With the Pakistan Stock Exchange (PSX) set to be upgraded into MSCI’s Emerging Markets Index come June 1, Dar mentioned how it outperformed all its peers in Asia in calendar year 2016; becoming Asia’s best and the world’s fifth-best performing market.

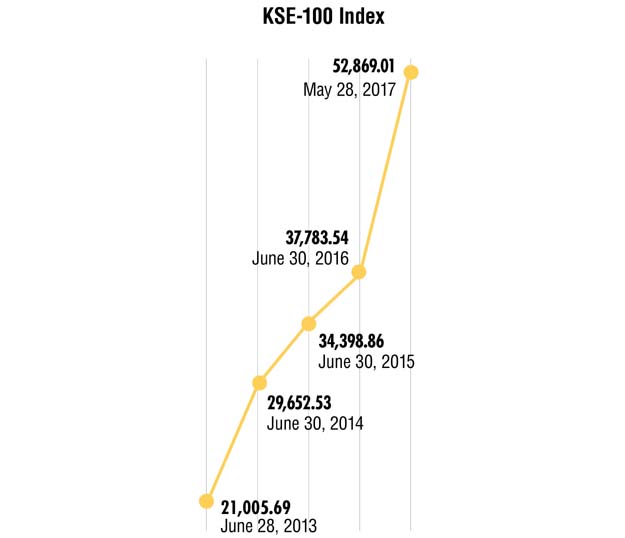

The KSE-100 Index, a benchmark for market performance, has also soared 40% in the current fiscal year to date, as stocks attracted the available liquidity in the economy.

Pakistan Stock Exchange: Market noisier than ever, but outlook still positive

The index surged 39.92%, or 15,085.47 points, in the outgoing fiscal year and closed at 52,869.01 points on Thursday.

The closing is fractionally low from the all-time high of 52,876.46 points recorded on Wednesday (May 24). But the index never fell below the July 1, 2016 level of 37,783.54 points throughout the review period (July 1, 2016 to May 25, 2017). Arif Habib Limited Head of Research Shahbaz Ashraf said the 40-year low interest rate helped the market outperform among several asset-class markets.

“Rupee remained stable so the money market relocated its huge investments to the stock market. In addition, the real estate sector’s investors also moved their investment to the PSX due to confusion (on taxation),” he said.

Mutual funds appeared as the single largest investor at PSX this year, as they received huge funds from institutional and individual investors.

The market recorded trade transactions of over $41 billion during the review period, according to the National Clearing Company of Pakistan Limited.

The market also attracted huge liquidity with significant support of robust financial reporting by listed companies, projects expansion stories mainly from cement, steel and automotive sectors, improvement in political maturity and last, but not the least, the planned PSX upgrade to MSCI Emerging Market on June 1, 2017.

“PSX reclassification into MSCI EM after nine years is expected to project the market furthermore in the days to come,” said Topline Securities Head of Research Saad Hashmi.

“After the reclassification, there may be profit booking, which is due for some time. The Qatar and UAE markets saw 10-15% profit-selling within one month in the aftermath of their upgrade.

“The market still has the potential to increase by another 5% till the current fiscal year ends (on June 30, 2017),” Hashmi added.

The Economic Survey 2016-17 stated, “The return of 46% [in calendar year 2016] stood out as the best in MSCI Frontier Markets and compared favourably with the PSX average gains of 20% over the past 10 years and average return of 24% over the last 20 years.”

Ashraf added that the integration of three local bourses into PSX, sale of PSX’s 40% stake to strategic Chinese consortium and comparatively higher number of enlistment of companies at the PSX also kept sentiment positive.

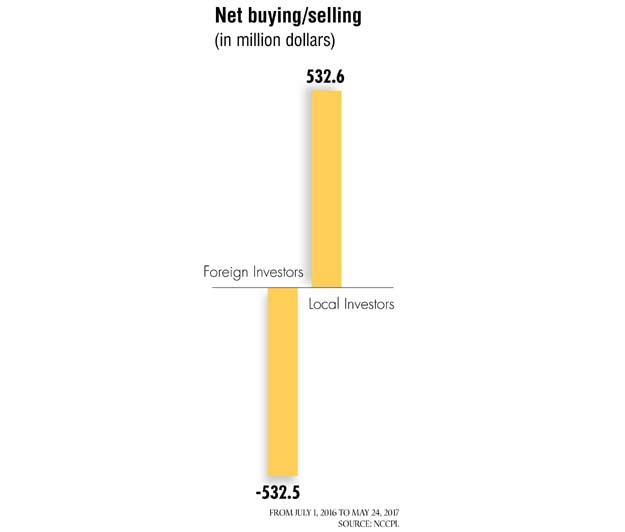

On the flipside, foreign investors sold stocks worth around $530 million in the review period.

Foreign passive fund managers, who only work in MSCI Frontier Market globally, were selling shares at the PSX in the aftermath of Pakistan’s exclusion from the Frontier Market and its upgrade to MSCI EM. Hashmi said now the passive funds, which work only in MSCI EM, would enter Pakistan.

Making changes: PSX initiates process to launch derivatives

EFG-Hermes Pakistan CEO Muzammil Aslam has estimated that the PSX would record trade transactions worth $1.25-1.5 billion on the day it is upgraded. The market records trade transaction worth, on an average, $150-180 million per day.

Stock report

On Thursday, the KSE 100-share Index endured a volatile session, trading between an intraday high of +251 points and an intraday low of -142 points.

At close, the index finished with a decline of 7.45 points or 0.01% to end at 52,869.01.

Overall, trading volumes fell to 408.9 million shares compared with Wednesday’s tally of 607 million.

Shares of 401 companies were traded. At the end of the day, 153 stocks closed higher and 237 declined while 11 remained unchanged. The value of shares traded during the day was Rs24.4 billion. Foreign institutional investors were net sellers of Rs1.22 billion during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, May 26th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (5)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ