KSE-100 falls below 44,000 as investors remain jittery

Benchmark-100 index falls another 328.39 points on Wednesday

Benchmark-100 index falls another 328.39 points on Wednesday. PHOTO: EXPRESS

After its worst one-day performance on Tuesday, investors resorted to continued panic selling on Wednesday morning before the index found support near 43,000. Oil and banking stocks helped the recovery, but it was not enough for the index to end positive.

Market talk suggests that the index is likely to remain under pressure until a final verdict is out on the Panama case. The hearing is set for July 17.

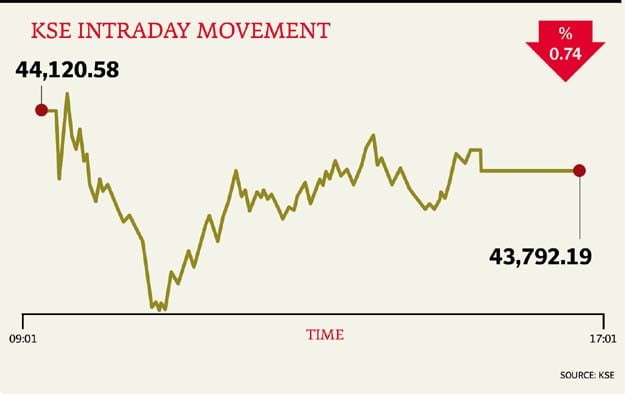

At close on Wednesday, the benchmark KSE 100-share Index finished with a decrease of 0.74%, or 328.39 points, to end at 43,792.19.

Elixir Securities, in its report, stated equities continued the losing streak and closed lower as reportedly institutional investors remained net sellers in Index names perturbed by ongoing political turmoil.

“The day kicked off on a bearish note with benchmark KSE-100 Index extending declines and tanking by over 1,000 points within the first two hours of trading,” stated the report.

Notable index names across major sectors witnessed hammering pre-dominantly from local banks and asset managers amid no serious buyers on screen. Index, however, found support over 43,000 level and pared losses as value hunters cherry-picked oils, financials and fertilisers; pushing KSE-100 Index up by over 700 points from its intra-day low.

“Index heavy Oil & Gas Development Company (OGDC PA +4%), Habib Bank (HBL PA +1.7%) and Fauji Fertilizers (FFC PA +4.5%) emerged as top gainers while Lucky Cements (LUCK PA -3.6), Hub Power (HUBC PA -3.3%) and Engro Corp (ENGRO PA -2.6%) were among the top losers,” stated Elixir.

“[We] see volatile and choppy trading to continue in near-term as looming political uncertainty will likely keep gains in check.”

JS Global analyst Arhum Ghous said that the index further slipped by 1,093 points in the early hours of the trading session on Wednesday. However, it later recovered to close at 43,792 level, 328 points below Tuesday’s close as buying was witnessed on attractive price levels.

“The auto sector shed points, on account of the PAMA numbers showing a decline in auto sales of 2% YoY in FY17 and 25% MoM in June-2017. HCAR (-4.81%) and PSMC (-5%) from the aforementioned sector closed in red,” said Ghous.

Commercial bank heavyweights witnessed buying during the latter hours, with HBL (+1.73%), ABL (+1.96%) and NBP (+2.30%) closing in the green zone. OGDC (+3.98%) and PPL (+2.72%) gained points on account of increasing prices of oil in the global market on US government cutting its crude production outlook for next year and fuel inventories plunging.

Political noise is expected to continue impacting the market unless matters are completely resolved, the analyst remarked.

“We recommend investors to stay cautious reducing their short-term positions, where we believe an appropriate strategy would be to invest in dividend yielding stocks.”

Overall, trading volumes rose to 215 million shares compared with Tuesday’s tally of 185 million.

Shares of 345 companies were traded. At the end of the day, value of 144 stocks closed higher, 189 declined while 12 remained unchanged. The value of shares traded during the day was Rs12.6 billion.

K-Electric was the volume leader with 19.9 million shares, gaining Rs0.32 to close at Rs6.76. It was followed by TRG Pakistan with 14.7 million shares, gaining Rs0.29 to close at Rs36.13 and Engro Polymer with 8.4 million shares, losing Rs0.92 to close at Rs33.28.

Foreign institutional investors were net sellers of R862 million during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, July 13th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ