imran submitted that he had played in Australia for New South Wales between 1984 and 1985, earning Australian $50,000. In 1984, he had mortgaged a one-bedroom apartment in London through Royal Trust in the name of Niazi Services Limited.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ