Pakistan’s debt burden high, deficit to exceed official projections: Moody’s

Says economic growth likely to remain below expectations, keeps country’s credit rating unchanged at B3

PHOTO: REUTERS

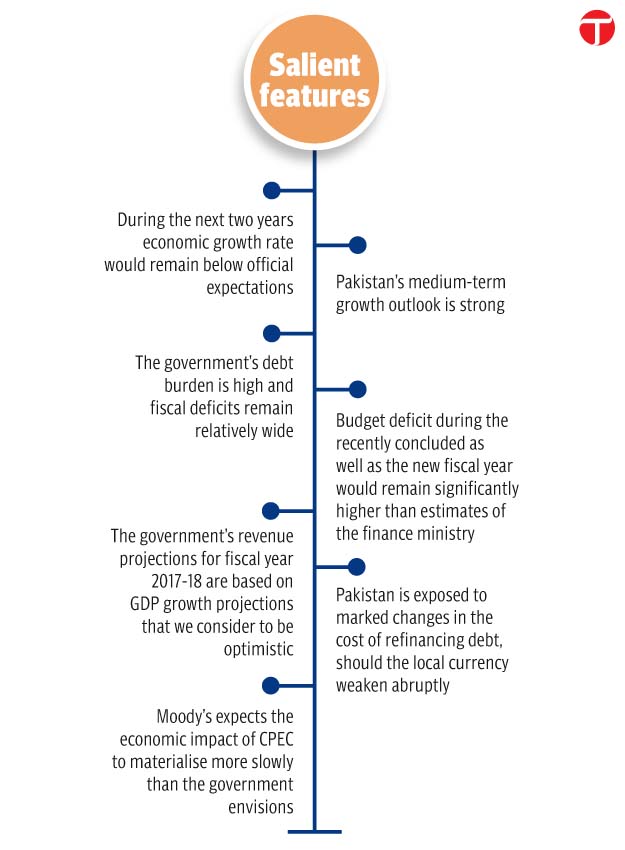

In its latest report on Pakistan, Moody’s - one of the two leading credit rating agencies - also said that during the next two years economic growth rate would remain below official expectations due to slow materialisation of China-Pakistan Economic Corridor (CPEC) projects. But it said that Pakistan's medium-term growth outlook is strong due to CPEC and reforms initiated under the International Monetary Fund (IMF) programme four years ago.

However, Moody’s kept Pakistan’s credit rating unchanged at B3, which means investment in Pakistani bonds is highly speculative. It maintained a stable outlook for Pakistan. The B3 rating is at number 16 out of the 21 ratings-tier followed by global rating agencies. It is only a notch above from the Caaa3 rating, which is assigned to countries that have substantial risks for potential investors.

Moody's says Pakistan's external debt will increase to $79 billion

Moody’s had assigned the B3 rating to Pakistan in June 2015 and has not changed it since. It said that domestic politics and geopolitical risk also continue to represent a significant constraint on the rating.

“The government's debt burden is high and fiscal deficits remain relatively wide, driven by a narrow revenue base that also restricts development spending,” said Moody’s. In addition, foreign exchange reserve adequacy would still be vulnerable to any significant increase in imports.

By March-end of this year, Pakistan’s total debt and liabilities stood at Rs24.14 trillion or 75.8% of Gross Domestic Product, according to the State Bank of Pakistan. Out of that, the government’s total debt and liabilities stood at Rs20.8 trillion or 65.5% of the GDP, excluding Public Sector Enterprises obligations. By including the PSEs obligations, the government’s liabilities would touch 70.4% of the GDP.

Fitch says Pakistan’s external finance pressures manageable

In the past one year, the federal government twice amended the definition of public debt in its desperate efforts to show a relatively better picture by changing the goalpost.

Moody’s said that the government's debt burden was materially higher than the B-rated median of 52.6% of the GDP.

The international rating agency also forecasted that the budget deficit during the recently concluded as well as the new fiscal year would remain significantly higher than estimates of the finance ministry. The fiscal deficit will widen to about 4.7% of GDP or Rs1.5 trillion in fiscal year 2017 that ended on June 30. It was even higher than the IMF’s forecasts and the revised estimates of the finance ministry.

Not only that, Moody’s said that the budget deficit would touch 5% of the GDP in fiscal year 2018 despite the government's intention to advance fiscal consolidation. This is almost 1% or Rs350 billion higher than the target approved by the parliament last month.

Pakistan’s trade deficit touches new height, stands at $32.6b

The Moody’s said that government's revenue projections for fiscal year 2017-18 are based on GDP growth projections that we consider to be optimistic.

“Large fiscal deficits and a reliance on short-term debt have also contributed to very high gross borrowing requirements,” said the ratings agency. Pakistan had budgeted $2 billion short-term foreign commercial borrowings but it closed the fiscal year at around $4 billion.

Moody’s said that Pakistan is exposed to marked changes in the cost of refinancing debt, should the local currency weaken abruptly. “In addition, debt affordability metrics, which include interest payments as a percentage of revenues and GDP, are very weak for Pakistan relative to its peer group.”

Pakistan’s GDP growth expected at 4.9%: Moody’s

During the first nine months of the last fiscal year, the cost of external debt servicing mounted up to $5.23 billion, which consumed more than one-fourth of the total annual exports for the fiscal year 2016-17, showed the central bank data.

Moody's expects the economic impact of CPEC to materialise more slowly than the government envisions, resulting in real GDP growth closer to 5.5% over the next two years, compared to government’s forecast of 6% growth in fiscal year 2017-2018.

The security related issues and a weak track record of public project implementation suggest the pace of project execution will be relatively slow, it added.

The rating agency said that greater exchange rate flexibility would contribute to a more durable accumulation of foreign exchange reserves over time, which would help to strengthen external buffers and export competitiveness. However, it added, any shift in exchange rate management will be gradual, as the government will likely want to avoid abrupt currency and other price movements, in particular in advance of the 2018 general election.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ