This year’s budget likely to see modest taxation measures

International Monetary Fund has asked Pakistan to impose Rs180 billion worth of new taxes

International Monetary Fund (IMF) has asked Pakistan to impose Rs180 billion worth of new taxes. PHOTO: Reuters

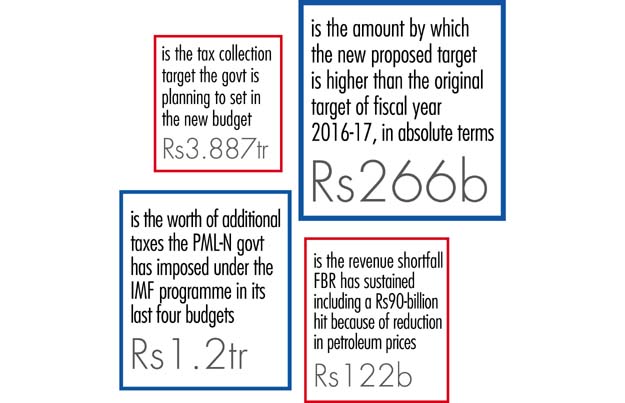

Due to elections of the National and Provincial Assemblies in the next year, it will be difficult to set a revenue collection target that requires double-digit growth of about 18% over outgoing fiscal year’s tax collection, said sources in the finance and revenue ministry. They said that based on this assumption the Federal Board of Revenue (FBR) has proposed Rs3.887 trillion tax collection target for 2017-18, which is only 7.4% higher than the Rs3.621 trillion original target for the outgoing fiscal year.

Punjab has envisaged strategy to mobilise tax revenues: Ayesha Ghaus

In absolute terms, the new proposed target is only Rs266 billion higher than the original target of fiscal year 2016-17.

The government has also informed the IMF that the FBR may not collect more than Rs3.5 trillion in the outgoing fiscal year, as it has been facing Rs168 billion shortfall in the first nine months of the fiscal year. The sources said that although the government has pitched a revised Rs3.5 trillion target to the IMF, the actual collection would remain even below Rs3.4 trillion.

IMF’s reservations

The discussions with the IMF took place early this month in Dubai under Article-IV consultations. The IMF’s ‘advice’ is no more binding on Pakistan, as its $6.2 billion programme has already ended in September last year. However, the finance ministry wants to avail more loans from the World Bank and the Asian Development Bank, which is not possible without winning a Letter of Support from the IMF.

The government would not officially downward revise the outgoing fiscal year’s tax target, as it may provide an excuse to the tax machinery to put less effort, said Haroon Akhtar Khan, Special Assistant to Prime Minister on Revenue. He said that the FBR was facing shortfall primarily because of policy changes that the government introduced after announcing the last budget.

Khan said that so far the FBR has sustained Rs122 billion revenue shortfall due to these policy changes including a Rs90-billion hit because of reduction in petroleum prices. However, the government has already reversed the decision of keeping prices unchanged and started increasing the prices twice a month.

The sources said that the IMF did not accept Pakistan’s views on setting less than a Rs3.9-trillion tax collection target. The IMF was of the view that the FBR can collect Rs3.9 trillion next fiscal year without putting extra efforts due to tax buoyancy. Therefore, the sources said that the IMF urged Pakistan to impose new taxes equivalent to 0.7% of Gross Domestic Product or over Rs180 billion.

If the government accepts the IMF’s views, next year’s tax collection target will be close to Rs4.1 trillion, said the sources. However, the finance ministry is not in a mood to impose new taxes, which may antagonise influential lobbies ahead of the next general elections.

The IMF has not yet made public its views about the outcomes of the Dubai consultations. The Article-IV report is expected to be released in early June.

Govt considering withdrawing banks’ special tax regime

In its last four budgets, the PML-N government has imposed a staggering Rs1.2 trillion in additional taxes under the IMF programme. Most of these taxes were regressive in nature and implemented through various withholding tax provisions. This has significantly increased the cost of doing business that equally affected export-oriented sectors.

The sources said that because of the election year it would also be difficult to convince the prime minister to take additional revenue measures, although the authorities are planning to withdraw banking sector’s special concessionary tax regime.

Published in The Express Tribune, April 22nd, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ