Weekly review: KSE-100 gains 1.1% amid upcoming MSCI inclusion

KSE-100 Index added 550 points end the week at 49,851

Benchmark index rises 42.34 points to end at 49,827.51. PHOTO: INP

After a long weekend, the index started off on a bearish note, shedding 1.4% in the first two days. However, the feel good factor returned in the final two trading sessions where the market gained 2.6%.

The positivity can be attributed to increased locals’ participation in anticipation of foreign inflows as the date of MSCI review, where Pakistan will reclassified as an emerging market, comes closer.

It looked like local politics hit the back burner this week as investors at the PSX were more concerned with lapping up key MSCI-EM names ahead of the review on May 15, leading up-to the actual upgrade on June 1, 2017.

Rally was primarily fueled by financials (3.7%) that alone added 532 points to the KSE-100 index where significantly higher than expected inflation readings for April’2017 re-ignited hopes of an early interest rate lift-off.

MSCI-painted stocks led the surge with HBL up +7.4% and UBL up +5.0%, while MCB up +5.6% contributing a cumulative 439 points to the index. Lucky Cement (+6.3%) and Engro (+5.11%) also came back in limelight.

Oils, -52 points, were the major drag to the index with Mari Petroleum and Pakistan Oilfields declining by 3.8/2.6%, respectively, on the back of weakness in international oil prices.

Foreigners remained net sellers during the week with a net FIPI outflow of $19.2 million. However, the selloff was largely absorbed by local individuals who reported a total buy of $27.8 million. Trading activity, however, remained lackluster with average volume traded decreasing by 26.4% week-on-week while average value traded also decreased by 19.9% week-on-week.

Individuals (+$27.8 million) were the biggest buyers during the week as against selling of $10.7 million last week; most of the selling was concentrated in cement ($5 million), power ($2.8 million) and banks ($1.8 million), while foreigners bought $2.9mn of E&P’s.

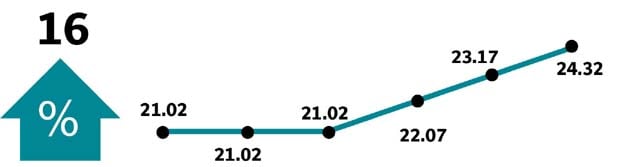

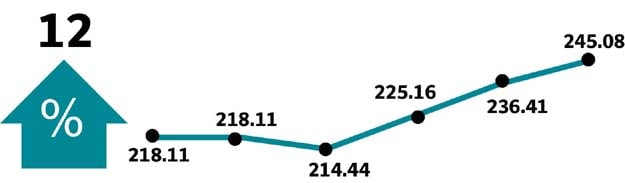

Winners of the week

Faysal Bank

Faysal Bank Limited provides commercial, consumer and investment banking services.

Feroze1888

Feroze 1888 Mills Ltd manufactures and sells a wide range of cotton towels and fabrics.

Crescent Steel

Crescent Steel & Allied Products Limited manufactures steel-lined pipes and multi-layer pipe coatings, which are used for water, oil and gas transmission. The company also has a cotton division that manufactures cotton yarn.

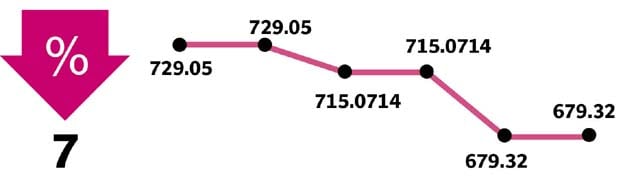

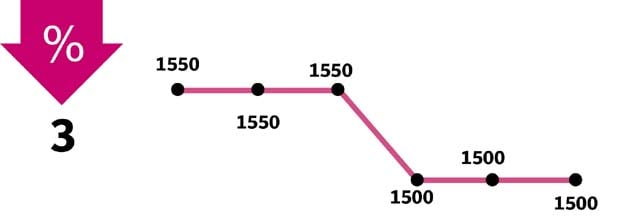

Losers of the week

Standard Chartered Bank

Standard Chartered Bank Pakistan Limited is an international bank that provides consumer and wholesale banking.

Indus Dyeing

Indus Dyeing and Manufacturing Company Ltd manufactures and sells yarn.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Published in The Express Tribune, May 7th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ