Oil consumers paying up to 38% extra

Govt charging petroleum levy as well as GST on POL products

US benchmark West Texas Intermediate for March fell $1.13 to $29.64 a barrel. PHOTO: FILE

This is because the full impact of relief had not been passed on to consumers despite a dip in global oil prices. The major portion of this extra amount is going into the national kitty on account of different taxes, including petroleum levy and general sales tax (GST).

Crude oil production reaches record high of 100,000 bpd

The increase in prices of petrol and high-speed diesel (HSD) directly affect consumers. For example, in Punjab gas supply to compressed natural gas (CNG) retail outlets had been disconnected for the last couple of years. Since petrol is the alternative of CNG, people have switched to petrol which has seen its demand going up in the province.

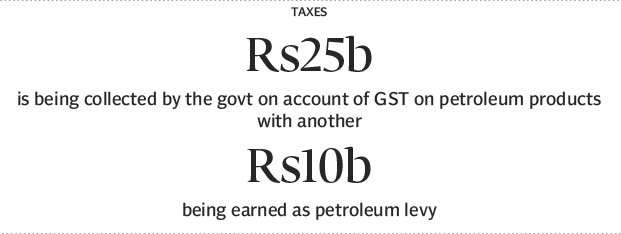

The government was collecting over Rs25 billion under GST on petroleum products and Rs10 billion in petroleum levy every month from oil consumers.

At present, the consumers were paying 31% GST and Rs6 per litre petroleum levy on HSD, while on petrol the government is charging 14.5% GST and Rs9 per litre petroleum levy.

Both products are used by the majority of people in the country as diesel is used in the agriculture and transport sectors. Therefore, high prices of diesel directly hit farmers and cause inflation due to increase in the cost of transportation.

According to a report submitted by the Oil and Gas Regulatory Authority (Ogra) to the Economic Coordination Committee (ECC) of the cabinet, the price of petrol in international markets stood at Rs44.33 per litre compared to Rs62.77 per litre ex-depot price in the local market. So, the consumers in Pakistan were forced to pay 29.37% extra on petrol.

The price of petrol in the international market stood at Rs109.83 per litre in October 2014, whereas in the local market it was Rs103.62 per litre that showed that the government was charging less taxes at that time compared to March 2016.

Ogra recommends up to 7.5% hike in petroleum prices

The price of HSD in the international market was calculated at Rs37.37 per litre. However, consumers were paying Rs71.12 per litre which was 37.66% higher compared to the price in the international market.

The price of diesel was Rs109.71 per litre in the international market and in the local market, consumers were being charged Rs107.39 per litre which again shows that the difference between local and international markets was small.

This also means that there were fewer taxes during that period compared to March 2016.

The report also reveals that the price of crude oil had also witnessed a sharp decline – going down to $28.73 per barrel in March 2016 compared to $99.03 per barrel in October 2014 due to a flood of shale oil in the global market by the US.

Published in The Express Tribune, December 2nd, 2016.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ