Rs4.75tr status-quo budget unveiled

Inadequate measures to control emerging threats to external sector; no reforms to improve governance of public sector

Finance Minister Senator Ishaq Dar. PHOTO: REUTERS

The new budget for the fiscal year 2017-18 also revealed the government’s intentions to deviate from the path of fiscal discipline, earlier agreed with the International Monetary Fund (IMF).

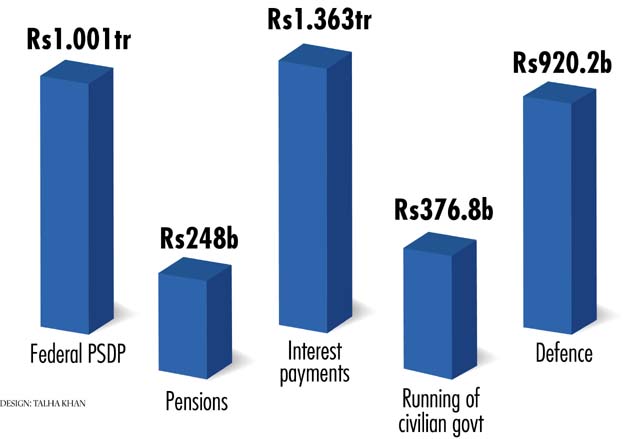

It presented a budget deficit target which is Rs217 billion higher than what had been agreed with the IMF, indicating the government’s spending priorities in the election year. The government allocated Rs1.001 trillion for federal development spending, including Rs272 billion for special schemes.

Almost half of the total budget or Rs2.3 trillion will be spent on two major heads –servicing of ballooning debt and defense of the country. The amount is exclusive of money that the government gives to military for defence procurements, estimated at Rs180 billion.

While delivering his fifth budget speech, the finance minister also tried to give relief where possible like on agriculture and tech startups. The salaried class was offered an olive branch by merging seven-year old 50% ad hoc allowance and giving further 10% increase in salaries but on ad hoc basis.

‘Historic’ Rs1.001 trillion allocated for development budget

However, the much-touted textile package remains under-funded as an amount of only Rs9 billion has been allocated against the old and the current package despite the textile division’s demand of Rs40 billion for the new package. In addition to that, elusive allocations were made for many other areas.

Dar did not fulfill his promise to end super tax collected from banks and companies and instead extended it for a third year, creating mistrust between him and the business community.

The government has proposed exempting the income of political parties from the levy of income tax.

The federal government announced the budget deficit – gap between income and expenditures -- equivalent to Rs1.826 trillion or 5% of the Gross Domestic Product (GDP) for fiscal year 2017-18.

However, the budget deficit target seems understated as the government has not fully taken into account the implications of grants and other expenses. This black hole of Rs1.826 trillion will be filled by borrowing Rs968 billion from domestic and Rs511 billion from external sources and taking into account cash surplus generated by the provinces.

The finance minister announced the overall budget deficit target at 4.1% of the GDP or Rs1.48 trillion on the back of Rs343.3 billion savings by the four provinces. The announced overall budget deficit is Rs217 billion or 0.6% of the GDP higher than what the government had committed with the IMF under its medium-term macroeconomic framework.

Even this 4.1% deficit is highly understated as the finance minister had presented 4% budget deficit target to the prime minister in the second last cabinet meeting with an allocation of Rs855 billion for federal development spending. The PM had directed the finance minister to increase spending to Rs1.001 trillion, which Dar did, but did not fully reflect its impact on the budget deficit.

Status Quo

Dar did not either announce measures to reform the corrupt to the core Federal Board of Revenue (FBR) and loss-making public sector enterprises. Also, he did not say a word on privatisation nor did he give a plan to end circular debt.

Asia’s best-performing market gives finance minister something to be proud of

The budget appeared protecting the status quo both on the expenditures and the revenue side, as the government did not venture into areas requiring immediate attention to put the economy on sustainable footings. The tax burden of the existing sectors has been further increased. For instance, tax rates on steel, cement, garments, leather and surgical goods have been further increased.

It relied on taxing the imported goods to enhance its revenues, which will stoke inflation in the country. The cost of construction industry will significantly go up, the food items will become expensive and the corporate sector that is already paying heavy taxes will get even more burdened.

The prices of almost all the goods will go up after the finance minister announced increase in withholding tax rates on all kinds of goods sold by non-filing manufacturers, wholesalers and distributors.

Not even a single new meaningful measure has been announced in the budget that could show the government’s intentions to address the structural problems of the economy.

The government did not announce a plan to restructure and reform the ailing Pakistan Airlines, the Pakistan Steel Mills and power distribution and generation companies while fearing backlash in the upcoming general election.

As Finance Minister Dar rose from his seat to present his government’s fifth budget, Leader of Opposition in the National Assembly Khursheed Shah stood up and protested over the use of force against the farmers who were demanding relief from taxation and seeking subsidies.

“There was no plan to protest in the budget session but the government has forced us to do that by using force against poor farmers,” said Shah.

The opposition members called finance minister a liar and tore apart copies of the budget document before they boycotted the budget speech. However, after a brief period, the opposition parties again joined the session.

The defense spending, meanwhile, increased by 9.4% to Rs920.2 billion and the social spending on Benazir Income Support Programme marginally grew to Rs121 billion.

Excluding foreign loan repayments, the total estimated size of federal expenditures is Rs4.75 trillion, which is 11.7% higher than the revised estimates of Rs4.26 trillion, said the finance minister while sharing the details of the budget.

By including foreign loan repayments, the total outlay will increase to Rs5.1 trillion. However, since the foreign loans are repaid by obtaining new loans, the government does not book it on the budget.

There is a black hole of Rs1.83 trillion that the government will fill by borrowing from the banks. Out of Rs4.8 trillion, the size of current expenditure is Rs3.5 trillion, including Rs1.363 trillion for interest payments.

The federal government approved Rs138.8 billion subsidies for the next fiscal year, which are underreported, as the government did not include the impact of Rs3.50 per unit reduction in electricity prices for agriculture tubewells in the budget. The power subsides are only Rs118 billion.

The defense spending has been proposed at Rs920.2 billion, higher by Rs79 billion over this year’s revised spending. An amount of Rs376.8 billion has been proposed for running the civilian government.

Another sum of Rs248 billion has been set aside for paying pensions to both military and civilians. The military pensions are estimated at Rs180.2 billion. A major chunk of Rs430.2 billion has been allocated under the head of grants and transfers, including Rs180 billion contingent liabilities for defence procurements.

Rs1 trillion development budget unprecedented in history of Pakistan: PM

The four provinces will get Rs2.39 trillion as their share in federal taxes which will be 12.4% higher than in the outgoing fiscal year. Punjab will get the highest amount of Rs1.16 trillion, Sindh Rs612.5 billion, Khyber Pakhtunkhwa Rs389.9 billion and Balochistan Rs220 billion.

Dar said the country had been put on path of sustainable development and the environment was conducive for takeoff.

Agriculture package

Dar announced to reduce mark-up rates from 15% to 9.9% for farmers holding 12.5 acres of land. Small loan of up to Rs50,000 per farmer will be provided to two million farmers by the ZTBL and the NBP. The State Bank of Pakistan will monitor the implementation of this new scheme.

The volume of agriculture credit is being enhanced to Rs1.001 trillion from the last year’s target of Rs700 billion which will be an increase of 43%. As a further measure to support farmers, the government has already decided to sell the existing stock of imported urea fertilizer available with the NFML at a concessional Rs1,000 per bag.

In order to create ease of disbursement of subsidy on the DAP, it has been decided that the DAP will be subject to fixed sales tax. As a result, GST has been reduced from Rs400 to Rs100 per 50 kg bag. This will have a subsidy impact of Rs.13.8 billion.

In order to facilitate the farmers in obtaining credit from banks, the State Bank will take steps to align the banking system with the Land Record Management Information System for mortgaging of a property by the banks or farmers.

Scant raise: Religious affairs ministry budget raised by 6%

The government will continue provision of subsidised tariff on agri-tubewells at the rate of Rs5.35 per unit in FY 2017-18. This is estimated to cost around Rs27 billion in the fiscal year 2017-18. Production Index Units will be increased from Rs4,000 to Rs5,000 to facilitate farmers to obtain maximum credit from the banks.

Housing Sector

In order to address availability of long-term financing in the housing sector, a Risk Sharing Guarantee Scheme for low-income housing has been announced and the government will provide 40% credit guarantee cover to banks and the DFIs for home financing of up to Rs1 million. An amount of Rs6 billion has been allocated for the purpose. It has been decided that the facility will also be made available through micro-finance banks.

SME Sector

The biggest constraint of the Small and Medium Enterprises (SMEs) sector is access to credit. Banks are generally reluctant to offer credit to the SME sector because of the high risk attached to the sector. In order to enable banks to provide financing to the SME sector, the government announced to introduce Risk Mitigation Facility for SMEs through a Rs.3.5 billion fund to be established in the SBP. The facility will cater to both Islamic and conventional banking products.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ