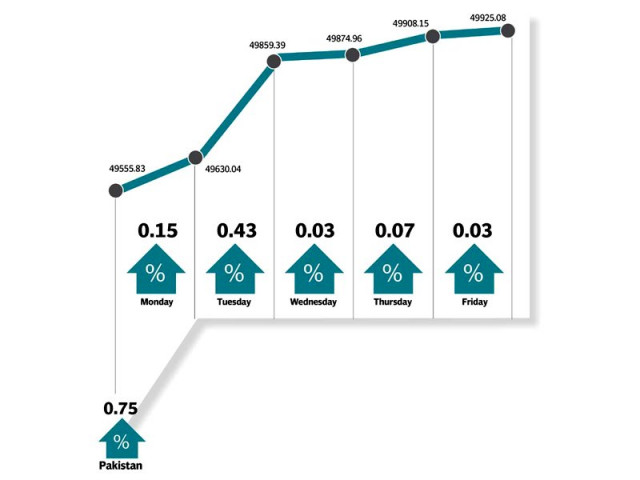

Weekly review: Index sees resistance, ends below 50,000

Benchmark index rose 0.7%, closed week at 49,925 points

Benchmark index rose 0.7%, closed week at 49,925 points.

The KSE-100 remained range bound, surpassing 50,000 multiple times amid undergoing volatile trading across all five sessions but eventually finished at 49,925 points. Investors opted to tread with caution as confidence and liquidity waned amid Securities and Exchange Commission of Pakistan’s (SECP) compliance requirements with brokers taking a step back. The regulator is clamping down on in-house financing, however, sentiments gained some respite as a US judge suspended the executive order that banned travellers from seven Muslim countries.

Despite political uncertainty not playing a part this week, results and sector-specific news were the only triggers this week.

Financial sector performed as excitement built over the upcoming results season with Habib Bank Limited amongst the top performers of the sector. However, MCB posted below-expected earnings per share (EPS) of Rs19.67 which led the stock into negative territory.

Among blue chips, Pakistan State Oil posted an EPS of Rs20.75 for 2QFY17 (beating analyst expectations) while on the other hand, Engro Fertilizer posted an EPS of Rs6.78 for the year ended CY16. Nishat Mills Limited was also among investors’ favourites after it announced its plan set up an automobile manufacturing plant in collaboration with Hyundai.

Overall, activity remained low in the blue chips while retail activity was mainly witnessed in the side stocks. Interest was seen in fertiliser, oil & gas marketing and cement sectors, which were up 2.9%, 2.0% and 1.8%, respectively.

The National Tariff Commission (NTC) imposing 6-40% duty on galvanised coil spurred activity in the cold-rolled players with International Steel Limited, being the prime beneficiary, attracting highest positive movement.

On the other hand, news that government plans to make another pipeline to import RLNG pushed Sui Southern Gas Company and Sui Northern Gas Pipelines Limited to post week-on-week gains of 10.3% and 6.8%, respectively.

On the macro front, Fitch Ratings affirmed Pakistan’s long-term foreign and local currency IDR at ‘B’ with stable outlook. On the other hand, Pakistan’s trade deficit rose to $17.428 billion during 7MFY17 (up 28.68% year-on-year). Exports declined by 3.21% year-on-year to $11.685 billion and imports increased by 13.65% to $29.113 billion.

Foreigners remained net buyers of $5.4 million during the week as against selling of $15.3 million last week.

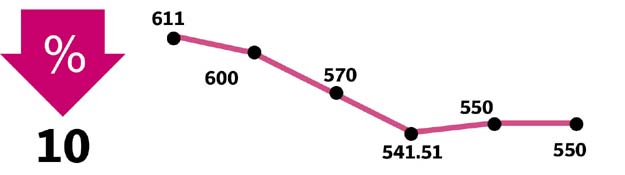

Average traded volume increased 12% with volumes skewed towards retail plays and penny stocks while average value traded declined by 10% week-on-week to $177.1 million.

Winners of the week

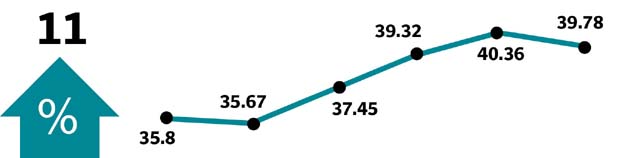

International Steels Limited

International Steels Limited manufactures steel. The company produces cold rolled sheet and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements and packaging industries.

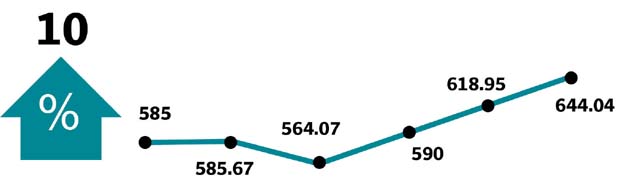

Sui Southern Gas Company

Sui Southern Gas Company Limited transmits and distributes natural gas and constructs high pressure transmission and low pressure distribution systems. The company’s transmission system extends from Sui in Balochistan to Karachi in Sindh.

Jubilee Life Insurance Co Ltd

Jubilee Life Insurance Company Limited is a general insurance company which offers both individual life insurance and corporate business insurance. The company’s individual products include life, personal accident, critical illness and investment insurance. Jubilee’s corporate products include group life, health and pension schemes.

Losers of the week

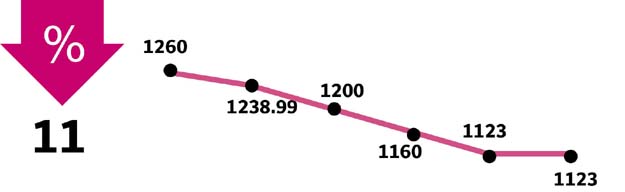

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Indus Dyeing

Indus Dyeing & Manufacturing Company Limited manufactures and sells yarn.

Mari Petroleum

Mari Petroleum is a large oil and gas exploration company that operates the Mari field.

Published in The Express Tribune, February 12th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ