Market watch: Stocks recover after early-morning plummet

Benchmark KSE 100-share Index falls 87.27 points

Benchmark KSE 100-share Index falls 87.27 points

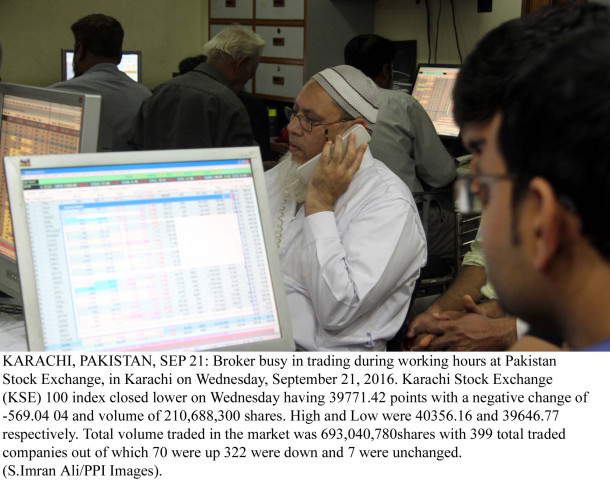

Stocks nose-dived as political uncertainty and, more importantly, Monday’s terror attack in Quetta sent investors to the caution zone where they stayed for most part of the morning half. However, institutional buying after noon and unconfirmed rumours of Pakistan’s credit rating upgrade sent some positive sentiments along the way.

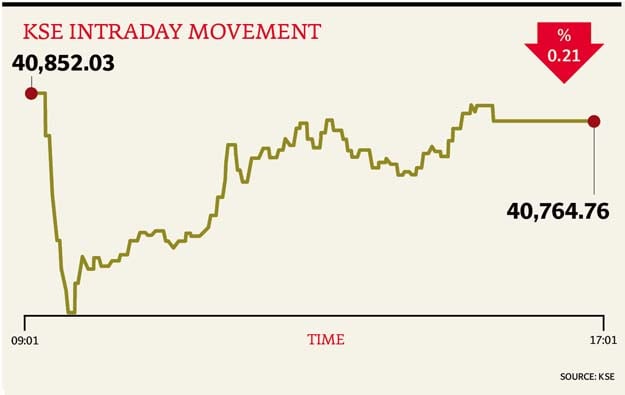

At close on Tuesday, the Pakistan Stock Exchange’s benchmark KSE 100-share Index finished with a decline of 0.21% or 87.27 points to end at 40,764.76.

Elixir Securities, in its report, said stocks plummeted as participants treaded cautiously after Monday’s terror attack. Recent developments regarding Imran Khan’s planned protest and cleric Tahirul Qadri’s decision to join the opposition party’s protest in an attempt to lock down Islamabad on November 2 worried investors even more.

“Recovery came amid value buying primarily from institutional investors while rumours of Imran Khan calling off protests after Monday’s terror attacks and also unconfirmed rumours of Pakistan’s credit rating upgrade to B1 by Moody’s wiped most of the losses.

“Financials led the gainers table while most blue-chips ended the day above respective day averages, thanks to late buying and cherry picking,” said the report.

“Despite domestic politics and law and order taking centre stage, earnings announcements reignited interest in select names with Engro Fertilizer (EFERT PA +1.9%), a great example that gained sharply after 3Q pay-out surprise,” the report added.

“Despite sharp recovery and remarkable resilience shown by the market, we continue to advise caution and recommend gradually adding fundamentally strong plays as we see volatility to pick up heading closer to next week’s protest,” remarked Elixir Securities analyst Faisal Bilwani.

Meanwhile, JS Global analyst Nabeel Haroon said selling pressure was witnessed at market opening by sceptical investors as the index declined to make an intraday low of 675 points. “Nonetheless, investor came in to buy during the latter hours, as the index recovered to close at 40,765 level.”

“Pak-Suzuki Motor Company (PSMC) closed on its lower circuit as the automobile assembler posted 56% year-on-year (YoY) decline in its bottom line in its 9M2016 result announcement.

“This decline in earning can be attributed to absence of Punjab Government Cab Scheme and appreciation of Yen during the concerned period.

“PNSC gained to close on its upper circuit as the company declared its result for 1QFY17 in which it posted EPS of Rs3.63/share.”

Haroon, at the end of the report, recommended a cautious approach to investors on the back of on-going political uncertainty.

Trade volumes fell to 368 million shares compared with Monday’s tally of 278 million.

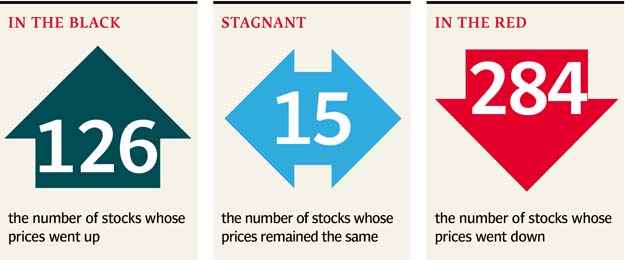

Shares of 425 companies were traded. At the end of the day, 126 stocks closed higher, 284 declined while 15 remained unchanged. The value of shares traded during the day was Rs11.6 billion.

The Bank of Punjab was the volume leader with 50.2 million shares, gaining Rs0.39 to finish at Rs17.64. It was followed by K-Electric Limited with 27.4 million shares, gaining Rs0.07 to close at Rs9.19 and Dost Steel (R) with 22.8 million shares, gaining Rs0.07 to close at Rs3.53.

Foreign institutional investors were net buyers of Rs179 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, October 26th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ